Jet-setting Americans are missing out on hundreds of dollars of free travel annually by failing to take advantage of one simple thing: travel-focused credit cards. Collectively, Americans leave $22 billion worth of free travel expenses on the table per year, NerdWallet found in its recent 2018 Travel Credit Card Survey.

On an individual level, those who don’t take advantage of travel rewards cards miss out on an average of $227 a year. That number is even higher for new cardholders who earn lavish sign-up offers.

These offers alone are worth an average of $450 after fees, NerdWallet reports. Combined with points earned throughout the first year, new cardholders receive an average of $901 in rewards.

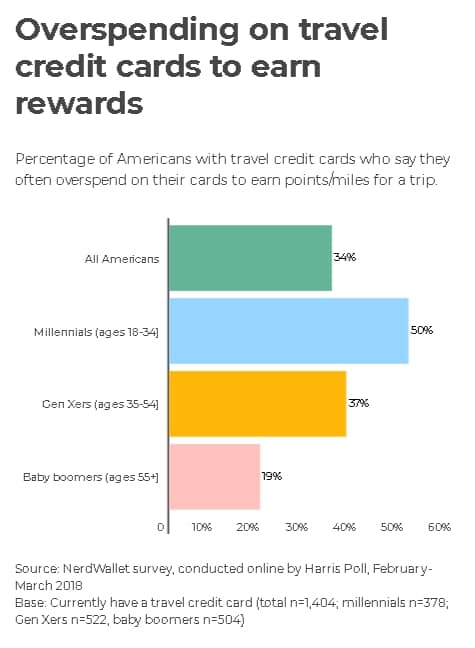

It’s still important to use credit cards responsibly. You should never sign up for a new credit card just to get perks or overspend simply to earn more points, something 34 percent of survey respondents cop to doing.

In fact, the fear of taking on debt keeps 34 percent of Americans from signing up for a travel card at all. And if you’re already in debt, it’s probably best to stay away. But “for consumers who can stay within their budget and plan to travel anyway, a travel rewards card will save them money over time, as rewards will reduce what they spend out of pocket for travel,” NerdWallet reports.

inancial services site WalletHub named the Capital One Venture Rewards Credit Card its top choice for travelers. The card is free for the first year and charges an annual fee of $95 after that. You’ll need relatively good credit to be approved for it.

However, it comes with a host of flexible perks that can be applied to almost any trip, including 50,000 bonus miles if you spend $3,000 in the first three months, earning double points on every purchase and no foreign transaction fees.

Frequent flyers may also want to consider the Chase Sapphire Reserve, as recommended by CNBC Make It Money writer Kathleen Elkins. It has become a favorite among millennials since its debut in August 2016.

Despite the card’s steep $450 annual fee, Elkins says the benefits outweigh the cost. “For starters, the Sapphire Reserve offers a $300 annual travel credit reimbursement each calendar year,” Elkins says. “That essentially bumps the annual fee down to $150 a year if I spend at least $300 on travel related expenses a year,” which she regularly does.

You can also check out NerdWallet’s list of the best travel credit cards for 2018 and decide which perks work best for your situation.

If you’re already an avid traveler — or have a goal of becoming one — using a travel rewards card could save you big.