Traders are making big bets that shares of Intel and AMD move higher.

On Tuesday investors bought more than 13,000 Intel calls with a May 52.50 strike price, according to Investitute co-founder and “Halftime Report” contributor Pete Najarian.

As of Monday’s close Intel was trading at $49.11, which means the stock will need to pop nearly seven percent to hit the 52.50 level. So long as it tops that price by May 18, the buyers of these contracts have the right to exercise their options.

Separately, on Tuesday Citi named Intel its “top pick,” which helped propel the stock to an 18-year high. Analyst Christopher Danely wrote in a note for clients that he has “more conviction on our recent upgrade of Intel from Neutral to Buy due to improving fundamentals and terrible sentiment.” He reiterated his “buy” rating on the stock and $58 price target, which represents an 18% upside from Monday’s close.

But Intel isn’t the only semi stock traders are eyeing — bullish investors are also making bets that AMD pops in the near future.

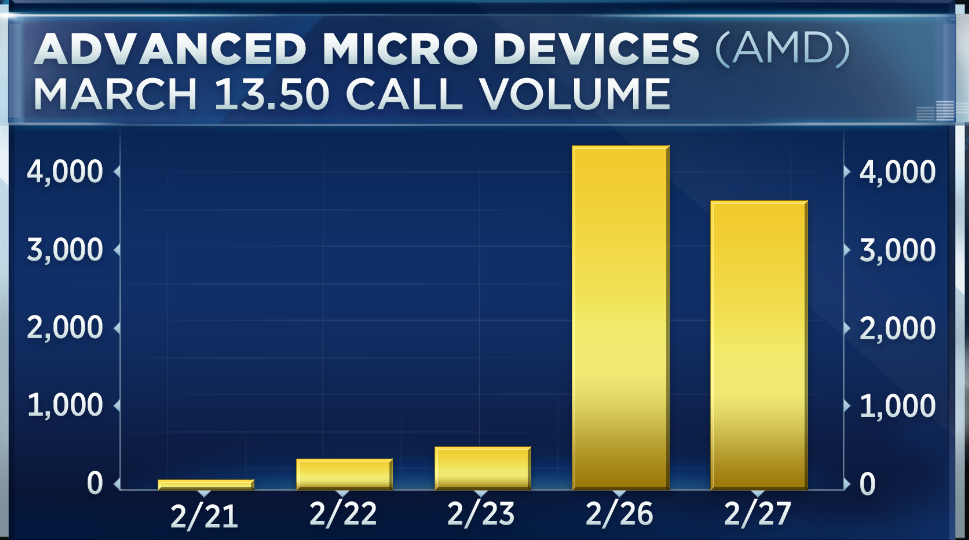

In the past week more than 5,000 March 13.50 calls have been bought. These options expire this coming Friday, which means bullish traders are expecting a more than 8% pop from Monday’s close.

AMD is up more than 22% this year, and currently trades at 32.3X forward earnings.