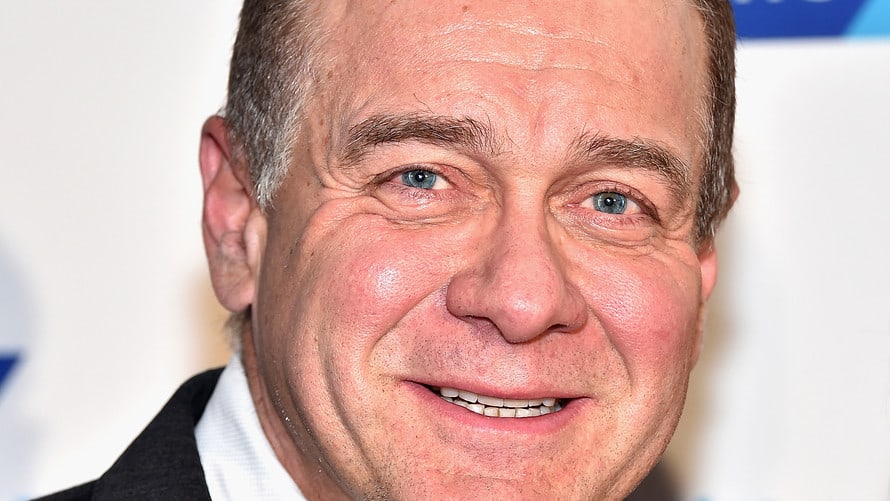

Scott Minerd, head of investing at Guggenheim, made that call in a CNBC interview on Wednesday as stocks were rallying sharply in an attempt to take back a Monday meltdown that marked the worst Christmas Eve performance in stock-market history.

Minerd, who in April warned of a looming recession and said stocks could fall 40%, argued Wednesday that the market drop that’s left the S&P 500 SPX, +4.96% and the Dow Jones Industrial Average DJIA, +4.98% on the cusp of ending a long-running bull market and has already sent the likes of the Nasdaq Composite COMP, +5.84% and Russell 2000 RUT, +4.96% into bear territory, is of the magnitude that has historically given the Federal Reserve pause. He predicted this time would be no different.

Read: These U.S. stock benchmarks are already in a bear market — and the S&P 500 isn’t far behind

When there has been “this kind of pullback in stocks, the Federal Reserve reacts — they at least pause,” Minerd said. “About half the time they go on and do a rate cut.”

With the Fed likely to react, Minerd said he would be looking to “selectively pick up some, what I think, some cheap assets out there because I think inevitably the Fed’s going to have to react to this.”

The Fed last week delivered a widely expected rate increase, its fourth of 2018, and signaled it remained on track to deliver further increases in 2019.

Stocks roared back on Wednesday from their worst-ever Christmas Eve performance, with the S&P 500, Dow and Nasdaq logging their biggest one-day percentage gains since March 2009 and the best Dec. 26 performance in history.