Investors in these fast-growing businesses look poised for prosperity.

The raging bull market has already caused many growth stocks to soar, but that doesn’t necessarily mean the good times are ending anytime soon. With that in mind, we asked a team of investors to highlight a growth stock that they think still has plenty of gas left in the tank. Here’s why they picked Yamana Gold (NYSE:AUY), A.O. Smith (NYSE:AOS), and Five9 (NASDAQ:FIVN).

This gold stock could glitter

Neha Chamaria (Yamana Gold): Gold stocks may not sound like great growth candidates, given the unpredictability of gold prices, but there’s one stock that looks poised to soar, backed purely by its growth plans: Yamana Gold.

Yamana surged 22.8% in December and ended an otherwise somber year with 11% gains. The market’s excitement wasn’t unwarranted, as Yamana just proved with its preliminary fiscal 2017 numbers.

Yamana had upgraded its full-year production estimate during the third quarter, but it turned up an even better fourth quarter and beat its fiscal 2017 guidance by a strong margin. Now, expect the gold miner to report strong revenue growth when it releases its final numbers on Feb. 15.

We are equally optimistic about Yamana’s upcoming guidance for 2018-2020. Since its production for 2017 was way higher than estimates, we wouldn’t be surprised if Yamana upgrades its outlook through 2020 in February, especially as its high-potential seventh mine, Cerro Moro, comes online in the coming months. Cerro Moro could be a game-changer for Yamana. As of now, Yamana foresees 20% growthin gold and a 200% jump in its silver production between 2017 and 2019.

Overall, Yamana has been an underrated gold stock that has the potential for strong gains if the miner’s growth plans pan out as planned.

The future looks as good as the past

Reuben Gregg Brewer (A.O. Smith): A.O. Smith’s Chinese business makes up around a third of its total sales. Growth in that country has been nothing short of incredible, with the company posting compound annual sales growth of 22% in the decade through 2016. These results have powered the company’s overall financial performance and have been a key factor in the massive 1,000% stock price gain over the past decade. Perhaps the next 10 years won’t see that type of gain, but there’s every reason to think the stock will continue to soar.

You see, A.O. Smith makes water heaters. In developed markets, which bring in around two-thirds of revenue, the water heater business is mature. But in developing markets such as China, it’s growing quickly, as residents are increasingly capable of affording the luxuries we so often take for granted. China makes up virtually all of A.O. Smith’s foreign sales at this point, but it’s starting to move more aggressively into fellow Asian giant India.

The plan is simply to repeat everything that worked so well in China. Even if A.O. Smith has to make adjustments along the way, which is highly likely, the opportunity is huge. India’s population is set to exceed China’s in 2022, according to recent statistics. And both China and India are expected to eventually surpass the size of the U.S. economy — and not in some wildly distant period, but over the next 20 years or so. If A.O. Smith can catch that demographic and economic wave, which looks highly likely, its stock will have the wind at its back in a big way.

To the cloud

Brian Feroldi (Five9): Technological advancements have allowed remote work to become more common these days. One company helping to drive this movement is Five9. This software-as-a-service company helps businesses to move their customer care operations into the cloud. Doing so enables call center agents with a computer, headset, and internet connection to deal with customer service issues from the comfort of their own home.

The advantages of deploying a cloud-based customer service system are huge for employees, businesses, and customers alike. Employees are offered a chance to work from home and, in some cases, set their own schedule. Those are highly attractive benefits for working families, which can help to lead to productivity gains, increased retention, and higher employee engagement. Meanwhile, businesses can more easily scale their customer care operations as they grow without needing to add additional square footage. Finally, customers can gain easy access to customer service agents by phone, chat, email, social media, or even video.

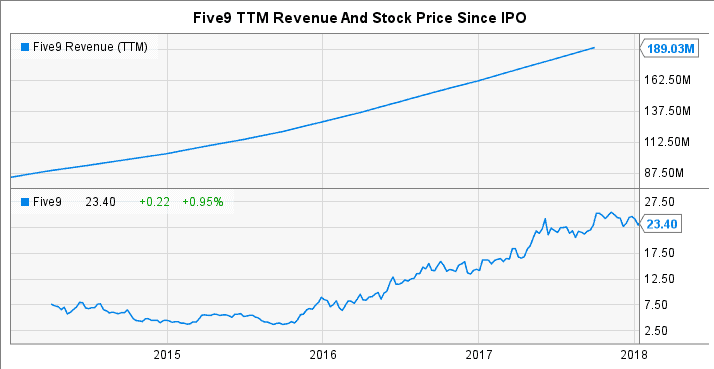

These advantages haven’t gone unnoticed by businesses, which is why customers have been signing up in droves. In turn, Five9’s revenue and stock price have soared.

Five9’s financial statements should continue to flourish as the trend toward remote work continues to heat up. While Five9’s stock isn’t cheap — shares currently trade for more than 170 times forward profits — high-quality small-cap businesses rarely are. Despite that fact, we think Five9’s future looks so bright that this red-hot growth stock can continue to perform for investors from here.