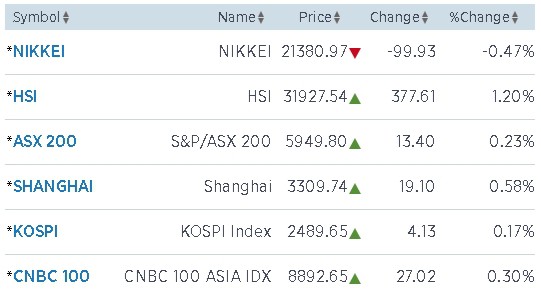

Asian markets traded cautiously higher on Wednesday, with markets focused on the Federal Reserve after it kicked off its March meeting. Gains in the region took cues from the overnight move higher on Wall Street after a pull back earlier in the week.

Hong Kong’s Hang Seng Index got a lift in early trade, jumping 0.98 percent as technology, energy and industrial names led gains. Shares of index heavyweight Tencent rose 1.24 percent ahead of its earnings release later in the day.

Mainland markets also notched gains, with the Shanghai composite rising 0.45 percent and the Shenzhen composite adding 0.48 percent.

Elsewhere, Seoul’s benchmark Kospi index inched higher by 0.05 percent while the junior Kosdaq edged up by 0.42 percent.

Shippers were firmer in the morning as South Korea’s “Big Three” shipbuilders rose, with Hyundai Heavy Industries adding 2.39 percent.

Over in Sydney, the S&P/ASX 200 drifted higher by 0.07 percent. Energy stocks rose 1.18 percent after oil prices surged to their highest levels in three weeks overnight, while consumer and telecommunication stocks declined.

Markets in Japan were closed on Wednesday for the vernal equinox.

Fed meeting kicks off

The Fed is widely expected to raise interest rates for the first time this year on Wednesday U.S. time. The probability of a 25 basis point rate hike in March stood at 94.4 percent, according to the CME Group’s FedWatch tool on Wednesday morning.

Markets are also watching the meeting for clues about whether the central bank potentially intends to raise rates more than three times this year.

“Expectations are skewed towards a more upbeat outlook for growth, employment and possibly inflation, whilst there has been a rise in market opinion that the FOMC may raise rates four times this year. We do not expect the Fed to shift its outlook aggressively,” ANZ Research analysts wrote in a note.

Also in the mix were concerns over the Trump administration’s protectionist slant.

“[N]ews that the Trump administration is planning further trade sanctions against China may continue to weigh on market sentiments in the near term,” OCBC Bank analysts said in a note.

Gains stateside in the previous session came after U.S. stocks pulled back at the beginning of the week as a fall in Facebook shares dragged on the tech sector. Regulators are looking into whether the social media giant potentially violated a consent decree following reports that data of 50 million Facebook users was accessed by Cambridge Analytica.

Meanwhile, in corporate news, dairy company Fonterra said Wednesday that its CEO, Theo Spierings, would leave the role later in the year. The New Zealand-listed company, which is the largest dairy exporter in the world, announced earlier in the day that it had recorded a net loss in the six months ending Jan. 31.

Also in Australia, James Packer has stepped down as director from the board of Crown Resorts due to personal reasons, the casino operator said in a release on Wednesday. Crown shares were down by 1.53 percent.

In currencies, the dollar pared some of its overnight gains as markets awaited the Fed. The dollar index, which tracks the greenback against six rivals, traded at 90.338 by 9:55 a.m. HK/SIN. The index touched a three-week high in the last session.

The U.S. currency traded at 106.46 against the yen after firming in the overnight session. Meanwhile, the Australian dollar traded at $0.7694 after slipping below the $0.77 handle in the last session.