Wall Street has been mostly running around in circles so far in 2018.

U.S. equity markets have been extremely volatile in 2018, with massive swings in both directions on a near-daily basis. Investors have weighed supportive economic data and corporate earnings on one hand against the prospect of resurgent inflation, trade-policy uncertainty, and other geopolitical issues on the other. The Dow Jones Industrial Average DJIA, +0.37% and the S&P 500 index SPX, +0.17% have recently shown signs of strength, but they’ve also wallowed in correction territory—defined as a drop of 10% from a peak without a gain of 10% from that bottom—for the longest stretch since the financial crisis.

What’s the result of all these gyrations? Basically nothing.

More than five months into 2018, Wall Street has made essentially no progress over where it ended 2017, with major indexes holding at roughly break-even levels for the year. The Dow is up less than 0.1% year to date, as of Thursday’s close, while the S&P is up 1.9%. The Nasdaq Composite Index COMP, -0.03% powered by outperformance in large capitalization technology and internet stocks, is up 7.3%.

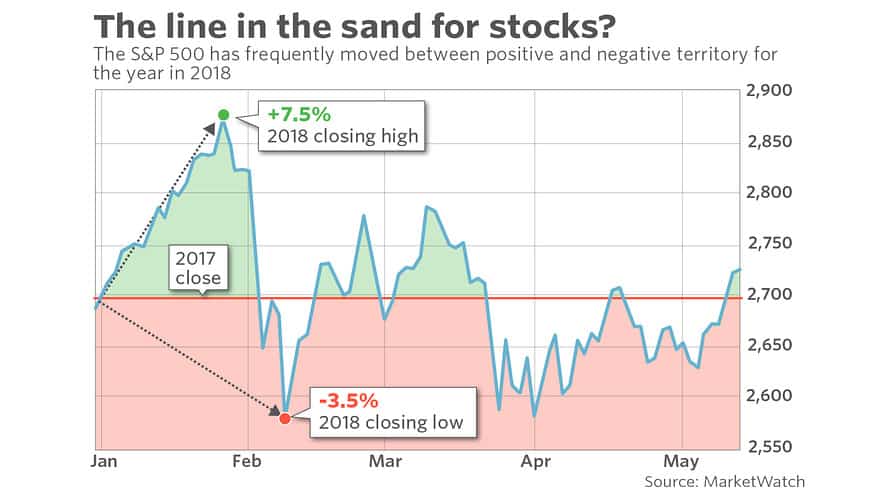

The year-to-date standing belies the degree by which the market has been whipsawed. The Dow has gained as much as 7.7% over where 2017 ended, based on its closing high for the year, and it has dropped as much as 4.8%. The S&P has traded in a range of gaining 7.5% and falling 3.5%.

“Markets seem eager enough to buy back their book at year-end 2017 levels, but are less certain about any other price. More than four months of news flow and U.S. stocks are essentially unchanged on the year,” wrote Nicholas Colas, co-founder of DataTrek Research. He added that earlier this week, the S&P crossed the break-even point for the year for an eighth time in 2018.

That stocks have been stuck in a range marked by the S&P’s record and its correction low has been long noted by investors. While recent trading has been to the upside—the Dow could post its seventh straight daily gain on Friday—the range speaks to the level of uncertainty there is over what the market’s next move could be.

According to the AAII Sentiment Survey, 41% of investors describe themselves as neutral on the market, meaning they expect prices to be essentially unchanged in six months. This is the 12th straight week that the neutral reading has been above the historical average of 31%.

That feeling of uncertainty has been stronger than optimism or pessimism thus far. The ratio of bullish investors is 33.5% while the percentage of bearish market participants stands at 25.5%. Both are below their historical average, extending a notable trend. Optimism has been beneath its long-term average for 11 straight weeks, while pessimism has been below its long-term average in 18 of the past 22 weeks.

Muddling the outlook is a tug of war between bulls and bears, with both intermittently marshaling evidence to back their cause for a market rebound or persistent equity turmoil.

Market optimists can point to muted inflation data, a recovery in technology stocks, and one of the best earnings seasons on record for support, while bears can cite the notion that the economy in roughly its ninth year of economic expansion may be on its last legs and entering a late-cycle phase, marked by monetary-policy tightening across much of the globe.

Both cases have been apparent in stock prices. While the Cboe Volatility Index VIX, -4.38% is at low levels—and it is on track for its fifth straight weekly drop, its longest such streak since August 2016—it has been unusually active this year, tracking the steady drumbeat of big daily moves in markets.

There have been 90 trading days thus far this year, through Thursday’s close. Of those, 32 of them have ended with a 1% move (in either direction) in the S&P 500, for a ratio of nearly 36%. According to data from Morgan Stanley Investment Management, the average going back to 1960 is for 1% moves in 21% of trading days. (Last year, a historically quiet one, the market had 1% moves in just 3% of trading sessions.)

“The problem with this higher volatility is it comes in a year where I doubt the market will make much progress overall,” wrote Andrew Slimmon, a managing director and senior portfolio manager at the firm. “I do not believe this is the end of the secular bull market but rather a pause coming in a year ripe for increased volatility. And that makes for a dangerous combination.”