Crypto’s June swoon has shaken the confidence of even the most ardent bulls.

But many pros that watch and trade the sector aren’t yet thinking about a longer-term demise for digital assets in the face of such stark price declines.

“You are seeing a lot of the leverage that was built up around crypto come unglued quickly,” Rick Rieder, BlackRock’s chief investment officer of global fixed income told Yahoo Finance Live. “I still think Bitcoin and crypto are durable assets. It’s a durable business, but there was so much excess built around it in cash.”

To be sure, it has been a wild week for the crypto faithful.

Bitcoin prices fell below $21,000 this week in a broader flight to safety amid uncertainty on how fast the Federal Reserve will lift interest rates. The total value of the crypto market plummeted to as low as $908 billion on Thursday, down from roughly $3 trillion in late 2021.

Crypto-exposed stocks such as Coinbase (COIN) , Robinhood (HOOD) and Microstrategy (MSTR) continue to be hammered, and short-sellers are reaping huge profits on this trade.

This week, Coinbase froze hiring and announced the the crypto trading platform would cut 18% of its workforce. Robinhood, meanwhile, was hit by a series of Wall Street downgrades on market volatility concerns. The stock is now trading at about 17% below book value, reflecting in large part the pullback in crypto prices and weakening retail investing participation.

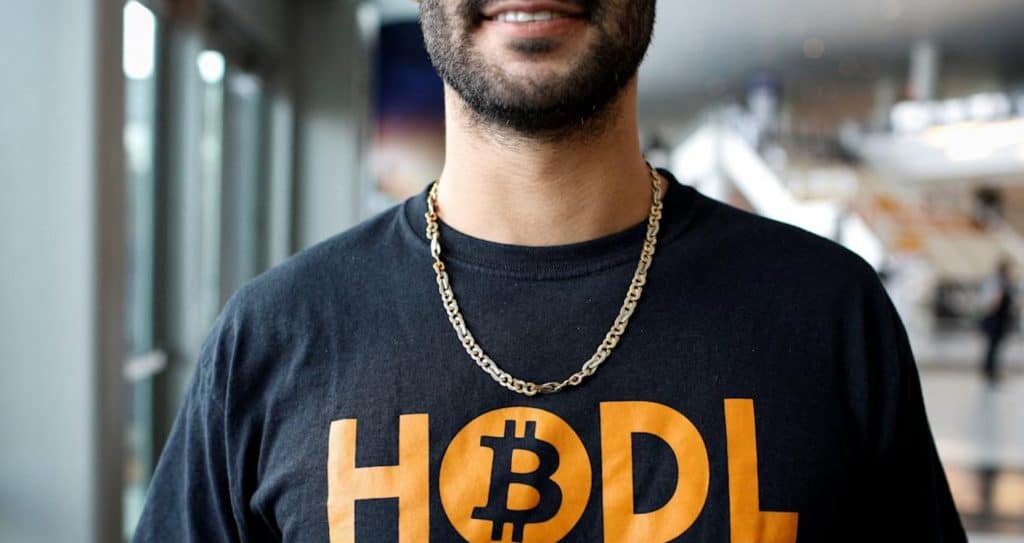

This flushing of speculators calls into question a common rallying cry that bitcoin will hit $1,000,000 by 2030 — or even whether it’s worth buying the current crash.

Rieder says it’s difficult to predict where prices go next for bitcoin, but cautioned that assets under this amount of pressure often overshoot to the downside before recovering.

“My sense is in all these situations you overshoot, and my guess is you have probably got some downside to go from here,” Rieder explained. “It’s hard to say what fair value is. My sense is like a lot of assets, you look two to three years hence, they will be higher than today. But it could overshoot on the downside. This is hard to figure out, just like gold, because I can’t figure out my free cash flow multiple and what my security is underneath it.”