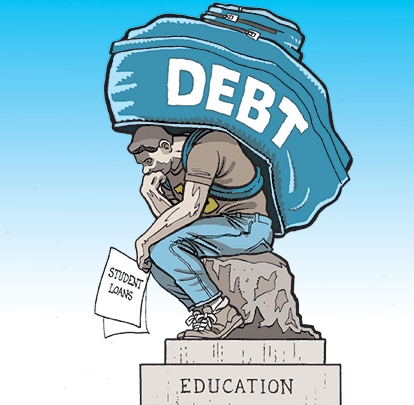

The bill can haunt college graduates decades after receiving their diplomas. It can be difficult to know where to even start when it comes to digging out of college debt.

Emilie Engesether graduated from an online college with nearly $70,000 in student loans. She’s made monthly payments ever since. Still, Engesether is years away from paying them off.

WCCO took her numbers to a financial expert, who came up with some new homework to get her back in the black. The deadline for this assignment still comes every month.

“I’ve never missed a payment,” Emilie Engesether said.

She earned her Bachelor’s Degree in business leadership.

“When I was beginning the conversations with the education counselors you know they’re sales people, too,” Engesether said.

What started as 11 different loans totaling $69,000 has gone down.

“There’s a large payment every month that goes to that and it seemingly doesn’t move,” she said.

Engesether has paid a $500 minimum monthly payment since she graduated five years ago. She’s paid off $14,000 in student debt. Mostly, by kicking in $10,000 of her own savings.

“I’m never going to get out of this,” she said.

Engesether is a single mom and makes a good six-figure salary. Still she feels like there’s no way out.

“What is the best way to tackle this and get out from under this?” she asked.

We took Engesether’s finances to Prosperwell Financial’s Nicole Middendorf.

“If you’re only paying the minimum of $500/month, you’ve got to figure out a way to double that and make it $1,000/month,” she said.

She says it’s critical students graduate with a plan. The average graduate leaves college $30,000 in debt with at least a $300/month re-payment plan. Middendorf suggests starting with negotiating a new interest rate.

“What’s the worst thing that can happen if you call and ask to have them to lower your rate. The worst thing that can happen is that they’ll say no,” Middendorf said.

Next, Middendorf says it’s back to the budget. She took a look at what Engesether spends each month, suggesting she cut way down on dining out and bring her lunch from home. It’s a move that will save her at least a couple hundred dollars a month.

Middendorf also questioned her $320 per month car payment. In some cases, she suggests clients get into older cars with no loans to get them back on track.

“You’re going to make some short term sacrifices for the long-term gain of really getting rid of that debt,” Middendorf said.

Some tough advice Engesether says she’s ready for, desperate to finally put that college degree in her review mirror.

“It’s so frustrating I just feel like I’m spinning my wheels,” Engesether said.