The major market averages were mostly unchanged in early trade Thursday, as they mounted a furious rebound following an early dive. Social media giant Facebook (FB) jumped to a new high in the stock market today. All three major indexes — the Dow Jones industrial average, Nasdaq and S&P 500 were only slightly below their break-even marks.

Meanwhile, the price of Bitcoin fell over 8% to $9,300 on CoinDesk after India’s government said it will take all measures to eliminate payments using the cryptocurrency.

Among companies reporting earnings, Facebook beat Q4 earnings targets. The stock moved up over 2% to hit a fresh record high. Its 5% buy range from a 184.35 flat-base entry runs up to 193.57, so shares are barely still in buy range.

Ferrari (RACE) raced 5% higher to break out past a 121.24 cup-shaped base buy point. Early Thursday, the luxury-car maker reported strong quarterly results.

Meanwhile — after the closing bell — three tech heavyweights will report their quarterly results: Alphabet (GOOGL), Amazon.com (AMZN) and Apple (AAPL).

Alphabet sits well-extended from a 1,006.29 flat-base buy point. Analysts expect the search giant to report EPS of $10.12 on revenues totaling $25.66 billion.

Amazon fell 0.6% and is extended from its most recent buy point — a 1,213.51 flat-base entry. Analysts estimate EPS of $1.85 on revenue of $60.03 billion.

Apple rallied 0.3% Thursday ahead of its much-anticipated fiscal-Q1 earnings release. Consensus estimates show EPS rising nearly 14% to $3.82 on a 10% boost in revenues to $86.29 billion.

Among retailers, Ralph Lauren (RL) posted declining same-store sales globally and in North America, sending its shares 2% lower. The stock has had a near-100% recovery off its lows set in May 2017. Shares are extended above a 97.30 cup-with-handle entry.

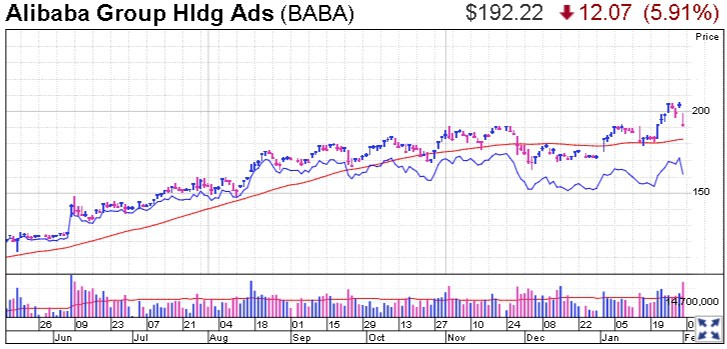

Inside the IBD 50, Alibaba (BABA) dropped over 3% after its earnings fell short of analyst targets, sending shares back into buy range from a 191.85 cup-shaped base buy point. But potential investors should wait for signs of strong support before considering a new purchase of shares.

Payment processor PayPal (PYPL) plunged over 8% after eBay (EBAY) said it will switch to a new payments provider, Adyen. Shares of PayPal gave back all of their gains from a 79.49 flat-base entry and found themselves fighting for support at the 50-day line.