Stock Markets

U.S. stocks managed to eek out another gain, ending the week in and the month of August on positive note. The rally was fueled by optimism about the possible reduction of trade clashes between the U.S. and China based on conciliatory talk emerging from both countries. The economic data that showed consumer spending rose by 4.7% over the second quarter also helped. Remember that consumer spending accounts for for 70% of all economic growth. A change in Britain’s Brexit situation reared its head once again as the odds of the U.K. leaving the European Union without an agreement were bolstered by the new prime minister announcing he would be suspending Parliament before October 31 – the Brexit deadline. So even with the spate of geopolitical uncertainties, the solid consumer fundamentals, rise in corporate profits continuing, and generous monetary policies are likely to extend the current economic expansion – one of the longest in recent history.

U.S. Economy

The end of August was the period on a volatile month during where stocks swung on frequent changing trade news between China and the U.S. Sometimes they rebounded off progress on negotiations and then escalated based on news of tariffs. Overall, the S&P 500 is up a strong 17% in 2019. It is down 3.5% from the recent high and at about the same level as it was this time last year. The sell-off last December was followed by a strong rally to new highs through much of 2019. It lost some traction over the past month. But as impressive as this bull market has been over the last 10 years, it is certainly not smooth, with several significant periods of market volatility. And while stocks finished August on a high note, recession fears are still hanging on. So there are several cautionary signals that give pause to the bull market’s longevity.

Metals and Mining

Gold was softer on Friday as both the US dollar and equities moved up. Despite the slight slide in the market, concerns about the economy trade war battles kept the gold on track for its fourth consecutive monthly rise. Gold surged through a more than six year peak earlier in the week, climbing over US$1,550 per ounce as investors sought safe haven refuge. The situation between the US and China has been grabbing the attention of market participants for over a year now, and fueling concerns around a global slowdown. Silver managed to continue its rally on Friday, holding strong. Like gold, it is being supported by interest from investors thanks to concerns surrounding the state of the economy and geopolitical issues. In terms of where the silver price may go from here, markets watchers say that investors won’t have to wait long for it to hit US$20. As for the other precious metals, platinum made gains, finally breaking through the US$900 per ounce level. That’s over a more than one-year high and heading for its best month since January of last year. Palladium made huge gains this week, ticking up over 5 percent as it went head-to-head with gold on Friday for the highest trading precious metal title.

After a relatively lackluster August, it got momentum at the end of the trading week as it hit a one month high. Palladium was trading at US$1,526 per ounce as of 11:00 a.m. EDT, Friday.

Energy and Oil

It looked like oil prices were set for their biggest weekly increase since July until demand fears caused by Hurricane Dorian hitting Florida sent prices crashing on Friday morning. Oil prices were initially pushed up by cautious language from the U.S. and China, falling oil inventories, and also by the major Hurricane heading for the southeastern U.S. Despite the apparent easing in the trade war, tariffs are set to jump on Sunday. Analysts state that upside momentum should not be taken for granted and that recession fears are casting a shadow on sentiment and oil prices should keep dancing to the tune of the U.S.-China trade saga.

Natural gas spot prices fell at most locations this week. Henry Hub spot prices dropped slightly from $2.25 per million British thermal units (MMBtu) last Wednesday to $2.24/MMBtu this week. At the New York Mercantile Exchange, the September 2019 contract expired yesterday at $2.251/MMBtu, up 8¢/MMBtu from last week. The October 2019 contract increased to $2.222/MMBtu, up 4¢/MMBtu from last week. The price of the 12-month strip averaging October 2019 through September 2020 futures contracts climbed 3¢/MMBtu to $2.373/MMBtu.

World Markets

European markets rose this week lifted slightly by improvements in U.S.-China trade talks and a new agreement forwarded by Italian political parties to join together for a new government. The pan-European STOXX Europe 600 Index rose over 2%, while the German DAX advanced 2.5%, and Italy’s FTSE MIB Index made serious headway and gained almost 4%.The FTSE 100 Index rose after Prime Minister Boris Johnson suspended Parliament from mid-September until October 14 in an attempt to push through Brexit. The idea behind the move shortens the time period when opponents of Brexit will have to prevent a disorderly Brexit. It was endorsed by by Queen Elizabeth II. Unfortunately it could end up triggering a possible election based on non-confidence.

Chinese investors were not as pleased by the latest trade developments and seemed to be preparing for a new wave of U.S. tariffs. The benchmark Shanghai Composite Index declined 0.4% and the large-cap CSI 300 Index dropped 0.6%. Both indices fell in August, with the Shanghai composite falling 1.6% and the CSI 300 giving up 0.9%.

The Week Ahead

The coming week is shortened by the Labor Day holiday, and holds light reporting including the Manufacturing Purchasing Managers’ Index on, auto sales, foreign trade deficit numbers, non-farm payrolls and August’s jobs report on Friday.

Key Topics to Watch

- Markit manufacturing PMI

- ISM manufacturing index

- Foreign trade deficit

- Motor vehicle sales

- Weekly jobless claims

- Markit services PMI

- Non-farm payrolls

- Unemployment rate

- Average hourly earnings

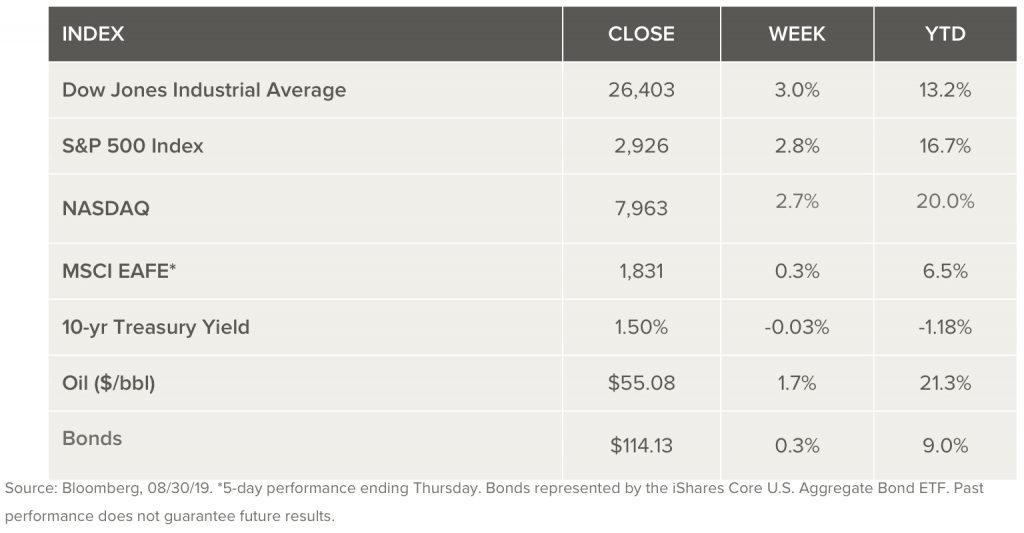

Markets Index Wrap Up