Active money managers have gotten their fair share of bad press in recent years, and for a good reason. Swaths of actively managed equity funds fail to outperform their benchmarks over five, 10, and 15-year times frames, according to S&P Dow Jones Indices.

But according to new research published by Klakow Akepanidtaworn of the Booth School of Business, Alex Imas of Carnegie Mellon, and Lawrence Schmidt at M.I.T., much of this underperformance can be chalked up to one startling shortcoming of professional money managers: an inability to adeptly sell stocks.

In other words, “while investors display clear skill in buying, their selling decisions underperform substantially,” according to the researchers.

The data show that professional investors do outperform their benchmarks when isolating their decisions on which stocks to buy, and when to buy them, both in terms of raw and risk-adjusted returns. But in terms of selling—the performance isn’t so hot.

The study found that “selling decisions not only fail to beat a no-skill strategy of selling another randomly chosen asset from the portfolio, they consistently underperform it by substantial amounts. Portfolio managers forgo between 50 and 100 basis points (half-a-percentage point to 1 percentage point) over a 1-year horizon relative to a random selling strategy.”

The research was done in cooperation with Rick Di Mascio, CEO of financial data analytics firm Inalytics, and used anonymized data, tracking the daily buying and selling habits of 783 stock pickers—with an overage of $573 million funds under management—between 2000 and 2016.

The findings, perhaps, are worth keeping in mind as stock-market investors now wrestle with a new regime of stock-market volatility, characterized by the type of dizzying rallies and gut-churning price declines that could test the mettle of even die-hard Wall Street investors.

Although equity indexes have enjoyed a respite from extreme downside swings over the course of the past six sessions, more uncertainty my be waiting in the wings with earnings season set to unofficially start.

On Friday, the Dow Jones Industrial Average DJIA, -0.02% edged 5.97 points lower to 23,995.95, while the S&P 500 index SPX, -0.01% slipped less than a point to 2,596.26m, and the Nasdaq Composite Index NQH9, -0.15% shed 0.2%, to end at 6,971.48.

A partial government shutdown that was set to carve out a record for length on Saturday and worries about Brexit may have capped gains and could inject a dollop of fresh choppiness in markets next week.

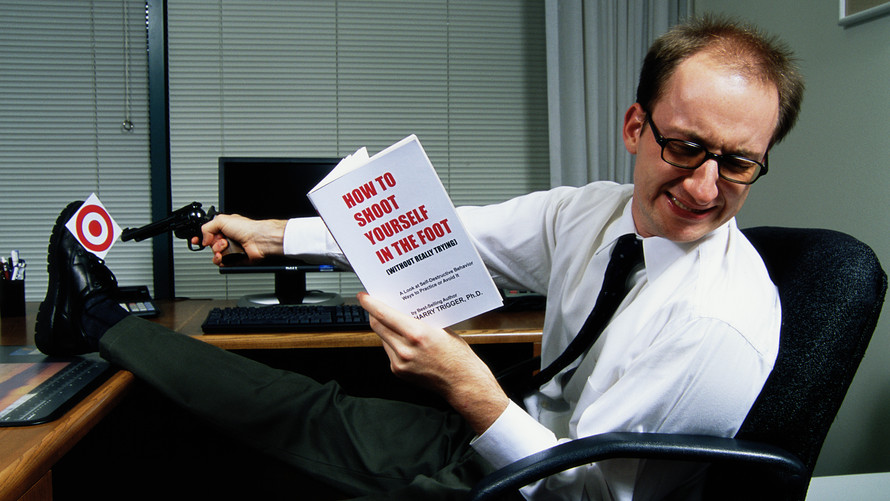

So, why are professional stock pickers, who have a proven record of choosing the right stocks to buy, so bad? Posited simply by the researchers, money managers don’t put nearly as much thought into selling as they do buying.

“They view the job as finding the next big thing, whereas selling stocks are a cash-raising exercise,” Schmidt, finance professor at M.I.T told MarketWatch.

Di Mascio, who spent decades as a portfolio manager at places like the British Coal Pension Fund and Goldman Sachs Asset Management, says that he was motivated to study this question through his own investment experiences. “From my own experience, I knew that I was absolutely dreadful at making selling decisions,” he said in an interview. “I knew it was true of me, and I suspected it was true of others. Now we can see that it is a widespread problem.”

The good news?

When money managers do put in the effort to make selling decisions based on careful research, they can outperform random strategies, as evidenced by the performance of selling decisions when they coincide with the release of relevant information, like earnings announcements. When stocks are sold using such new and relevant information, managers also outperform the counterfactual.

“There’s nothing fundamentally difficult about selling, and when managers focus on it, they get it right,” Di Mascio said.

The unofficial start of earnings

On Monday, before the bell, Citigroup Inc. C, +0.44% will issue fourth quarter earnings, followed by Delta Air Lines Inc. DAL, -0.35% JPMorgan Chase & Co. JPM, -0.48% and UnitedHealth Group Inc. UNH, +1.14% on Tuesday.

Later in the week, we’ll get fourth-quarter reports from several other big-name firms like Alcoa Corp.Bank of America Corp BAC, +1.17% CSX Corp. CSX, +0.82% Netflix Inc. NFLX, +3.98% as well as American Express Co. AXP, +0.30%

What data are ahead?

New data on the U.S. economy could be light next week, if the government shutdown doesn’t end. While investors will get a new reading of the producer-prices and a report on manufacturing activity in the Empire State Tuesday morning, Wednesday’s scheduled retail sales and business inventories numbers could be delayed depending on the unfolding drama in Washington.

Thursday will feature weekly jobless claims data and the Philly Fed index, while housing starts and building permits data could also potentially be delayed.

On Friday, investors will get a snapshot of industrial production, capacity utilization and the University of Michigan consumer-sentiment index.

Brexit vote

Another key even event to watch is U.K. Parliament’s vote on Prime Minister Theresa May’s Brexit deal on Jan. 15. Market participants are skeptical that she will be able to marshal enough votes to push forward with her plan to exit from the European Union before a March 29 deadline, which itself could be pushed back.