DoubleLine chief Jeffrey Gundlach said Tuesday that President Donald Trump will likely follow through on his threat to raise tariffs on China, further weighing on a stock market that the money manager believes is already in a weakened state.

“I think we’re going to keep seeing more tension and I think the 25% tariff bump is better than 50% chance” of happening, Gundlach told Scott Wapner on CNBC’s “Halftime Report.” “Both the premier of China and the president of the United States want to come across that they prevailed and didn’t give in.”

“I think you’ve got an irresistible force meeting an immovable object,” Gundlach added.

DoubleLine has more than $130 billion in assets under management.

If tariffs increase as scheduled on Friday, Gundlach thinks the U.S. stock market will sell off further. The Dow Jones Industrial Average has fallen more than 600 points this week after Trump on Sunday threatened to add more tariffs on Chinese imports.

“It’s already happening, I think. The market obviously doesn’t want increased tariffs, so it’s been kind of reacting to that,” Gundlach said.

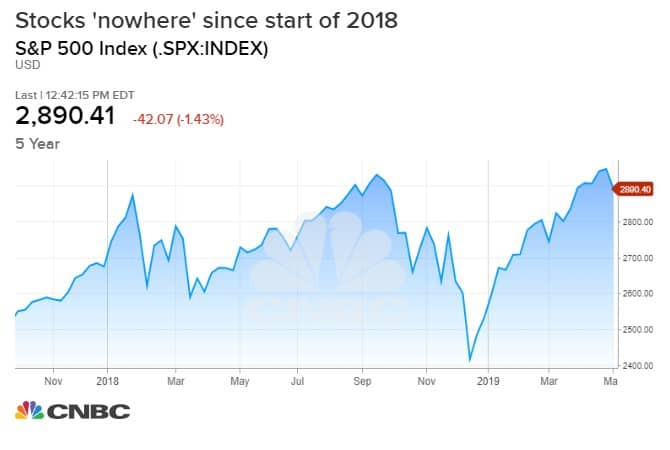

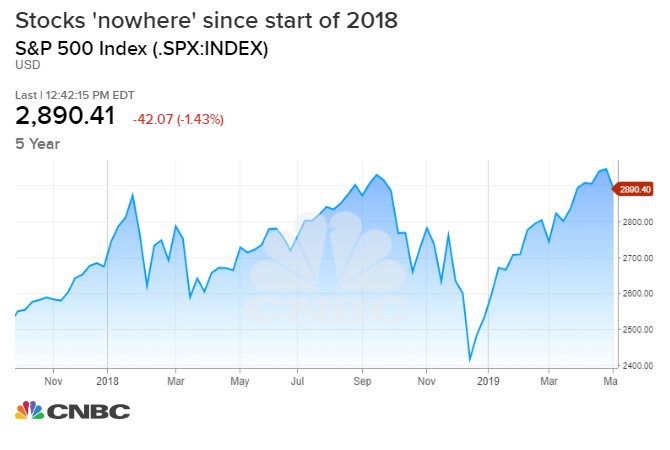

“I think that we’re in a late cycle and I think the market can only be termed by the way I look at evolution of market prices as a bear market,” Gundlach said. “The market hasn’t gone anywhere in 15 months.”

“People keep acting like this is some sort of locomotive that’s chugging along, but the New York Stock Exchange Composite Index — which to me is the most important one because it’s the biggest — it peaked in January of 2018 and then couldn’t quite make it back to that peak in October and now it couldn’t quite get back to that October level and now it’s rolling over again,” Gundlach said.

He believes U.S. stocks are still in a bear market because the NYSE composite index has fallen “over 20% and has failed to return to its high.” Until the index “takes out that high,” it remains in a bear market, Gundlach said.

“A bear market is really more about cycles and manias and then things one by one rolling over and the market getting narrower and narrower, and I think all of that has been happening over about an 18-month time period,” Gundlach said. “I think that we’re in the late cycle … [and] to characterize the last 15 months as a bull market is just wrong.”

Gundlach also criticized the president for heralding monthly economic reports, such as U.S. job creation, as symbols of the economy. The money manager doesn’t think Trump can “get away with … blaming it on” Federal Reserve Chairman Jerome Powell “if the economy does print a negative.” And if that happens, Gundlach said, Trump “can’t brag about the economy any more.”

“That’s what he’s about: bragging about the economy,” Gundlach said. “He keeps talking about how the jobs have never been created so much ever in history. Except for one little fact: If you take the number of months Trump’s been in office and take the average nonfarm payrolls and compare it to the same number of months at the end of the Obama president, there were more under Obama!”

“It’s unbelievable the twilight zone that we’re sort of living in, where people just say things and it gets repeated. I think probably we’re numb to that because of social media,” Gundlach added.