Apple has announced its new Apple Card credit card at the company’s Show Time services event on Monday. The announcement follows reports last month that the tech titan has been working with investment bank Goldman Sachs on a joint credit card.

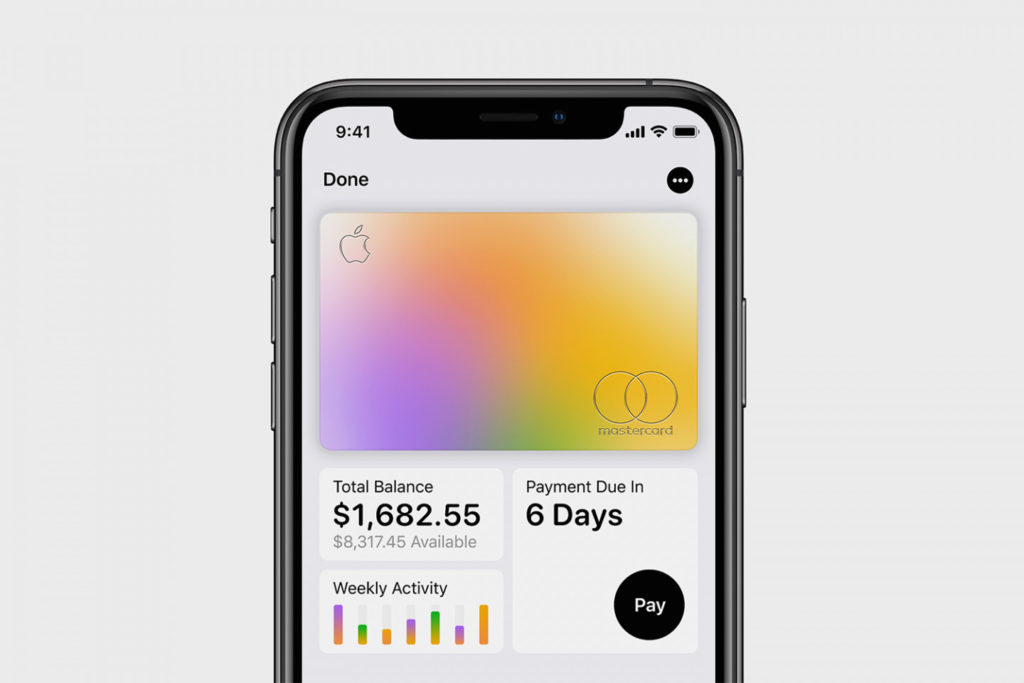

The card comes both in physical and digital form, living in both the wallet in the user’s pocket and the Apple Wallet app on their iPhone. The Cupertino giant says the Apple Card will have no fees, lower interest rates, better rewards, and provide a “new level of privacy and security.”

To acquire an Apple Card, users can sign up via the Wallet app. The digital card can be used anywhere Apple Pay is accepted. Customers will be able to track purchases, check balances, and more right from the app, while Apple Card support is available 24/7 via text.

Apple Card customers will also receive cashback rewards through the Daily Cash feature, with a percentage of purchases being put straight back on to the user’s Apple Card. Purchases made through Apple Pay using the Apple Card recoup 2 percent, purchases from Apple will get 3 percent back, and purchases made using the physical Apple Card get back 1 percent.

The physical Apple Card is made of titanium and has no card number, security code, expiry date, or signature for improved security, with all authorization information stored on the Wallet app.

As previously reported, Apple Card is the result of a partnership with Goldman Sachs, with Mastercard responsible for payment processing. Apple Card will be available this summer.