Investors are fearful the stock market is signaling that a recession could be on the way either because of a Fed policy misstep or trade wars, but that doesn’t have to be the case.

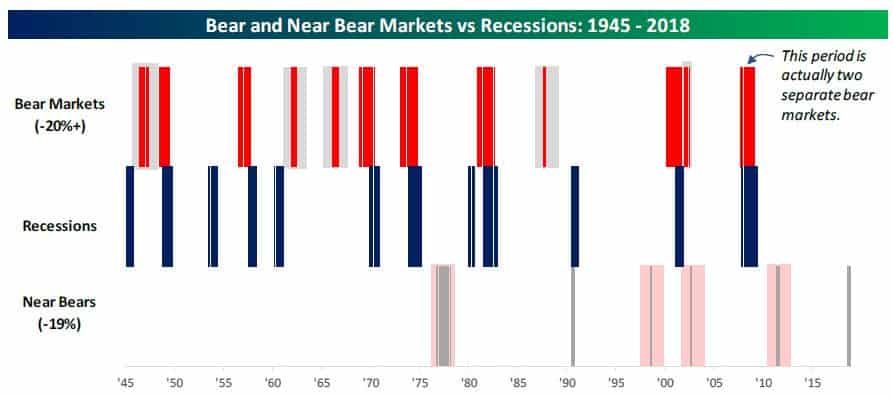

Not all big market declines have signaled a recession, but once a market decline reaches 20 percent, the odds are higher, according to Bespoke Investment Group. Of the 13 bear markets for the S&P 500 since World War II, eight of them overlapped with some part of a recession.

Bespoke is not counting the current decline in the S&P 500 as a bear market, since on a closing basis it is only 19.8 percent from its September high to the Dec. 24 close of 2,351. On an intraday basis, the S&P has been down 20 percent, a bear market level.

“More often than not a bear market accompanies a recession,” said Bespoke co-founder Paul Hickey. “The bear market usually comes first. We also looked at ‘near bear’ markets where the S&P falls 19 percent but it doesn’t fall 20 percent … there have been five of those so far … only one occurred in conjunction with a recession.”

But still, while economists say a recession is unlikely next year, not everyone will rule it out.

“I’m real worried about a recession next year because the Fed seems to have a tin ear with respect to what its quantitative tightening and rate projections mean for the markets and global risk taking,” said Joseph LaVorgna, chief economist Americas at Natixis. “The Fed is too focused on domestic data. … The vast majority of the macro data looks solid but that’s almost always the case before the economy goes into a recession.”

LaVorgna said the Fed will have to signal soon that it is more flexible about policy tightening. For instance, following the central bank’s December rate hike, Fed Chairman Jerome Powell said its program to shrink its balance sheet was on “autopilot.”

That spooked investors even though New York Fed President John Williams said several days later that the Fed was flexible on the program which reduces the balance sheet through an almost reverse quantitative easing. In essence, the Fed allows securities it holds to mature, and roll down the balance sheet.

The Fed has also forecast two rate hikes for 2019, while some market pros are betting it will not be able to do any.

James Paulsen, chief investment strategist at Leuthold Group, said the Fed could slow its pace of tightening because of a slower economy, expected to grow in the low 2 percent range next year.

Paulsen said that even with this week’s wild market volatility, he is now a buyer of stocks on the dips and that he has become bullish again because he does not expect a recession. The recovery of the stock market, from its steep correction, will also depend on the economy.

“The whole key is recession. Some of those are deep. 1990 is a great example where you had a recession and you barely had a 20 percent correction,” he said. “Typically there tends to be a correlation with how bad the recession is both in terms of length and depth with how deep a bear market is.”

Paulsen said the stock market may be able to avoid the negative impact of a trade war since both the U.S. or China would be concerned about the economic repercussions of continuing the impasse. However, a pickup in tensions could send the market tumbling.

“If the [U.S.] data is going weak and China is already a mess, I don’t think the trade war is going anywhere,” he said.

LaVorgna said there are other warning signs that a recession could be on the horizon. He pointed to the decline in consumer confidence, which fell to 128.1 from 134.4 in large part because of a steep drop in consumer expectations. The Conference Board said the back-to-back declines in expectations in November and December signal concern about a slowing economy in 2019.

“The crux of it is the most forward-looking data tends to be measures of sentiment which themselves are heavily influenced by what’s happening in financial markets,” LaVorgna said. “The question is what is going to stabilize the equity market, so we don’t have a recession next year. Other than a sharp snap back in growth overseas, which seems unlikely at this point, it has to be a meaningful relent by the Fed.”

LaVorgna said the Fed has prevented steep declines in the market from turning into even steeper bear market corrections accompanied by recessions. For instance, in 1998, the Fed cut rates after the failure of Long Term Capital Management, helping to avoid a recession then.