Stock Markets

The market ascended to a record high in the past week on the back of renewed optimism over an impending economic recovery. The week’s developments did much to calm investor fears. A moderate inflation report and a slowdown of the upward movement in interest rates fueled the market rally, but the big news was the President’s signing of the $1.9 trillion American Rescue Plan (ARP), also known as the covid stimulus bill. The passage of the long-awaited fiscal stimulus lifted most benchmark indices to new highs, even as investors digest the volatile longer-term bond yields and factor in their discounts on future earnings. As a result, the Nasdaq Composite fluctuated due to speculation on the technology-oriented counters that comprise it. Within the S&P 500 the small real estate sector performed above average, while the health care and energy shares underperformed.

U.S. Economy

The fiscal stimulus package had been anticipated as the trigger for the continued economic recovery. Now that it has been passed there are varied speculations about the future implications it may have on the economy and financial markets. While the recovery has already taken off during the second semester of 2020, there are areas of the economy and the labor force that have lagged behind which the new stimulus may support. The state of the economy has been greatly helped by the preceding fiscal policy responses throughout the past year. Whilst in a typical recession, the plunge in employment would have been accompanied by a significant drop in aggregate income, the strategy of sending out stimulus checks directly to those whose livelihoods have been curtailed has sufficiently bridged the wage gap resulting from the shutdowns. Current personal income has surpassed pre-pandemic levels even before the most recent $1,400 checks have been sent out.

- The U.S. household net worth is presently at its record high level because in addition to personal income, home and asset values have arisen as well as stock prices being at their peak. With income levels receiving another boost from the new stimulus, consumer spending will find an additional impetus, as well as the U.S. GDP of which 70% is comprised by consumer spending. Economic growth may further ascend in the coming quarters, with GDP growth likely increasing to above-average levels in the current year.

- The ARP includes $400 billion in direct check payments to consumers amounting to $1,400, with distribution to commence over the weekend. This component alone amounts to 2% of the annual GDP, although it is expected to be spent over an extended period. The personal savings rate climbed from 13% to 20% during the last round of stimulus checks released in December, suggesting that people are depositing rather than spending their pandemic payments. This is not surprising, given the simultaneous lockdowns of retail businesses from which consumers would have purchased the goods and services they needed.

- While a strong recovery that may lead to a boom-type scenario may be seen for this year, it is pre-emptive to say that this trend will be sustained beyond 2021. There have been sectors of the economy that experienced accelerated growth during the pandemic, such as cloud computing, remote working, automation, and machine learning. It is premature to speculate, however, that this new trend may continue to push booming productivity enough to push the economy beyond the present year. The possible downside to the ARP remains in the form of the risk of an overheating economy, massive government debt, and the expectation that similar future downturns will prompt the same stimulus response from the Federal government.

Metals and Mining

Gold broke out from its week-long slump below the $1,700 level, beginning the week at $1,681 per ounce and rallying midweek to $1,739,10, 3.46% up for the week but still far below the $1,804 high it reached in later February. The metal corrected from its midweek rally to trade at $1,702.24 on Friday. The four weeks preceding saw a steady decline in the price of gold due to the strengthening bond yields simultaneous with the rising US dollar. The fundamentals for the metal remain sound, however, and a bull market is possible in its future.

Silver performed better than gold for the week, climbing 4.8% on Thursday from Monday’s prices, although it retraced slightly to trade at $25.58 per ounce on Friday. Platinum reversed two weeks of losses to peak at $1,218 per ounce and ended trading on Friday at $1,177. Palladium traded at $2,268 per ounce on Friday. Platinum is expected to outperform palladium and gold for the rest of the year due to positive fundamentals, although precious metals, on the whole, are expected to do benefit from quantitative easing and economic recovery.

The values of base metals are coming down from their strong performance at the beginning of the year. The recent pullbacks have been more consistent with a consolidation rather than a breakdown, however. Copper was priced at $9,062 per tonne on Friday, still below the eight-year high of $9,614.50 that it achieved in late February. Demand and economic growth may push the metal higher within the year. Nickel came down from its seven-year high of close to $20,000 per tonne in February to trade below $16,000 shortly thereafter on news that lower-grade nickel ore will be used to make battery-grade nickel sulfate. Nickel traded at $16,434 on Friday. Zinc made a modest gain rising from $2,742.50 per tonne on Monday to close at $2,784 for the week. Lead adjusted downward slightly, giving back $48.50 to close at $1,934.50 per tonne on Friday.

Energy and Oil

Tight supplies caused a drain in global inventories to push oil prices upward towards the week’s end. The success of vaccine deployment and the resumption of robust economic activity are bound to increase demand for oil in the coming weeks and months. OPEC had taken the contrarian view and downgraded its demand forecast, however, due to what it foresees as ongoing lockdown measures and other pandemic restrictions. Short-cycle shale drillers, on the other hand, are tempted by the increase in prices that they may be contemplating a ramp-up in production. Analysts point to the decision of OPEC+ to continue withholding production as a possible enticement to shale producers to take advantage of the tight supply and strengthening demand.

In further developments on the US side, the Biden administration’s Interior Department has approved 200 drilling permits in the last two weeks, mostly in Dakota and Wyoming. Although the government has temporarily suspended leases on federal lands, the recent approval of drilling permits appears to signal a rethinking of this position. Analysts also note that over the next five years, fewer investments will be poured into the oil and gas companies as the largest institutional investors in the world appear to be scrutinizing more intensely the environmental credentials of the companies that compose their portfolios.

Natural Gas

At most locations during the report week (March 3 to March 10), natural gas spot prices declined as a result of warmer-than-normal climate throughout the lower 48 states. The Henry Hub spot prices slid to $2.60 per million British thermal units (MMBtu) from the previous week’s $2.84/ MMBtu. The price of the April 2021 contract at the New York Mercantile Exchange (NYMEX) fell to $2.692/MMBtu, a reduction of $0.12 from the previous $2.896/MMBtu. The price of the 12-month strip averaging April 2021 through March 2022 futures contracts fell to $2.890/MMBtu, a difference of $0.10/MMBtu.

World Markets

In Europe, share prices trended upward on the prospect that pandemic restrictions may soon be relaxed due to the ongoing vaccine distribution. Also, there is widespread expectation that supportive fiscal and monetary policies may be soon implemented to further spur the economy on the road to recovery. The stock market gains were somewhat muted by the apprehension that central banks may take measures to address the rising inflation rate. The pan-European STOXX Europe 600 Index gained 0.91%, in tandem with the major stock indexes. The UK’s FTSE 100 Index rose 2.27% for the week on the possibility of more fiscal stimulus in the annual budget and the expectation of an earlier-than-projected economic recovery. In response to long-term inflation expectations, core and peripheral eurozone bond yields increased. Yields were further boosted by uncertainty concerning possible European Central Bank action to address possible overheating.

Lockdown restrictions were extended by German Chancellor Angela Merkel and the regional chief ministers until March 28, dampening somewhat the expectation of a speedy recovery. Italy blocked 250,000 doses of the Oxford- AstraZeneca coronavirus vaccine that were scheduled to be transported to Australia, a decision condoned by Brussels. The shipment was supposed to have been the first intervention since the European Union (EU) introduced the rules governing vaccine shipment outside of the EU. It is also likely that France might block vaccine shipments abroad.

In Asia, Japan’s stock markets ended mixed for the trading week. The Nikkei 225 Stock Average ended 0.35% lower while the broader benchmark TOPIX Index closed higher by 1.70%. The yen lost ground against the dollar by JPY108 to USD. The 10-year Japanese bond ended the week at 0.09%, the lowest yield from the middle of February. The Japanese government continued to implement its state of emergency in Tokyo and three neighboring prefectures due to the persistent coronavirus spread. Volatility in China’s stock markets sent shares falling on concerns of contagion from rising US yields and inflation growth. The large-cap CSI 300 Index slid 1.4% whilst local currency A shares gave back 0.2%. Remarks from China’s banking and insurance regulators on the need to deleverage and avoid financial bubbles sent technology shares falling, including counters in the consumers, electric vehicles, property management, and financial sectors. The yield on China’s sovereign 10-year bond climbed 3.36% while the renminbi closed unchanged against the US dollar.

The Week Ahead

In the coming week, among the reports expected to be released are the Fed Funds target rate, retail sales growth, and housing starts.

Key Topics to Watch

- Empire state index

- Retail sales

- Retail sales ex-autos

- Import price index

- Industrial production

- Capacity utilization

- National Association of Home Builders index

- Business inventories

- Building permits (SAAR)

- Housing starts (SAAR)

- Federal Reserve announcement

- Federal Reserve Chair Jerome Powell press conference

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Philadelphia Fed manufacturing survey

- Index of leading economic indicators

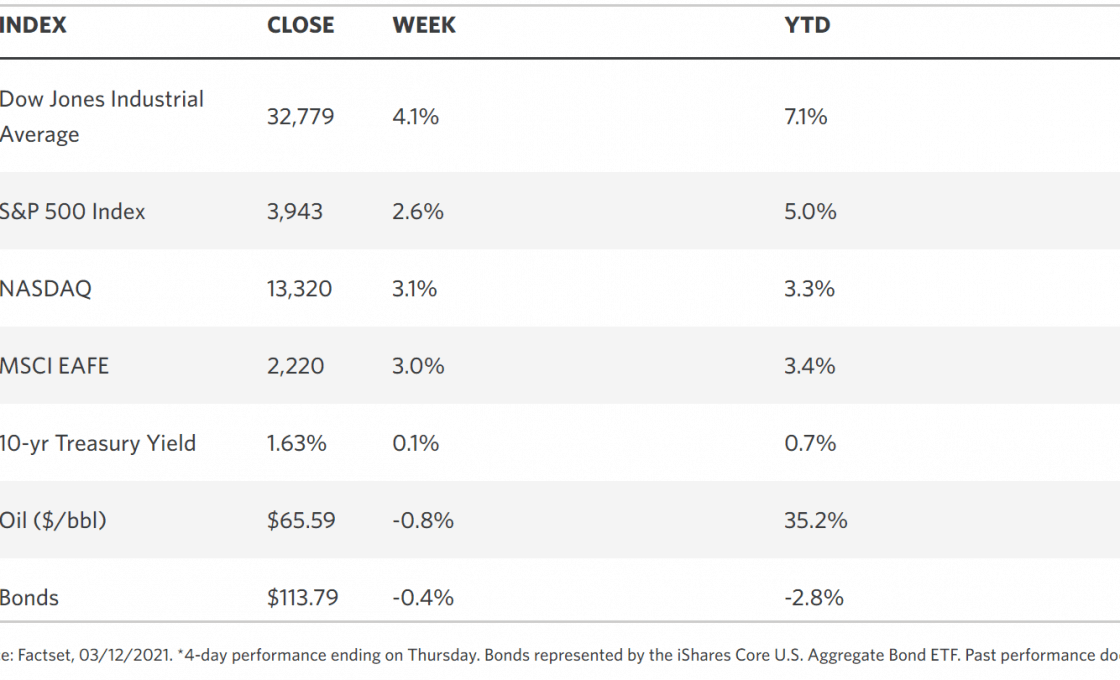

Markets Index Wrap Up