It’s an old fashioned budgeting method that’s gaining new popularity on TikTok.

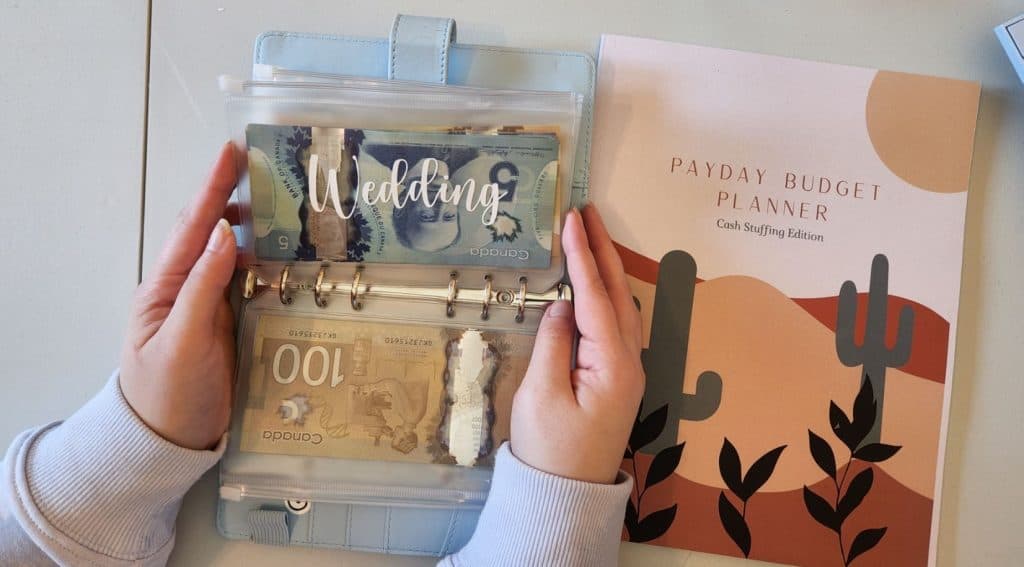

“Cash Stuffing” or the “Envelope System” has been around for years.

Now, a younger generation is embracing it because it’s easy and effective, according to money experts.

“It’s a simple process,” said Jeff Massey of Massey & Associates. “Put an envelope for each of the bills that you need to pay, and when you get your check, you know what you have to split out in each of those envelopes, and one of which should be entertainment.”

That being said, there are a few things to keep in mind.

If you’re going to be setting aside a lot of cash each month, Massey says it’s important to have a fire-proof safe.

It’s also worth noting that when it comes to saving, there are better, more long term solutions that don’t involve envelopes.

“It’s important to build up your savings account, especially for those that are still working, because you should have, as your first line goal, at least six months’ worth of your expenses in a savings account in the bank, in case your job gets interrupted,” explained Massey. “That way you’ve got that emergency money to fall back on – that’s the more important financial concept that people should wrap their arms around – in addition to having a good spending plan so you know what’s going on.”

Massey said part of your spending and savings plan should include your contributions to your retirement plan.

He recommends people put 10% to 15% of their income into a retirement plan.

If you can’t swing that much, he says at least set aside enough money to get the company match – if your employer offers that perk.