Results of a private survey on Monday showed China’s manufacturing activity expanded for the month of July — the fastest pace in nearly a decade, according to records.

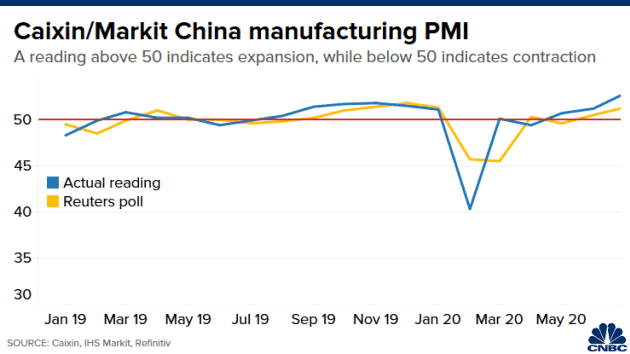

The Caixin/Markit manufacturing Purchasing Managers’ Index (PMI) came in at 52.8 for July, marking its third straight month of expansion.

Companies registered the fast expansions in output and new orders since January 2011 amid reports of firmer customer demand, noted Caixin and IHS Markit in their report of the survey results.

“As production and demand expanded, measures for purchases and stocks of purchased items both remained strong,” said Wang Zhe, senior economist at Caixin Insight Group.

Economists polled by Reuters had expected Caixin/Markit manufacturing PMI to come in at 51.3 for July as compared to 51.2 for June.

PMI readings above 50 indicate expansion, while those below that signal contraction. PMI readings are sequential and indicate on-month expansion or contraction.

China’s manufacturing sector has been battered as factories were shut earlier in the year due to large-scale lockdowns to contain the coronavirus pandemic.

Demand was also hit as the virus spread globally. The gauge for new export orders remained in contractionary territory for the seventh consecutive month in July.

“Although the pace of the contraction slowed, overseas demand remained a drag on overall demand,” Wang wrote in a report.

While recently there was some resurgence of the virus in parts of China, supply and demand both improved, he added.

“Overall, flare-ups of the epidemic in some regions did not hurt the improving trend of the manufacturing economy, which continued to recover as more epidemic control measures were lifted,” said Wang.

However, employment remained weak in July, he said.

Policy stimulus helped

The private survey showed that policy stimulus is helping the world’s second-largest economy in its recovery from the pandemic, said Julian Evans-Pritchard, senior China economist at Capital Economics, a consultancy.

That is as the gauge for export orders remained low at 48.3. Most of the strength in the gauge for new orders — which came in at 54.4 — was therefore due to the rebound in policy-driven domestic demand, Evans-Pritchard said in a note after the release of the survey results.

“The survey data are consistent with our view that policy stimulus has paved the way for a period of above-trend growth in construction and industry,” he wrote. “In the near-term this should help offset continued weakness in consumption and services activity, allowing the economy as a whole to return to its pre-virus trend by year-end,” he added.

Official manufacturing survey results release last week also painted a picture of recovery.

On Friday, China reported official manufacturing PMI that came in at 51.1 in July as compared to 50.9 in June, beating economists’ forecasts of 50.7. The expansion in China’s official PMI for the fifth straight month was due to demand for electrical and pharmaceutical goods.

The official PMI survey typically polls a large proportion of big businesses and state-owned companies. The private Caixin and IHS Markit survey features a bigger mix of small- and medium-sized firms.