Having to constantly hand over cash for endless necessities is just part of being an adult. Mortgage or rent, food, roof repairs, surgery for your dog (these are some of my own recent budget line items) … The list goes on and on. With all that going on, it can become easy to make excuses as to why you’re not saving.

But setting aside money is crucial — for an emergency fund, education and retirement. Here are some common roadblocks to saving that I learned about from a few financial experts, along with their tips on how to get over the hump and just start saving now.

Excuse #1: I know I should be saving, but I just don’t know how to get started. Here’s how to get past that. “Kick-starting your savings is surprisingly simple,” said Madeline Daniels, communications director for America Saves and Consumer Federation of America. “Savers with a plan are twice as likely to make good progress meeting their savings needs for things like rainy days and retirement.”

What’s a great first step? Daniels said it’s “creating a simple savings plan by setting a goal such as saving for your education, then writing down how much you’re going to save each month and how long you’re going to save for.”

Bonus Tip: Once you have your plan, Daniels notes that the easiest way to save is an automatic process. If you have an employer that uses direct deposit, have a portion put into a separate savings account. If you don’t have the option for direct deposit or are self-employed, just set up automatic monthly transfers into your saving account through your bank or credit union.

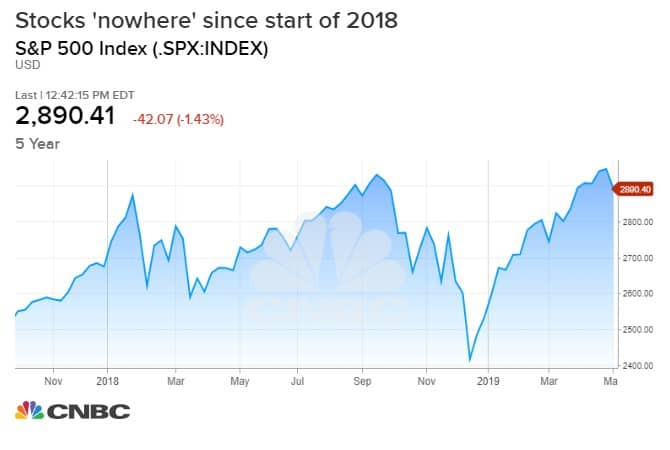

Excuse #2: Why bother saving money when you can just lose it in the market? The stock market has been a little crazy lately, no doubt. But that’s no reason to bail on investing, or savings in general. Michael Dinich, a financial advisor who runs website YourMoneyGeek.com, said he thinks many advisors forget that the Great Recession of 2008-2009 left a lot of scars. “Many young people either personally suffered during the worst of it or saw their parents lose money,” Dinich said, adding that that’s hard to get over.

Dinich compares getting started with investing to kicking off a new diet or exercise routine. “It sounds totally backwards from what many advisors in the industry do, but I like to start young people off with safe investments like indexed annuities or modified endowment contracts,” he said.

He says this helps set up new savers to have good experiences early on because a negative experience may turn them off from investing or saving. It’s the softer, easier version of saving.

Excuse #3: With interest rates so low, it’s not going to benefit me or make an impact. Eric Nisall, creator of online course Bookkeeping for Bloggers, reminds his clients that “it’s not just about getting rich.”

“It’s also about having another tool in your ‘financial toolbox’ for security and peace of mind that you’ll have something in case of emergency,” he said. “Regardless of the interest rate you may be getting on your savings, anything is better than zero as a rate of return.”

That said, it doesn’t hurt to research the interest rates, fees and fine print anytime you’re putting your money into something new. Check legitimacy before transferring or depositing any money, as well, and be wary of anything that offers returns that seem too good to be true. This will help you avoid scams.

Excuse #4: I don’t understand savings and don’t know who to trust. If you’re looking for a financial advisor, ask trusted family and friends for referrals. You can also check out a potential advisor with the Financial Industry Regulatory Authority via its online Broker Check tool. However, even a financial advisor can’t be with you every day. Winnie Sun, founder of Sun Group Wealth Partners, has a few tips for saving more and spending less, including using financial apps to help you.

“The apps act as a personal trainer for your finances and give you a visual representation of your budget at a glance and on the go,” Sun said. “They can really boost your self-control, too.” There are a growing number of easy to use, secure options when it comes to saving online or with an app.

“Many people equate budgeting with deprivation, and this only fuels them to spend more,” Sun added. “Instead, try to think of it as a tool for being able to afford the life you want.”

If you’re spending more than you should, you likely are racking up credit card debt, and that is costing you more money in interest. If that’s the case, make a plan to cut down your debt by paying off more of your card balances or checking out other options such as a debt consolidation loan or balance transfer credit card that might save you additional money on interest.

Excuse #5: No worries, I’m already saving. (But are you … really?) “Some people think they already are saving, only they aren’t,” said Neil Frankle, a certified financial planner with Wealth Resources Group. “What they do is save what’s left over at the end of the month, rather than make saving a priority.

“By only saving what’s left over, they end up usually only saving a fraction of what they otherwise could.”

So what should you be doing to combat that? We mentioned it before — automate. Direct deposit, automatic 401(k) plan contributions or an account transfer every month will help you stash away money on a regular basis.

It’s never too early or too late to start saving and making the most of your money, so you have it for a rainy day and to secure your future.