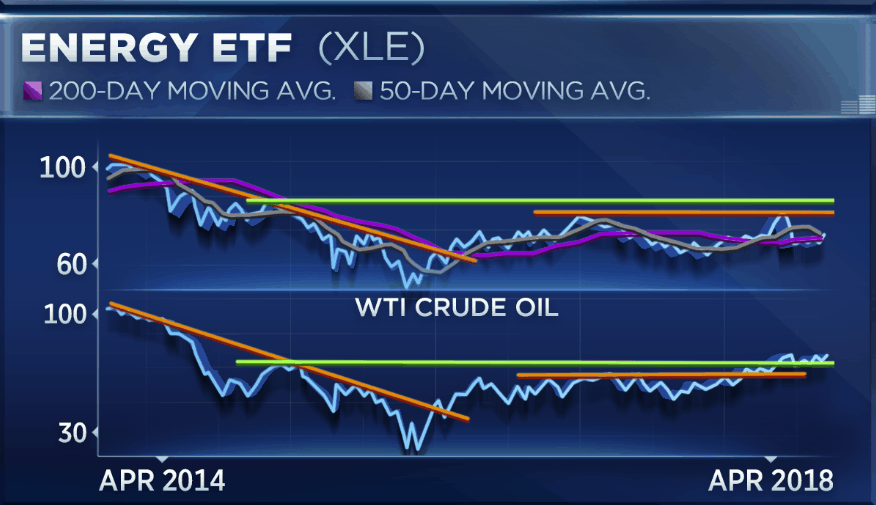

Energy stocks are still negative for 2018 even as crude oil has gained 11 percent. One market technician expects the sector to play catch-up as we head deeper into the year.

“The divergence between what we’re seeing with crude oil and the XLE, this is a divergence that is clearly going to close,” Craig Johnson, chief market technician at Piper Jaffray, said Thursday on CNBC’s “Trading Nation.”

The XLE energy ETF has fallen more than 1 percent this year, failing to join in on crude oil’s rally. It tumbled nearly 11 percent in February, its worst month since December 2015, while crude oil fell just 5 percent.

Energy has made a comeback since those lows. It posted gains in March and is on track to become the best performer on the S&P 500 in April. The S&P 500 energy sector has added 6 percent this month.

Even with those gains, Johnson says fear remains following years of underperformance.

“Most places are underweight the energy play. They’ve been burned by it, they haven’t wanted to come back to it yet,” he said.

But Johnson and his team are bullish on the sector and expect more upside this year.

“We’re overweight the sector at this point in time,” said Johnson. “If we’re going to get any sort of pullback, a shakeout (a deeper pullback and shakeout, I should say) in the broader market I think energy is probably a space that some of that money is going to rotate into, given how weak the performance has been so far this year.”

To Chad Morganlander, portfolio manager at Washington Crossing Advisors, the energy sector doesn’t look quite as good. A possible weakening in Chinese demand and growing domestic supply could unbalance oil and hit energy names, he said.

“China growth has actually been one of the critical contributors to demand for oil,” he said. “Any type of reset there within policy for credit growth is going to have this wash-back effect on demand for oil.”

“Secondarily, you do have the United States which is actually going to become in our estimates over the next five years the largest producer of oil and they’re not directed by OPEC,” he added.

U.S. crude oil exports moved north of 2 million barrels per day at the end of March, its highest level on record. Analysts expect that supply to grow this year with the U.S. possibly overtaking Saudi Arabia and Russia as the world’s largest producer.

“We’re neutral on the sector to underweight,” said Morganlander. “We would be much more cautious on this sector overall going forward.”

The XLE ETF surged more than 1 percent on Friday afternoon, while West Texas Intermediate crude oil prices gained 0.6 percent to trade at roughly $67.50 a barrel.