When it comes to corporate earnings, there actually can be too much of a good thing.

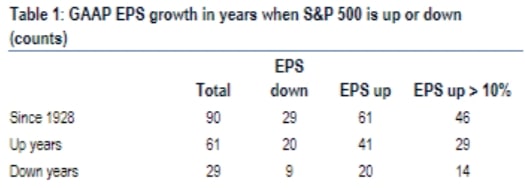

History has shown that years with particularly high profit growth, the chances are actually better that the market finishes lower. This comes about primarily when expectations get so high that even strong performance isn’t enough, and when investors get concerned that the strong earnings are indicative of an economy that is overheating.

Counterintuitive though it may seem, the pattern is important. That’s because many investors are using the strong performance on both the top and bottom lines for corporate America as the foundation for their bull market thesis.

History has shown, though, that froth comes in many forms, even profits.

“If you look at the years where earnings were up double-digits, you actually had a slightly higher probability of having a down market vs. other years, which is really quite fascinating,” said Dan Suzuki, equity and quant strategist at Bank of America Merrill Lynch.

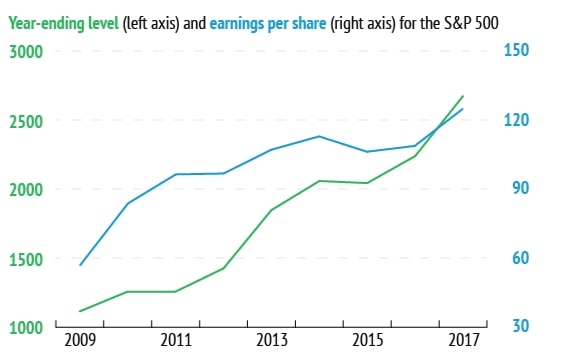

During the bull run of 2009-17, there was a strong correlation between profit growth and the rise of the stock market indexes.

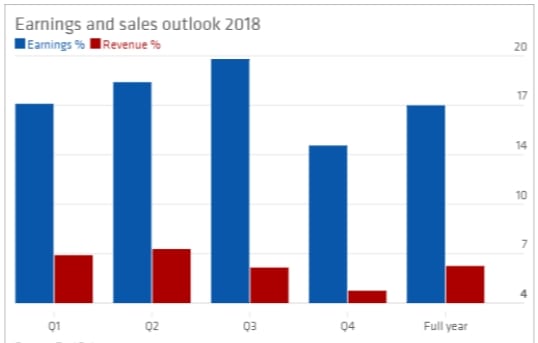

However, 2018 looks to be a particularly robust earnings year, potentially the best since the recovery began in 2009 and continuing off a powerful gain in the fourth quarter of 2017. The end period for last year now is tracking for a 13.4 percent earnings gain with 80 percent of companies beating on revenue, the highest level since FactSet began tracking the number in 2008.

With such big numbers, though, comes a coordinating level of expectations, and that’s where the market can run into trouble.

“When optimism is very high and valuations are high, the market is much more vulnerable,” Suzuki said.”Even a small uptick in fear can have an outsized effect in that type of backdrop.”

There already have been some manifestations of the trend.

Over the past several quarters, investors have provided little reward to companies that beat Wall Street earnings estimates. Most recently, outperformers have been rewarded with just a median 0.3 percent gain after reporting for Q4, compared with the historical norm of 0.3 percent.

All of this comes amid ever-higher expectations for market performance, at least before the recent correction that has hit the major averages.

While outsized profits may sound like a good problem to have, they’re adding another dynamic to an investing minefield that’s getting trickier to navigate.

“When we’re getting late into the cycle and sentiment-driven market expectations and optimism gets more and more bullish, this is what it leads to,” Suzuki said. “It really sets a high bar, in which it’s easy to disappoint.”