North American stocks recovered losses to rally on late Wednesday afternoon, shaking off a rocky start as the world’s two biggest economies released details of tariffs against each other, heightening global trade war fears.

China released a list of 106 U.S. goods valued at $50 billion US on Wednesday that could face a 25 per cent tariff increase. The goods include soy beans and aircraft.

Officials did not give a date for when the hike would take effect, but said it would depend on when the U.S. decides to raise taxes on a similar amount of Chinese goods.

The move comes after the U.S. issued a list of Chinese products on Tuesday that could see tariff increases. Sectors that would be affected include aerospace, telecoms and machinery.

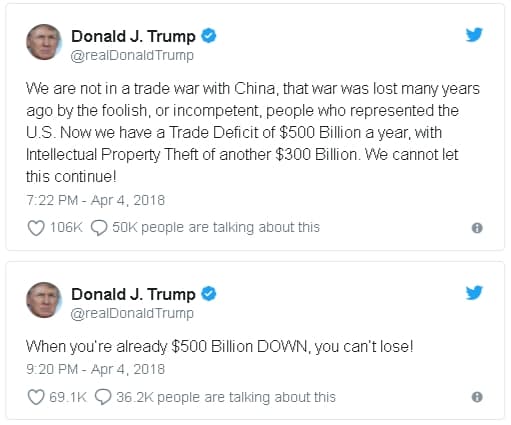

Meanwhile, U.S. President Donald Trump used Twitter again on Wednesday to respond to China’s announcement.

But despite the threat of a looming trade war, the benchmark Dow Jones industrial average jumped almost one per cent, or 231 points, to 24,264, while the broader S&P 500 gained 1.2 per cent to 2,645 points.

The tech-heavy Nasdaq composite saw the biggest gains, rising 1.5 per cent to 7,042 points. All three major indexes changed direction to close higher after seeing steeper losses in morning trading.

‘Risk-off’ bias

But market watchers were hesitant to say that equities had overcome trade war fears as investors started focusing on company earnings.

“Uncertainty over next steps as tensions escalate between the U.S. and China is driving a strong risk-off bias across global asset classes,” said Derek Holt, vice-president at Scotiabank Economics in a note. “The world’s ‘leaders’ are once again finding a way to blow what was otherwise shaping up to be a good picture for 2018.”

Mazen Issa, foreign exchange strategist at TD Securities, added that while both parties seem intent on avoiding a full-blown trade war, it is not “hard to envision how each could stumble into one.”

Companies in the IT, consumer discretionary and consumer staples sectors could be the most vulnerable in a trade war, said Oliver Jones, markets economist at research firm Capital Economics.

“This is presumably in part because all three depend on globalized supply chains which might be particularly vulnerable to a further deterioration of trade relations,” he said in a note.

Shares of U.S. exporters in industrials, IT and materials, including big names like Boeing were still among the worst performers on the indexes on Wednesday.

Meanwhile, the Canadian market was the only major North American bourse to end lower even though it pared losses in the afternoon.

The S&P/TSX composite index lost 0.1 per cent to 15,164 points with declines led by health-care stocks, particularly marijuana producers, which continued to decline.

The Canadian dollar also changed direction to close higher at an average value of 78.07 cents US, up 0.02 of a cent from Tuesday’s price.