Rising tensions between China and the United States pummeled stocks again on Friday, as investors began to take seriously the risk of a trade war between the world’s two largest economies.

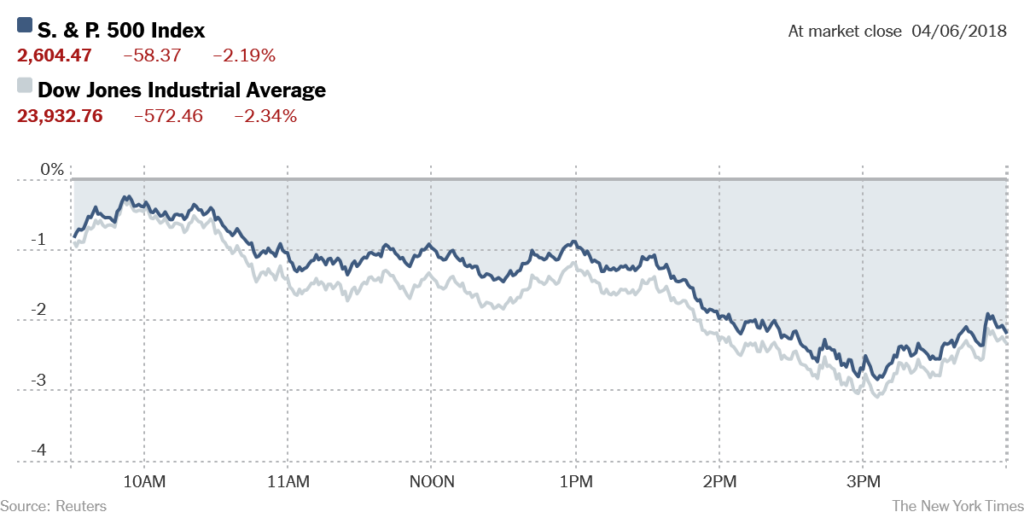

Markets began to slide at the start of trading after President Trump’s threat on Thursday to heap fresh tariffs on China, and the sell-off gained steam as the day progressed. A new report on hiring that showed the pace of job growth slowing in March — 103,000 jobs were added in the month — did little to buoy investors.

Investors took little comfort in statements from the administration’s top economic policymakers, Larry Kudlow, the director of the National Economic Council, and Steven Mnuchin, the Treasury secretary. Both men sought to tamp down the contentious back-and-forth between the two economic giants. On CNBC, Mr. Mnuchin emphasized that the United States was willing to negotiate with China, but he acknowledged that there was “potential for a trade war.”

And investors found few bright spots in afternoon comments from Jerome H. Powell, the new chairman of the Federal Reserve. In a speech in Chicago, Mr. Powell gave little indication that he planned to deviate from the Fed’s gradual path of lifting interest rates. He also suggested after his speech that he was unsure how the new tariffs imposed by the United States and China would affect the economy.

By the time markets closed, both the Standard & Poor’s 500-stock index and the Dow Jones industrial average had fallen more than 2 percent.

Mr. Trump, who had been a cheerleader for the rising stock market, acknowledged in a radio interview that was aired on Friday that the trade friction could take a toll on the market. The S.&P. 500 is now down 2.6 percent for the year and more than 9 percent from its late January peak.

“I’m not saying there won’t be a little pain,” Mr. Trump said. He added: “But we’re going to have a much stronger country when we’re finished.”

Mr. Powell’s comments underscored the shaky position stock investors are in, buffeted almost daily by conflicting announcements from the White House and by tariff announcements from Beijing that have strained one of the world’s most important economic relationships. A deep trade freeze between the two countries could chill global growth.

So far, though, there is little evidence of a slowdown. And without one, the Fed, as Mr. Powell suggested, will probably keeping raising rates, which traditionally is viewed as a drag on stocks.

The losses on Friday were especially heavy for American companies reliant on global trade. The aircraft maker Boeing tumbled 3 percent, and Caterpillar, which sells lots of construction and mining equipment in China, sank 3.5 percent.

With China tailoring its tariffs toward American agricultural products, investors also dumped stocks tied to the sector. The fertilizer giants CF Industries and Mosaic each fell more than 3 percent, as did Deere, the farm equipment maker.

The gloomy trading day in the United States followed a mixed day elsewhere.

Japan’s Nikkei 225 closed down 0.4 percent, while Hong Kong’s Hang Seng ended up 1 percent. Major European benchmarks like France’s CAC-40, Germany’s DAX and Britain’s FTSE 100 were all lower. (Mainland Chinese markets were closed on Friday.)

On Thursday, Mr. Trump said he had instructed his top trade officials to determine whether additional tariffs on $100 billion worth of Chinese imports were warranted and, “if so, to identify the products upon which to impose such tariffs.”

The comments were part of a roller-coaster week that has whipsawed investors.

“People have started to feel like this is a bit of the children’s game. Somehow the markets haven’t really gotten any actual sense of whether this will be true,” said Vincent Chan, head of China equity research for Credit Suisse, the investment bank.

“Tariffs on $100 billion of Chinese products is a big thing, but the market thinks it’s a bit of a childish move,” he added. “The market doesn’t know how to react.”

On Monday, China announced tariffs on $3 billion in American goods in response to steel and aluminum tariffs that Washington imposed last month. Then on Tuesday, American officials detailed plans for tariffs on roughly $50 billion in Chinese goods. China responded hours later by announcing tariffs on a similar amount of American goods.

Should Mr. Trump impose more tariffs, the impact could be significant. Capital Economics, a research firm, estimated that doing so could shave up to half a percentage point from China’s economic growth rate. A change of that size could be felt around the world, as China is a major force in global growth. Last year, its economy grew 6.9 percent.

The stomach-churning volatility in the stock market in recent months hasn’t spread to other markets.

There has been no panicked rush to the safety of United States government bonds. And while companies are having to pay slightly more to borrow in the bond markets, the interest rates haven’t risen to levels that could threaten the economy.

“We haven’t really, in a way, seen anything that has us too worried yet,” said Michael Feroli, chief United States economist at JPMorgan Chase.

Others aren’t quite so confident.

In a note to clients on Friday, Barclays analysts cited the intensifying trade tensions as a reason for investors to move out of stocks and into the safety of bonds.

“At this juncture, we think it is wise for market participants to take a break from risk,” they wrote.