When it comes to managing money responsibly, there are certain missteps that can have an immediate repercussion on your finances.

For example, unnecessary spending means less money in your bank accounts to cover your bills. Or missing a credit card statement can result in a late fee.

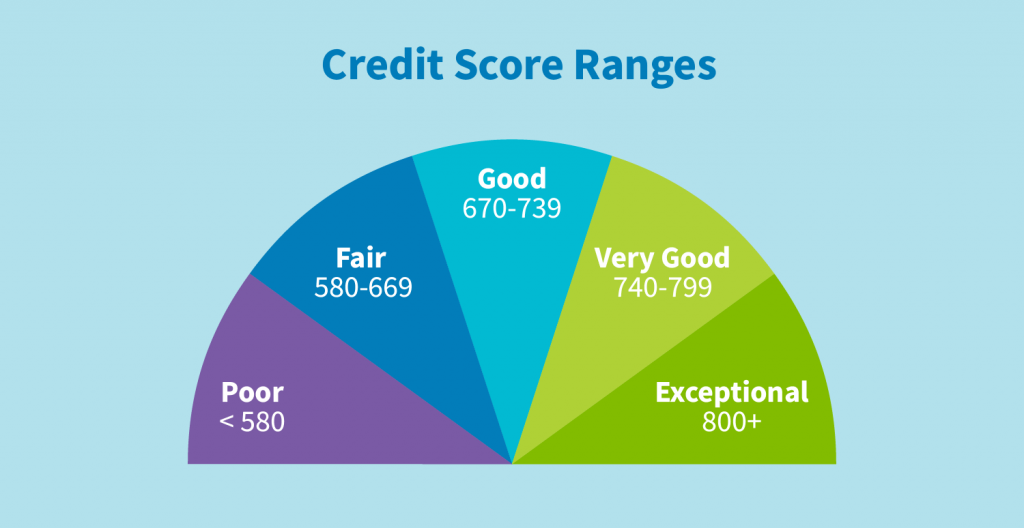

But there are also those money mistakes that may not have as dramatic and sudden effect on your wallet, yet they can hurt your credit score. These are just as important to avoid because, in the long run, they’ll add up to really damaging your access to affordable credit when you want to take out a personal loan or apply for a new credit card. A lower credit score means you may not qualify or, if you do, you’re interest rates will be high.

“Of all the financial mistakes that can come back to haunt you, the ones that impact your credit score can seem minor at the time but have lasting effects,” Rod Griffin, senior director of public education and advocacy for Experian, tells Select.

Here are four crucial “credit don’ts” you should avoid in order to stay on the right path to credit success.

1. Don’t run up high credit card balances

A hard and fast rule to having a solid credit score is maintaining a low credit utilization rate (CUR). Your CUR is the percentage of your total credit that you’re using. It’s calculated by dividing your total outstanding credit card balance by your total credit limit, then multiplying by 100 to get the percentage.

The higher your credit card balance, the higher your CUR, so it’s crucial to avoid running up excessive card balances. The lower your balances are as compared to your credit limits, the better. Pay off your balance in full each month, and if you can’t afford to do that, keep them below a certain threshold.

“At a minimum, you should strive to keep balances below 30% of the credit limit,” Griffin says. “Any balance can have some effect on scores, but once you cross the 30% threshold, scores begin to drop much faster.”

Griffin warns that those in the habit of revolving large balances on their credit cards month to month are certainly hurting their credit scores without realizing it, even if they never make any late payments on those accounts.

2. Don’t default on credit accounts

Making a late payment has the most significant negative impact on your credit scores. In fact, your payment history accounts for over a third (35%) of your credit score calculation.

“Missing so many payments that the lender declares the account in default will do such serious damage that it could take years to rehabilitate your credit scores,” Griffin says.

There are a number of ways that a defaulted account can show up on your credit report: foreclosure, bankruptcy, repossession, settled accounts, charge-offs and, if an account is charged off, a subsequent collection account. Each of these can severely hurt your credit for years, and, in the case of bankruptcy, up to a decade.

Those worried about going into default should automate their bills. With automation, your money is automatically taken out of your account each month by the due date so your bill is paid on time, every time. Even if you can’t afford to pay your full statement balance, paying the minimum each month will keep you in good standing.

3. Don’t apply for unnecessary new credit accounts

“Only apply for new credit when you need it and know how you will repay it,” Griffin says.

Applying for a bunch of different credit accounts in a short time period is a sign of risk to lenders. Not to mention, each application results in a hard inquiry on your credit report, which can ding your score a few points. A hard inquiry is when a lender requests your credit report to check your creditworthiness in response to your application.

Taking on too much unnecessary credit might also tempt you to overspend and accumulate too much debt. You should make sure you feel comfortable adding additional cards to your wallet before you sign up for another card.

4. Don’t make rash decisions that interfere with your budget

You’ve heard it many times before: budget, budget, budget. Having a budget is a surefire way to keep your spending in check and help guide you when you’re designing your long-term financial plan.

An app like Personal Capital helps you budget while also giving you advanced tools for all your financial planning needs. In addition to being a basic budgeting app, Personal Capital acts as an investment tool that links to your bank accounts and credit cards, as well as IRAs, 401(k)s, mortgages and loans. Its money-tracking dashboard makes it easy to see an overall view of all your accounts in one place. Learn more about the Personal Capital app in our review.

“Whether you use a pen and paper or an online app, it’s critical to have a plan,” Griffin says. “A new car, house, wardrobe or three-month Euro-trip with friends requires saving and preparation. A budget can help you reach those destinations and help you live a lifestyle you can afford.”

Have a high credit card balance that you just can’t get rid of?

Once you start carrying a balance month to month, it can be harder than ever get a handle on your credit card debt because interest is continuously accruing. A balance transfer credit card can help you finally make a dent in your credit card debt by offering introductory 0% interest period. This gives you more time to pay off your card balances while avoiding any additional interest.

The U.S. Bank Visa® Platinum Card comes with 20 months of no interest on balance transfers and purchases (after, 14.49% – 24.49% variable APR), plus no annual fee.

Meanwhile, if you are looking to get a credit card with rewards, the Citi® Double Cash Card offers zero interest for the first 18 months on balance transfers (after, 13.99% to 23.99% variable APR). Balance transfers must be completed within four months of opening an account. The card has no annual fee and comes with 2% cash back: 1% on all eligible purchases and an additional 1% after you pay your credit card bill.