For most of our working lives, we either accept the pay that’s offered to us, or we negotiate with an employer to get the best deal we can.

But if you’re fortunate enough to accumulate some significant savings by the time you’re ready to retire, you have another negotiation ahead of you. In this one, you get to negotiate from both sides, the payer (you own your retirement savings) and the payee (you will receive money from that savings pool).

You might think this is an ideal situation, putting you in total control – and in some ways it is. But this tricky negotiation is worthy of some careful thought.

Assume you have just retired or you’re on the brink of doing so, and you’re trying to figure out how much money you will have to live on.

In your role as the receiver of payments, you want as much as you can get. But in your role as owner of a retirement portfolio, you want to make sure your savings don’t ever run dry.

If you play your roles well, your negotiation will be an arm’s-length discussion between the owner of the money (a stingy old tightwad) and the recipient who’s eager for spending money.

How skillfully you carry out this negotiation will have a big impact on your retirement lifestyle and on what you may be able to leave to your heirs.

You could of course revisit this negotiation every year depending on how you feel about your investments and how much you want to spend. That would make you as the receiver feel pretty good: Ask for what you want…and get It!

But that would probably make you as the owner of the money pretty nervous.

It’s much better if you have an overall plan for distributing money from the savings.

Your negotiations should lead to three important decisions:

•How much money will you take out for living expenses?

•How much investment risk will you take?

•How will you invest the equity side of your portfolio?

Let’s address these items, one at a time. Our regular readers won’t be surprised to know that we have some tables of data to help with each one.

How much will you withdraw?

There are lots of ways to tackle that question, but when you put on your hat as the owner of the portfolio, you’ll probably want the answer to be expressed as a percentage of the portfolio value each year.

We’re going to suggest four possible answers: 3% (if you are very conservative and have saved more than you’re likely to need), 4% if you prefer a conservative approach that lets you spend a bit more, 5% if you’re comfortable with a moderate approach that will give you still more to spend, or 6% if (for any number of potential reasons) you are comfortable being that aggressive.

If your answer is relatively low, say 3%, your portfolio is in very little danger of running out of money. If your answer is relatively high, say 6%, that danger becomes much more real — but of course while the money lasts, you’ll have more to spend.

A good way to start thinking about this is to envision a percentage that doesn’t change except to be adjusted upward for inflation each year.

To help you see how this might work out in real life, we have built a series of tables of portfolio values based on real investment returns in every calendar year 1970 through 2017.

To spare you the time of poring over many long tables, each with 13 columns, I’ve selected some interesting data and put it into Table A.

This assumes an all-equity portfolio invested in an S&P 500 Index SPX, +1.67% fund that charges a modest 0.1% annual fee. It also assumes you retired at the end of 1969 with $1 million and each year took out either 3%, 4%, 5%, or 6% — adjusted each subsequent year to keep up with actual inflation.

There’s quite a bit of sobering information contained in that little table.

The negotiator who’s receiving money at 6% might love the big withdrawals in the first 15 years, only to be alarmed when there’s no money left after 1985.

Likewise, the negotiator looking after the portfolio might be happiest with 3% distributions that leave the portfolio worth $3.7 million after 20 years.

At its most basic level, this shows a tug of war between risk and return.

How much investment risk will you take?

In the example above, we assumed an all-equity portfolio without any fixed-income funds to moderate the risk.

But as all seasoned investors know, adding fixed income to an equity portfolio can reduce risks.

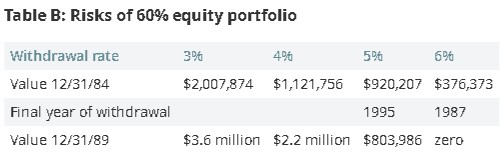

Using the previous assumptions, a portfolio made up of 60% in the S&P 500 and 40% in U.S. government bonds could generate the same annual withdrawals – with different resulting portfolio values after 15 years and after 20 years.

These are summarized in Table B.

The 60% equity portfolio presented here is considered more prudent than the all-equity mix of Table A. But it doesn’t do the whole job.

If you compare those numbers with the corresponding values in Table A, you’ll see that the 5% and 6% withdrawal rates held up longer — but not enough to last for the 30-year lifetime that a typical retiree should anticipate.

Clearly, something else was needed for such a portfolio to thrive for the long haul. That “something else” is a replacement for the S&P 500.

How will you invest the equity side of your portfolio?

The first is based on what we call the Worldwide Equity Portfolio. This reduces the S&P 500 to 10% of the equity part of the portfolio and substitutes nine other equity asset classes for the rest, providing massive world-wide diversification. You’ll find these tables here.

The second is based on what we call the All-Value Equity Portfolio, which is described here. This eliminates the S&P 500 altogether and substitutes five value funds with long track records of success. You’ll find these tables here.

You can learn many lessons from studying these tables, and you can download them and print them out for leisurely contemplation in advance of your retirement salary negotiations.

Here are three lessons that jump out:

•Across the board, the portfolios based on Worldwide Equity and All Value Equity produced much better results than the ones based on the S&P 500 index.

•Lower withdrawal rates of 3% and 4% were much more likely to hold up than the higher rates of 5% and 6%. This underscores the immense value in saving “more than enough” and in keeping your expenses well under control.

•When investors choose higher withdrawal rates along with higher portions of equity (90% or 100% instead of 50% or 60%, for instance), dramatic bear markets such as those of 1974-1975 and much more recently of 2000-2002 and 2008-2009 can become huge setbacks.

All this information should make your “retirement salary negotiations” much more meaningful than simply a tug of war between the stingy owner of the portfolio and the retiree who’s eager to spend money.