If you’re able to buy shares of a small growth stock — say, a company with a market capitalization of less than $20 billion — before the rest of the market catches on to the story, it can be a life-changing investment.

Consider, for instance, the 1997 investment that Motley Fool co-founder David Gardner made in — at the time — a tiny company called Amazon. With a split-adjusted purchase price of just $3.19, a simple $10,000 investment back then is now worth $4.5 million.

But what is a growth stock? There’s no hard-and-fast definition. Perhaps it’s best to define this type of investing in the context of a few other types of investing.

- Growth stocks: Stocks you buy because you believe the stock’s price could increase substantially — usually an uncapped amount with enormous upside potential. Revenue often increases dramatically. This tends to be a high-risk/high-reward type of investing.

- Income stocks: Stocks you buy because you want to receive regular dividends. Revenue growth need not be much higher than inflation. These companies tend to be larger and more stable and offer a lower-risk/lower-reward profile.

- Value stocks: Stocks you buy because — like growth stocks — you believe the stock’s price will go up. Unlike growth stocks, however, this is because you believe the stock to be currently undervalued.

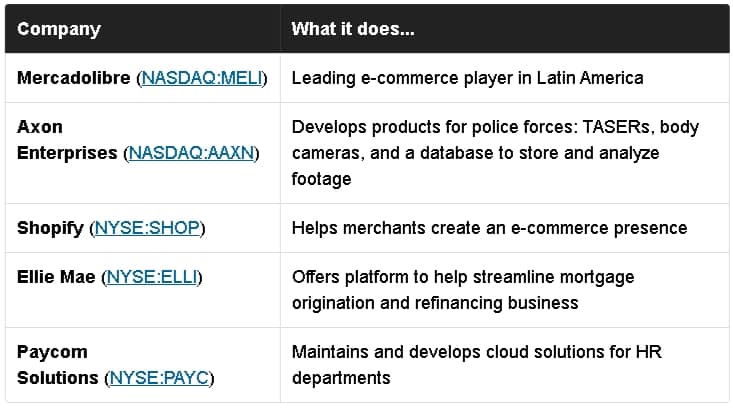

There’s no way to know if the five growth stocks I’m introducing today will have Amazon-like returns. However, they all share a few key traits I consider to be important for growth investors:

- A market capitalization of less than $20 billion.

- Revenue growth of at least 20% over the past three years.

- An “antifragile” balance sheet that will allow it to grow stronger in the face of economic crises.

- Founder-led companies where insiders own lots of stock

- An identifiable moat protecting the company from its competition.

We’ll cover each of those below for these five growth stocks.

Small and growing

For a company to be considered a “growth stock,” the only real criteria is that you are buying it because you believe in the unbridled potential for the stock’s price to go up over time.

That being said, I personally believe adding some specific criteria can help to increase the probability of finding a stock with Amazon-esque return potential. By buying companies with market capitalizations under $20 billion, there’s more room for the stocks to grow over time. And by buying companies that have shown strong revenue growth — an average of over 20% over the past three years — that makes it likely these companies are offering what consumers want more and more of.

Here’s how the five companies stack up on those aspects.

The concept of being antifragile

Nothing helps me understand what a great growth stock looks like more than the teachings of former hedge-fund manager, Wall Street trader, and best-selling author Nassim Nicholas Taleb.

In his book Antifragile, Taleb argues the entire world can be broken into three categories:

The fragile — this represents a class of things that will break over time — especially when volatility, chaos, and stress are introduced.

The robust — this represents a class of things that will remain unchanged over time. They are unaffected by the stressors described above.

The antifragile — this represents a class of things that actually grow stronger because of exposure to volatility, chaos, and stress…up to a point.

Because growth stocks tend to be a higher risk/higher reward category of investments, we want to find further ways of tipping the scales in our favor. Two ways of formalizing our search for “antifragility” is by investigating a company’s balance sheet and levels of insider ownership.

Financial fortitude

While evaluating the balance sheets of any stock — not just growth stocks — is important, there are far more minefields in this realm. That’s because fast-growing companies are often younger companies. Younger companies have had less time to build up cash reserves. As a result, an unforeseen economic crisis — whether it affects the entire economy or just the individual company — can be devastating.

Antifragile companies have lots of cash, manageable debt, and reliable cash flow streams can actually benefit — in the long run — from an economic downturn. Such companies can repurchase shares on the cheap, acquire distressed rivals, or simply bleed the competition out by undercutting them on price.

Because growth stocks tend to be younger and smaller, there isn’t a lot of overlap between them and “Antifragile” companies. When we find them, however, they again tip the scales in our favor.

Skin in the game

By the same token, companies that are run by management teams with lots of skin in the game — via stock ownership — are more acutely incentivized to create organizations offering long-term value. Taking it a step further, when a company is founder-led, that individual could be said to have his/her “soul in the game” — they view the company as an extension of themselves. That’s why Reed Hastings of Netflix, Jeff Bezos of Amazon, and Howard Schultz of Starbucks are still helping run their companies. They’ve made more than enough money, but they continue because the mission of their companies is motivating to them.

The five best growth stocks

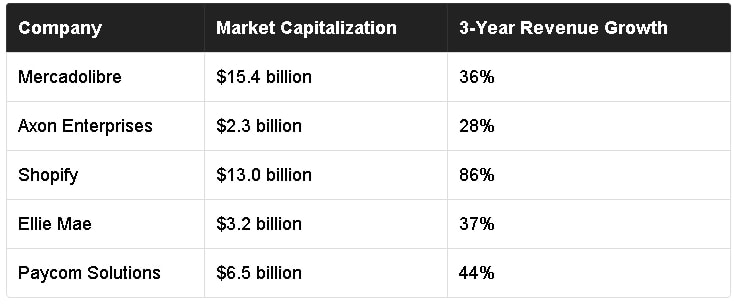

Here’s how these five companies stack up in terms of these antifragile metrics.

It’s clear that based on balance sheets, some companies — say Ellie Mae, with strong free cash flows and no debt — are more antifragile than others — like Mercadolibre, which sports a heftier debt burden.

But taken as a whole, and compared to the entire universe of investable stocks, these represent shares of companies with the potential to not only survive economic turmoil but benefit from it.

The growth linchpin: a wide moat

But perhaps the most important thing for any company to have — whether a small-cap growth stock or a large-cap value stock — is a wide and identifiable moat. In its simplest form, a moat is a sustainable competitive advantage. It’s what keeps customers coming back to one company year after year — while holding the competition at bay for decades.

Again, while there’s no single definitive definition of what constitutes a moat, there are four types that I always look for.

Network effects

When the network effect is present, each additional user a company gains makes the company’s products even more valuable for current and future users. This can take several forms.

- Facebook, Snapchat, Twitter, and other social media platforms are only as valuable as the number of users they have. If all of your friends are on one platform, you are incentivized to join. Once you do, other non-users you know have further motivation to join.

- Sometimes, adding people to a platform gives that platform more leveraging power. As Netflix gains more users, for instance, it has more money to use for original content, which draw in more users, giving it more money for original content.

High switching-costs

Once a customer starts using one company’s solution, it would be costly — financially or logistically — to switch to a competitor.

- In years past, major telecom players held customers on wireless contracts because of high fees associated with canceling a plan early.

- From a logistical standpoint, a company like Intuit has high switching-costs because taxpayers have decades of financial information stored with the company to complete taxes (with the company’s TurboTax product) or track company accounting (the QuickBooks product).

Low-cost production

If one company can offer a product of equal value to the competition’s, but at a consistently lower cost, then it will be the provider of choice. For a long time, companies with massive scale like Walmart were textbook examples of this: because the company had such enormous reach across the country, it could get products from merchants at discounts, and pass the saving on to customers. Walmart’s competitors couldn’t match those low prices.

These days, the moat is taking entirely new forms:

- Amazon’s network of fulfillment centers is unrivaled. Because of that, it can offer free two-day shipping over a wider swath of the world than any of the competition.

- Alphabet — parent company to Google — has seven products with over one billion users. As a result, it gathers tons of data for very little cost. It can turn that low-cost data into a valuable resource in selling ads to merchants.

Intangible assets

Intangible assets can take three primary forms:

- Patents are vital to many companies, especially drug companies. Rivals aren’t allowed to copy another’s products without fear of retribution.

- Brands allow one company to charge more for a product than its competition. Apple and its pricing edge over other smartphone and computer makers is a good example.

- Government protection can create a high barrier for competition to enter. Large energy companies, for instance, usually enjoy local monopolies — though that comes with the trade-off of being highly regulated.

All five of these companies have at least one viable moat, and many of them are multi-moat companies:

Mercadolibre

Mercadolibre is the leading e-commerce player in Latin America. Its primary moat comes from the network effect. As more and more customers flock to the company’s platform to buy things, vendors know that they have to list on the site to gain access to such a large base of buyers. At the same time, MercadoPago is introducing high switching costs thanks to the popularity of the service with unbanked customers in South America. And MercadoEnvios and select next-day delivery services are taking off thanks to the low-cost production afforded by Mercadolibre’s shipping facilities across the continent.

Axon

Axon not only produces stun guns, but it is spearheading efforts to put body cameras on all law enforcement officers. The company’s moat takes two forms — one for each line of business. On the weapons side, the company’s TASERs are ubiquitous, and the value of the brand is unmatched. On the Axon side, the key moat comes from high switching costs. As police departments put more and more footage on the Evidence.com platform — and rely upon the AI-generated record-keeping solution — they’re less inclined to switch to a different provider. Not only would such a move be expensive, but it would require entire departments to be retrained, and put critical data at risk for being lost.

Shopify

Shopify — a platform for merchants to create an e-commerce operation — benefits from both high switching costs and the network effect. As with Axon, those who use Shopify’s platform would be loath to switch away from it. Once a vendor has all of its data hosted on a single site, it’s an enormous headache to migrate all of that data. Equally important, Shopify allows third-party app developers to build services on its platform. Because Shopify has over 500,000 merchants, app developers flock to the site, which makes the platform even more valuable for potential merchants.

Ellie Mae

Mortgage-industry software provider Ellie Mae also benefits from the enviable combination of high switching costs and the network effect. As the company’s Encompass platform stores tons of data — from leads to loan origination data — anyone who switches away from it would have to retrain their staff and reset their data. Equally important, Encompass connects real estate officers with financiers, title companies, and insurance agents. As more join the platform, it becomes more valuable for current and future users.

Paycom

Finally, Paycom — which is changing how HR departments function — also benefits from high switching costs. The company’s solution goes well beyond legacy operations like payroll. It includes keeping track of employee health insurance compliance, managing potential hires, and even scheduling time off. That data is valuable, and so is the time that HR employees would have to spend retraining and migrating data if their employer chose a different HR platform.

The bottom line on these five growth stocks

While that last section might have been dense, it is also incredibly important. Growth means nothing if it can’t be protected. That’s where moats come in. Understanding these moats is critical to monitoring these investments.

By checking stats like retention rates and the total number of users a platform has — metrics that require some digging beyond the headline numbers — you can get a better idea for whether or not a company’s moat is widening (a good thing) or narrowing (a bad thing).

A final word on investing in growth stocks: traditional valuation metrics — like the price-earnings ratio — can take a back seat to the aforementioned metrics. That’s because young companies are often reinvesting back in the business so aggressively that it can be impossible to measure profitability. Because the pace of change in the world is only accelerating, relying on analyst forecasts — which are famously inaccurate — can be a fool’s errand.

Amazon, for instance, has been lauded as overvalued virtually every year since it went public. Growth investors that paid too much attention to valuation missed out on one of the greatest wealth creators of our time.

There’s no way to predict with 100% certainty if these stocks will produce life-altering wealth. But you can rest easy knowing my money is firmly where my mouth is: These five combine to form almost one-quarter of my real-life holdings. I think they’re all worth your time — and investment dollars.