A $634 billion rally in the Nasdaq 100’s top three megacap names this month has almost powered the tech-heavy gauge into a new bull market. Yet the nature of the rebound may signal that it doesn’t have much further to run.

The gains in Apple Inc., Alphabet Inc. and Microsoft Corp. have been fueled by their so-called safe haven status as fears of contagion in the banking industry pushed investors toward megacaps’ cash-rich balance sheets and durable revenue streams. Three other index heavyweights — Nvidia Corp, Meta Platforms Inc., and Tesla Inc. — are its biggest gainers in March.

Microsoft and Alphabet Have Best Week in Years Amid Bank Turmoil

Yet while big tech might offer some safety in turbulent times, it isn’t without risks. Valuations are elevated, the earnings outlook looks clouded, while a key factor behind the rebound — falling bond yields — could prove short lived.

“Right now you’re paying a big premium to be in the sector at a time of above-average risk, which suggests your return potential from here doesn’t look great,” said Keith Lerner, co-chief investment officer at Truist Advisory Services. “We don’t love tech, but while other options don’t look great either, tech has gotten so crowded that we could see a real reversal if emotions change.”

This month’s 6.2% rally means the Nasdaq 100 is now up 19.7% from its December closing low, near the 20% threshold that represents a new bull market. A 17% year-to-date gain compares with one of 3.4% for the S&P 500.

The Nasdaq 100 rose 0.1% on Monday.

The rotation back toward big tech, a partial reversal of widespread weakness throughout 2022, picked up steam after the collapse of Silicon Valley Bank led to contagion worries. At the same time, concerns about the economic fallout of the crisis led to the yield on the US 10-year Treasury collapsing from a peak above 4% earlier this month to around 3.5%.

Lower yields are beneficial to tech valuations since they enhance the present value of future earnings, but the drop may not be sustainable, especially if it seems like the worst has passed for banks and as the Federal Reserve expects to continue raising rates to fight inflation.

It’s not like tech’s rally has been matched by an improvement in fundamentals. According to Bloomberg Intelligence data, sector earnings are expected to fall 7.7% in 2023, compared with the growth of 5.2% expected six months ago. Forecasts for revenue growth have also turned negative over the same period, with consensus moving from a 6% rise to a 0.5% drop.

Falling estimates have the effect of making stocks look pricier at a time when the sector is already above its long-term multiple. The Nasdaq 100 trades at 24 times estimated earnings, higher than its 10-year average of 20. Both Apple and Microsoft, by far the two largest components, are notably above their long-term averages, while Nvidia is almost double its 10-year average.

Michael Nell, a senior investment analyst and portfolio manager at UBS Asset Management, remains positive about tech over the long term, but suggests that momentum could stall in the near-term.

“There’s been a continual stream of negative events that has people taking safety in big tech, but now valuations are generally stretched, and if investors warm to the idea that the world isn’t ending, they may feel this trend is played out.”

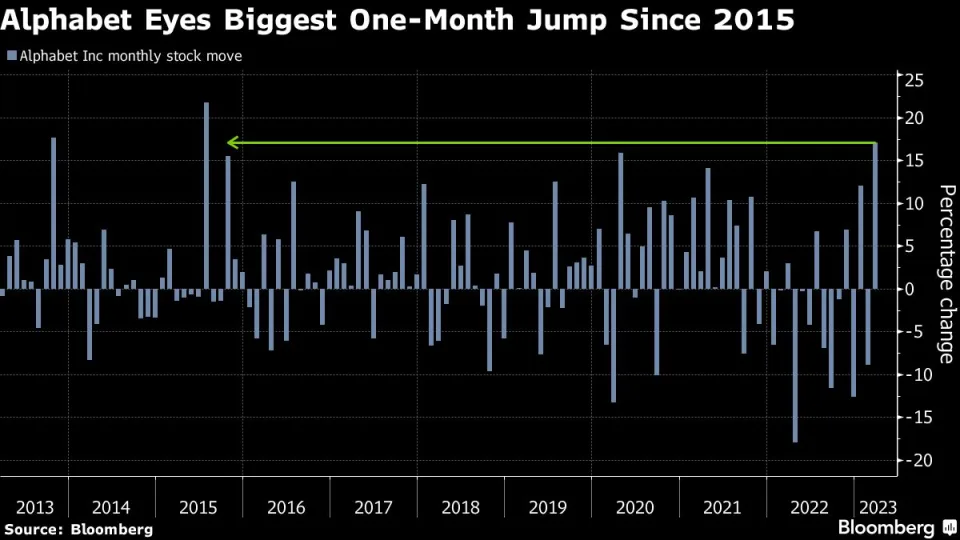

Tech Chart of the Day

Alphabet shares are on track for their biggest monthly gain in several years, as the Google parent leads the broad advance in megacap tech stocks. Recent gains have also been fueled by the release of the company’s Bard chatbot, a conversational artificial intelligence service that Bank of America Corp. analysts said could help ease concerns about the risk of competition from Microsoft’s AI-supported Bing.

Top Tech Stories

- Parts of Twitter’s proprietary source code were published online until last week, the company revealed in a California court filing Friday.

- Salesforce Inc. has reached an agreement with activist investor Elliott Investment Management, which will not proceed with its planned director nominations.

- Apple’s push into mixed reality will take years to pay off, with the company hoping the device follows the same trajectory as its smartwatch.

- Alibaba Group Holding Ltd. surged after the South China Morning Post reported that billionaire co-founder Jack Ma returned to his home country recently after more than a year abroad.

- Jack Ma might be one of Beijing’s best chances at repairing its reputation with the private sector in China and beyond. But the billionaire has been circumspect about invitations from authorities.

- Security researchers at Moscow-based Kaspersky Lab have identified and outlined potential malware in versions of PDD Holdings Inc.’s Chinese shopping app Pinduoduo, days after Google suspended it from its Android app store.

- Huawei Technologies Co. has developed software tools capable of designing chips as advanced as 14 nanometers, advancing efforts to help Chinese companies sidestep US sanctions and replace American technology.