Uber’s losses ticked up to nearly $1 billion during the third quarter and annualized growth is continuing to slow, according to the private company’s self-reported financials for Q3.

The news comes ahead of the company’s anticipated IPO next year, which some bankers are saying could value the company at $120 billion, well over its last reported private valuation of $62 billion. The company’s slowing growth could be attributed to Uber’s rapidly diversifying business, including expansion in its food delivery service, Uber Eats, and new transportation offerings, such as bikes and scooters.

Here are the numbers:

- Q3 revenue was $2.95 billion, up 38 percent from the same quarter last year.

- Gross bookings, or the amount collected before payouts to drivers, came in at $12.7 billion, up 34 percent year over year.

- Adjusted net loss widened in the third quarter to $939 million; it was $680 million in Q2.

- Adjusted EBITDA loss for Q3 came in at $527 million, which is down 13 percent year over year, but up 24 percent since Q2.

- Gross cash on hand decreased to $6.55 billion, down from $7.3 billion at the end of Q2.

The numbers reflect the slowing growth Uber has seen over the last two quarters. In Q2 Uber reported net revenue of $2.7 billion, up 51 percent from a year prior, and gross bookings of $12 billion, up 41 percent from a year prior.

The company also broke out some figures for Uber Eats to the press for the first time, saying it accounted for $2.1 billion in gross bookings in Q3. That’s an increase of 150 percent from the same quarter a year ago, Uber says.

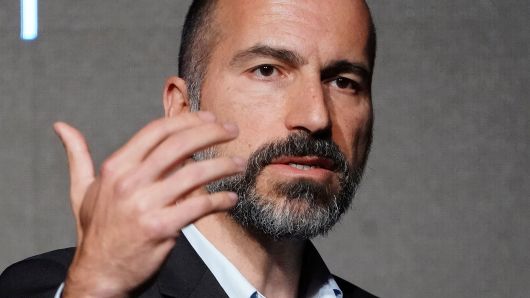

Uber is rapidly expanding its food delivery business and is investing in new mobility offerings, such as bikes and e-scooters. Last month Uber announced it would expand its food delivery business to cover 70 percent of the U.S. population. CEO Dara Khosrowshahi told CNBC at the time that Uber Eats growth ultimately drives growth back to Uber’s ride-hailing business.

Uber CFO Nelson Chai told CNBC the company had another strong quarter for a business of its size and global scope. “As we look ahead to an IPO and beyond, we are investing in future growth across our platform, including in food, freight, electric bikes and scooters, and high-potential markets in India and the Middle East where we continue to solidify our leadership position,” Chai said.

As it heads toward an IPO next year, Uber wants investors to know it’s more than ride-hailing, but some bankers say that could make it harder tovalue the company in an IPO.