One Wall Street analyst says Robinhood’s plan to offer accounts with an eye-poppinginterest rate could backfire with regulators.

The fintech start-up is offering what seems designed to look like a bank, UBS analyst Brennan Hawken said in a note to clients Friday. But that’s part of the problem.

“The details of this product are thin, since it actually is launching in early 2019, but based on what we understand, it seems to be a potentially risky ploy that is skirting very close to actual banking and therefore could draw regulatory scrutiny,” Hawkin said.

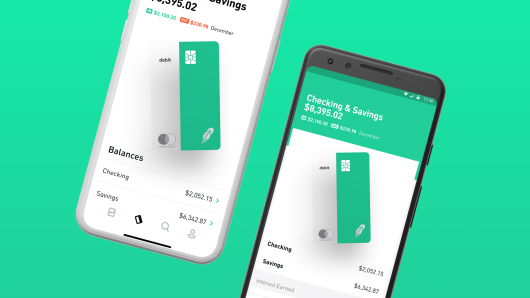

Robinhood on Thursday unveiled no-fee checking and savings accounts with no minimums, ATM fees, penalty charges or foreign transaction fees. It also is offering a 3 percent interest rate, which is well above the industry average 0.08 percent yield on U.S. checking accounts and the 0.1 percent average on savings accounts, according to the latest data from Bankrate.com.

Robinhood’s brokerage accounts are covered by SIPC insurance, which protects up to $250,000 of cash in the case of a broker’s failure. But there is a big distinction from bank accounts, which are covered by FDIC insurance.

“The fine print of the website says the offering is NOT a bank account, so the regulatory oversight of this offering is likely more thin,” UBS said, noting bank regulators would likely want to know more about anti-money laundering safeguards in place and capital levels. “There’s a risk that bank regulators could take issue with an entity with 3 million accounts presenting itself as offering banking products but avoiding the regulatory scrutiny that would go along with it.”

The head of the Securities Investor Protection Corp. told CNBC on Friday that the start-up didn’t contact his office ahead of the product launch, and to his knowledge Robinhood had not contacted the SEC, either.

SIPC President and CEO Stephen Harbeck told CNBC he had contacted the commission’s trading and markets division about it.

UBS’ Hawken said Robinhood is likely pulling a “few (clever) levers to improve the economics.” Robinhood said it is investing customer deposits in Treasury, currently yielding around 2.7 percent for the 2-year note. But UBS points out it is also offering ATM access through partners that are almost entirely retail stores. “Those firms may have given Robinhood a good deal when accessing those ATMs.” The income from the Treasurys and income from partner agreements could help pay the 3 percent Robinhood is paying on the accounts, UBS said.

But the UBS analysts cited concerns about how easily customers could get their money on request. The Robinhood accounts look more similar to a money-market fund, which is an open-ended mutual fund. “We suspect the liquidity may not be immediate,” Hawken wrote, “resulting in friction in and out of the product.”

Robinhood did not immediately respond to a call and email for comment.

Robinhood is a privately company, and therefore not usually covered by UBS investment research. But the firm does have a neutral rating on online brokerage competitor Charles Schwab, and a buy rating on TD Ameritrade.