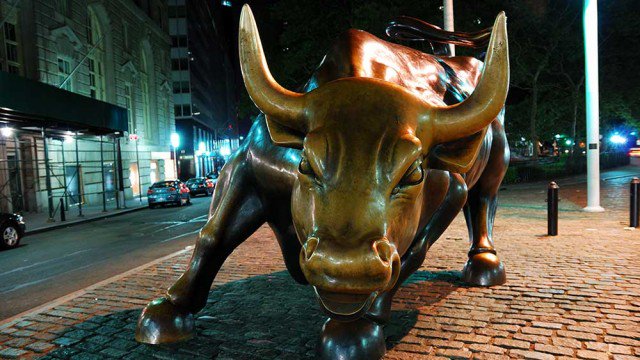

China, which has been a friend and foe to Wall Street recently, fueled a strong rally in the major stock indexes Tuesday.

China President Xi’s comments about opening up the world’s second largest economy and boosting automobile imports weren’t exactly new. But the market found solace in his non-retaliatory tone.

The Nasdaq composite jumped 2.1%, the S&P 500 added 1.7% and the Dow Jones industrial average picked up 1.8%.

Tuesday’s session was decidedly different from Monday, where a bullish session turned bearish by the close. Major stock indexes held strong gains into the close. Preliminary data showed volume on the NYSE and Nasdaq coming in higher than Monday’s levels, and more so on the NYSE.

FANG stocks ended with stout gains as Facebook (FB) rose more than 4.5%. The market seemed to like the sound of CEO Mark Zuckerberg’s Congressional testimony today. Still, a lot of technical damage has been done to Facebook’s chart, which will take some time to repair. Leaderboard names Netflix (NFLX), Amazon.com (AMZN), as well as Google parent Alphabet (GOOGL) ended with gains of 2% to 3%.

Oil and gas stocks outperformed as oil prices rose. Benchmark crude oil settled at $63.51 a barrel, up 3.3%.

ConocoPhillips (COP) cleared a cup-shaped base with a conventional entry at 61.41. Shares jumped nearly 3% to 62.34. The weekly chart shows a slightly earlier handle entry of 61.27.

In the stock market today, Alcoa (AA) ripped higher for a second straight session. Shares soared nearly 7% to 54.08. Shares were strong Monday after a big Russian aluminum producer said Trump sanctions against Russia could cause it to default.

Alcoa’s current consolidation shows a conventional entry at 57.60, although the stock has run up straight off the bottom, which makes the pattern lopsided.

China Stock Surges In IBD 50

Inside the IBD 50, Weibo (WB) was one of the top percentage gainers, but it’s still below the 50-day moving average as it consolidates gains. Shares vaulted 5.5%

Semiconductor stocks also did well in the IBD 50. Micron Technology (MU) poked above the 50-day line amid more positive analyst commentary. Mizuho Securities reiterated a buy rating on Micron with 70 price target. Evercore ISI on Monday lifted price targets for Intel (INTC) and Lam Research (LRCX) and said Micron under 50 “looks like a steal.”

Other top chip gainers in the IBD 50 included Nvidia (NVDA), MKS Instruments (MKSI) and Entegris (ETNG) with gains of 5% to 6%.