There’s a gold rush in Philippine telecom minnows and everybody’s invited. For now.

The Philippines will bid out a new telecom license in the first half of 2018, a process set in motion by Duterte’s invitation in November to Premier Li Keqiang for a Chinese company to invest in the sector and improve services. The bidding was moved to May from an original plan of March upon the request of contenders, said Eliseo Rio, acting head at the Department of Information and Communications Technology.

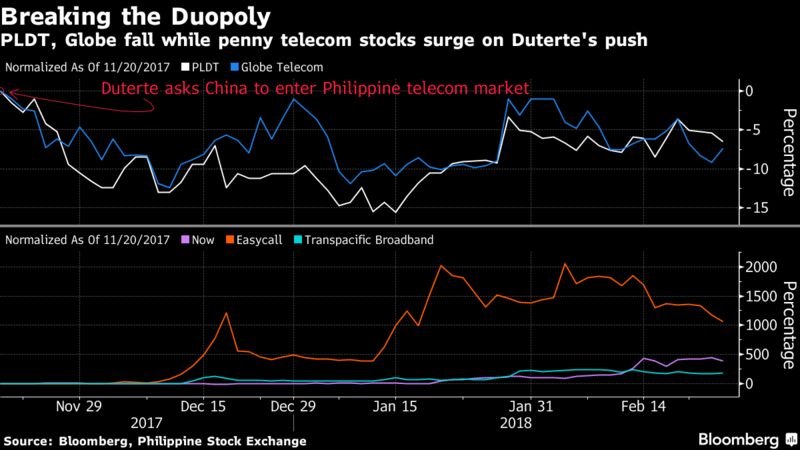

The proposal sparked investor interest in potential domestic partners for any Chinese bidders, and NOW, EasyCall and Transpacific Broadband are among the 10 biggest gainers this year in the all-share index. Bets that they can leverage their franchises, existing operations and listed status to potential overseas bidders will likely continue until the bidding, according to Jonathan Ravelas, chief market strategist at BDO Unibank Inc.

“This gives hope to small, listed telecommunication companies that they could be the third major player,” Ravelas said. “The government probably wants a company that can be up and running immediately.”

The speculation has even spread even to some real estate shares, according to market participants.

Golden Haven Inc., a builder of memorial parks that expanded into mass housing, has seen its shares surge over 1,300 percent this year on speculation its billionaire owner Manuel Villar will use the company to list his telecom venture that will bid for the frequencies the government will sell. Even Villar’s Starmalls Inc., a shopping mall builder, has risen over 170 percent in 2018 on the same speculation.

However, to some in the market, the rally has gone too far and there is a growing risk of a pullback. Rachelle Cruz, an analyst at AP Securities Inc. in Manila, is cautious on the sector given the speculative nature of the moves, even for shareholders of the company which gets the license.

“Share prices are already stratospheric and will likely collapse once the bidding is over,” she said. “Even the winner would see its stock collapse because raising the capital it needs will lead to massive dilution while its first five years of operations isn’t likely to be profitable.”

Gains in the stocks will moderate as the bidding nears, with the realization that the winner can’t build the business overnight, said Paul Michael Angelo, an analyst at Regina Capital Development Corp. “The incumbents will put up a tough competition,” he said.

As for the companies themselves, they aren’t convinced by the naysayers, preferring to highlight the logic they see behind the moves.

“There is irrational speculation, there’s rational speculation,” NOW President Mel Velarde said of his company which this month won a renewal of its franchise for another 25 years. “In this particular space, we are in the right spot and we want to seize this opportunity.”