China is doing little to stop its currency’s near daily decline, and some view that as a strategy to weaken the yuan in order to minimize the impact of President Donald Trump’s trade tariffs on its economy.

A weaker yuan would make Chinese goods more attractive in overseas markets, and at the same time a stronger dollar and those U.S. tariffs could make some American goods less appealing for Chinese consumers.

The Trump administration may view the fall in the yuan, now at a 14-month low, as an intentional devaluation—or the equivalent of China bringing its own economic weapon to the trade battle field. Goldman Sachs economists say the weakening currency may in fact have been the motivation behind Trump’s decision to announce the U.S. will now consider 25 percent tariffs instead of 10 percent tariffs previously proposed for another $200 billion batch of Chinese goods.

In fact, they said the currency ‘s decline may be one measure the U.S. will consider when deciding how much to impose in new tariffs on Beijing. Trump administration officials said there was no particular action that caused them to look at a new 25 percent level of tariffs.

“While it is unclear whether the Administration will move forward with a 25 percent tariff, we believe the announcement that it is under consideration further raises the probability that tariffs of at least 10 percent will be imposed on a substantial portion of the $200bn in imports recently detailed. We expect that the decision to increase the rate to 25 percent will depend in part on whether recent CNY [yuan] depreciation reverses or continues,” they wrote in a note.

The Goldman economists also expect the administration to impose more tariffs on Chinese imports, and the fact the Trump administration has upped the ante to 25 percent, makes it more likely the 10 percent tariffs on the $200 billion in goods will be imposed.

Currency strategists, however, say that China does not want a currency war and has not tried to drive the yuan to now 14 month lows— but it is also not stepping in to prevent the decline as it normally would.

China’s central bank sets a daily exchange rate for the yuan based on recent prices, and allows trading against the dollar in a band that could be as much as 2 percent above or below that level.

On Thursday, China increased the midpoint rate for the first time in five sessions to 6.7942, up 0.5 percent from the prior fixing. But the currency sold off in the spot, offshore market anyway, finishing at 6.83, the weakest since June, 2017.

“I don’t think they’re using it as a lever. if you look at the fix it [the yuan] was fixed higher today,” said Win Thin, senior foreign exchange strategist at Brown Brother s Harriman. “The market just took the dollar/yuan higher…I don’t think they’re weaponizing it, and it’s very dangerous for them to do that. It’s the law of unwanted byproducts.”

The dollar is rising on trade tensions, and emerging market currencies are in decline. “That’s indirectly weakening the yuan. it’s indirectly reflecting market forces but it’s not intentional,” he said. The yuan is down about five percent year-to-date but most of its move was since trade tensions heated up in June.

But China is not trying to stop the drop, although there has been some small interventions from local banks to prop up the yuan, amounting to about $1 billion a day, said Jens Nordvig, CEO of Exante.

“I think they are allowing it to move, and in the past they would not have allowed it, so there’s a difference in behavior. I don’ think it’s the start of them pushing it,” he said. “The economy is weakening. Chinese interest rates are really collapsing. Even in the past couple weeks, where they do things that sound stimulative to the economy, it’s not really changing the direction of interest rates. Interest rates rates are going down.” Nordvig said the Chinese 5-year yield is just above 3 percent, while it was at 4 percent a year ago.

Nordvig said his target for now on dollar/yuan is 7.10, since the currency pair looks set to move above the important 7 level.

“I’m sure the Chinese are saying: ‘we’re not doing something.’ And the Americans are saying: ‘They used to do it and now they’re not, so they’re causing it to fall.’ It’s really an organic move, and they’re just not stopping it,” he said.

Strategists expect the trade friction is expected to continue for months, and Nordvig said he expects the U.S. to impose tariffs on all Chinese imports to varying degrees.

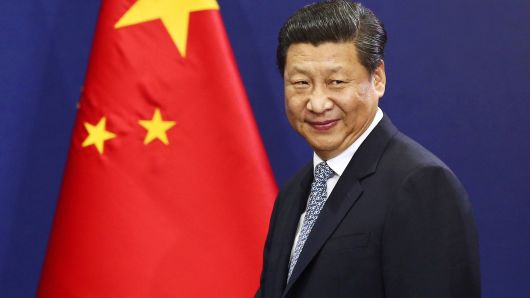

“I don’t’ really see what it is, what rabbit China china can pull out of its hat without looking like pushovers. which [President Jinping] Xi doesn’t want to look like,” said Nordvig. “I think we’re heading for escalation. A lot of people that have been following this process say ‘it can’t get this bad. It can’t get this bad.’ But it’s getting worse and worse.”

As the trade skirmishes continue, he expects the dollar could be driven higher, unless the Fed signals a slow down in its interest rate hiking cycle. The Fed is expected to raise rates in September and again in December.

“You shouldn’t be surprised. If you impose tariffs, the dollar is going to get stronger,” he said.

Trump has grumbled about the dollar’s strength compared to other currencies, specifically the yuan and euro, and he has also criticized the Fed’s rate hiking policy