1. Blame the bonds: The normally boring bond market is causing serious drama on Wall Street.

An avalanche of selling sent the Dow and S&P 500 careening 5% lower last week, one of the stock market’s worst weeks since the 2008 financial crisis.

The culprit: Rapidly rising bond yields are alarming investors who got hooked on a decade of low interest rates.

So what’s going on here? And why the focus on the bond market?

Modern financial markets function on the belief that U.S. government debt is the safest investment on the planet.

Knowing how much they can earn from “risk-free” Treasury bonds allows investors to determine the cost of stocks and other riskier assets. Treasuries serve as the benchmark for all other forms of credit, from junk bonds to mortgages.

“The 10-year Treasury sets the price for every asset in the world,” said Brent Schutte, chief investment strategist at Northwestern Mutual.

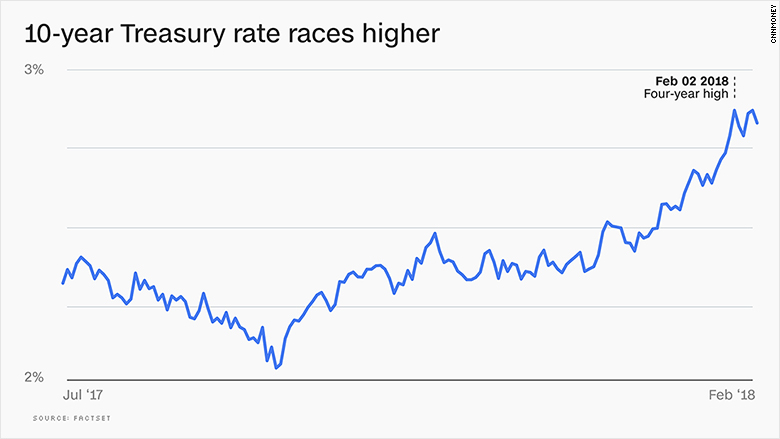

That means the surge in the 10-year yield — from 2.4% earlier this year to about 2.8% now — has increased the cost of money generally.

Investors fear that if rates continue to spike, the stock market won’t look like such a bargain anymore. When interest rates are low, investors are willing to pay up for stocks — and vice versa.

“Bonds and stocks are absolutely connected at the hip,” said Schutte.

Rates remain very low historically — but they’re climbing fast enough to unnerve a market accustomed to cheap money.

The spike is being driven by a range of factors, including faster economic growth and the anticipation of higher inflation now that the recovery from the Great Recession is nearly nine years old.

Rates climbed sharply after the January jobs report revealed the best wage growth since 2009. Bigger paychecks are great for Main Street, but Wall Street worries about the hit to corporate profits.

“When you start getting wage inflation, it tends to accelerate. That fear is being reflected by the markets,” said Jeff Korzenik, chief investment strategist at Fifth Third.

If inflation increases too quickly, the Federal Reserve may be forced to cool off the economy with aggressive rate hikes.

Another factor: The Republican tax cut and bipartisan budget deal could lift the federal budget deficit above $1 trillion in fiscal 2019.

That massive deficit will require extra borrowing, in the form of more Treasury sales. Attracting buyers may require higher yields, especially because the Federal Reserve has stopped buying Treasuries to stimulate the economy.

The bad news for stocks is that analysts think Treasury rates may keep climbing, potentially adding to Wall Street’s rate jitters.

The good news is that a steady climb in bond rates could be absorbed by the stock market, because the underlying fundamentals — the U.S. economy and corporate profits — remain strong.

The key will be the speed behind the move.

“If we get there gradually, it’s not a problem,” Schutte said. “If it happens suddenly, shocks can take the market off course.”

2. Trump’s infrastructure plan: The White House plans to release its infrastructure proposal on Monday. It’s been a long time coming.

President Donald Trump has said repeatedly that he wants to invest $1 trillion in repairing and upgrading U.S. infrastructure. He raised the target during the State of the Union. He said he plans to combine $200 billion in federal money with private spending to reach a $1.5 trillion infrastructure package.

It’s not clear exactly how that will happen.

Kent Rowey, a partner in the firm Allen & Overy who specializes in public-private partnerships, told CNNMoney that dozens of funds have been started for investing in infrastructure.

“There’s more product than demand at the moment,” he added. Money earmarked for loan programs that are typically used in public-private partnerships, he said, could serve as the “catalyst” that finally gets the ball rolling.

The White House is also scheduled to release the president’s budget proposal on Monday.

3. Food earnings: Several food companies are set to release earnings this week. On deck for Monday is Restaurant Brands (QSR), parent company of Burger King, followed by Pepsi (PEP) on Tuesday.

Dr Pepper Snapple (DPS) and Molson Coors (TAP) plan to report on Wednesday. And Coca-Cola (CCE), Campbell Soup (CPB), Kraft Heinz (KHC) and Smucker (SJM) are expected to share results on Friday.

A few other companies plan to report earnings next week, including Under Armour (UA), MetLife (MET), Hilton (HLT), Cisco (CSCO), Marriott (MAR), CBS (CBS) and Newell Brands (NWL).

4. U.S. retail numbers and inflation index: The government is scheduled to release U.S. retail sales figures for January on Wednesday. Sales were up 5.5% during the November and December holiday shopping season, according to the National Retail Federation’s analysis. We’ll see next week how much Americans were spending in January.

Also on Wednesday, the Labor Department is set to release its Consumer Price Index for January. The index is used to determine the rate of inflation — all the more important as the market wobbles with inflation jitters.