Tesla finished the trading day Tuesday with a market cap greater than $500 billion for the first time after its stock price surpassed $527.48 per share.

Tesla’s enterprise multiple, or its enterprise value relative to EBITDA, exceeded 130 based on the company’s last 12 months, according to Factset. With a forward enterprise multiple of 63, Tesla shares closed at $555.38, up 6.4% for the day.

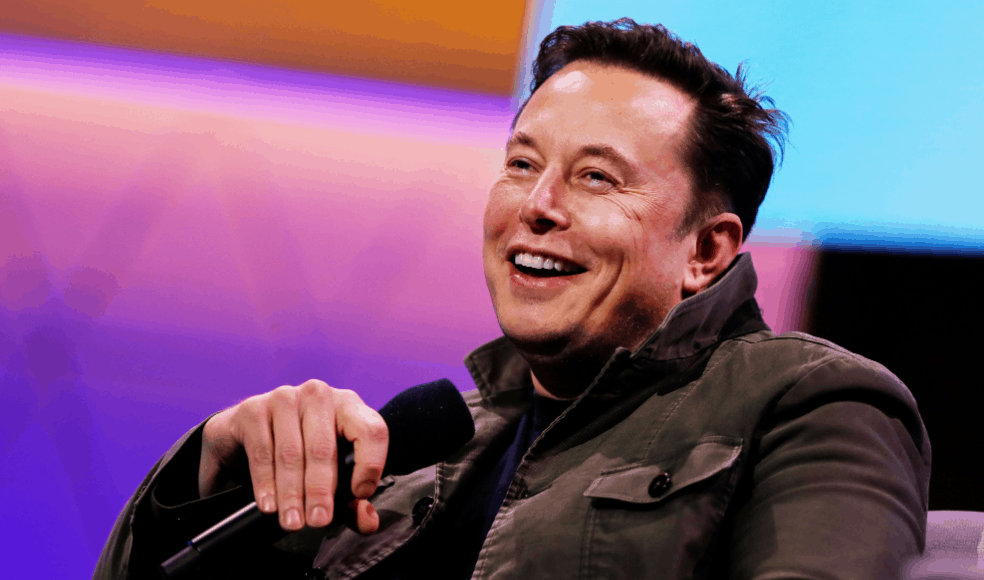

The company has been on a tear this year, with its stock price increasing more than fivefold. While the mark is largely symbolic, it underscores CEO Elon Musk’s push for growth. Tesla became the first $100 billion publicly listed U.S. carmaker in January.

In October, Tesla reported its fifth consecutive quarter of profit on third-quarter revenue of $8.77 billion. The company also reported earlier that month it delivered 139,300 vehicles during the third quarter, a record for the carmaker.

Tesla is set to join the S&P 500 before trading on Monday, Dec. 21, a move that pushed the shares higher earlier this month since money managers with funds that track the S&P 500 will need to buy the stock for their portfolios. Morgan Stanley also upgraded Tesla to a buy-equivalent overweight rating last week, the first time in years since the company put a buy rating on the stock.

This week’s stock jump also pushed Musk to overtake Microsoft billionaire Bill Gates as the world’s second richest person, according to the Bloomberg Billionaire Index, which tracks the wealth of the world’s 500 richest people. Musk’s net worth has risen more than $100 billion in 2020, marking the largest increase among those on the index. In January, Musk ranked 35th on the list. He now trails Amazon CEO Jeff Bezos.