Investing in precious metals is most often associated with directly owning bullion or investing in mining companies, but both strategies have notable drawbacks. Streaming and royalty companies, like Royal Gold, Inc., Franco-Nevada Corporation, and Wheaton Precious Metals Corp., change the equation, effectively avoiding many of those negatives, allowing them to provide more consistent returns to investors over time. Here are some of the key benefits and drawbacks you need to know about the gold streaming niche, including a deeper look at a few of the industry’s biggest companies.

What is gold streaming?

The precious metals mining business is pretty simple to understand: Find a spot that contains gold or silver, dig it up, and sell it. That’s obviously an oversimplification of a very complex, dangerous, and expensive business model, but you get the idea. A streaming and royalty company doesn’t do any of that, but instead provides an important part of the process: cash.

Essentially, streaming provides cash up front to miners in exchange for the right to buy gold, silver, or other metals at reduced rates in the future. Miners benefit from having access to an additional source of capital over and above what they can get from banks and capital markets, which at times can be costly sources of capital. Streaming companies, meanwhile, benefit from contractually locking in low costs for gold and silver.

Many companies that operate in the streaming niche also have royalty deals in their portfolio. Royalty deals are similar to streaming deals in that cash is provided up front to miners. In exchange, however, the miner pays a percentage of the sales from a mine to the streaming and royalty company. The up-front payment is usually larger, since the streaming and royalty company isn’t expected to buy any of the gold that is produced from the mine. For the most part, the risks and rewards of royalty and streaming deals are fairly similar.

An example of a streaming deal

In 2015, Royal Gold announced that it had inked a streaming deal with Barrick Gold Corporation, one of the largest gold miners in the world, related to Barrick’s 60% interest in the Pueblo Viejo mine in the Dominican Republic. Royal Gold provided the miner $610 million in exchange for 7.5% of Barrick’s interest in the gold produced at Pueblo Viejo until 990,000 ounces of gold have been delivered, and 3.75% thereafter, plus 75% of Barrick’s interest in the silver produced at the mine until 50 million ounces have been delivered, and 37.5% thereafter.

The gold and silver it will receive is notable, of course, but the really important number here is what Royal Gold is paying for that gold and silver: 30% of the spot price up to key production targets, and then 60% thereafter. It doesn’t matter what the spot price at the time is, Royal Gold has locked in wide profits.

Benefits to investing in streaming companies

Since streaming and royalty companies are only providing cash to miners, they are best looked at as specialty finance companies. However, for most investors interested in adding precious metals to a diversified portfolio, they are probably the best option. The reasons tie back to the unique streaming model, which includes contractually locked-in wide margins, as the example above illustrates. Benefits to investors include:

Consistent results. Although each streaming and royalty deal is different, the trailing EBITDA margins of streaming companies Royal Gold, Franco-Nevada, and Wheaton Precious Metals have been solidly positive over the past decade. Positive, and wide, EBITDA margins are a sign these companies are running their businesses profitably. The contractually guaranteed low prices these companies pay are the bedrock on which those consistently wide margins are built. Giant miners like Barrick Gold, Newmont Mining, and GoldCorp, for comparison, have each seen their trailing EBITDA margins dip into negative territory at least once, if not more often, during that same time period.

Fast-moving gold prices and the costs of mining, which is a slow and difficult process, combine to make consistency hard to achieve for miners. And it can be difficult for investors to stick around when a miner is struggling to turn a profit. The wide margins at royalty and streaming companies, on the other hand, can provide a reason for shareholders to stick around even if gold prices are falling.

Diversification means less risk. Diversification is another key benefit streaming and royalty companies offer, with even large miners generally only operating a handful of mines. Some small miners, meanwhile, only operate one or two. Streaming companies, however, generally spread their risk across a larger number of assets. Focusing on providing cash to the miners who take on the task of running mines makes diversification easier for them to achieve. Franco-Nevada, for example, provides exposure to nearly 300 mine investments, 50 of which are producing assets, while the rest are in some stage of development. That diversification materially reduces the risk that trouble at any one mine will derail performance. Since gold and silver prices are already prone to swift and often large price swings, with their prices driven by supply and demand (and often emotional investors), diversifying mine risk is a nice benefit.

Dividends. Dividend income is another key benefit provided by the larger gold royalty and streaming companies. Although miners often pay dividends, too, those can wind up being cut when commodity prices fall. Royal Gold and Franco-Nevada, on the other hand, have each increased their dividend for at least a decade. And while Wheaton’s dividend is variable, it is linked to the company’s performance, so investors know beforehand that the dividend is a moving target — but they know the math involved behind the payout.

Locked-in low prices, wide margins, and diversification are what allow streaming companies to be more generous with dividends. This is no small point, since dividends can provide investors something to watch, instead of stock prices, when gold and silver prices are weak. That, in turn, can help investors stick around through the entire commodity cycle to benefit from the diversification that gold and silver provide to an investment portfolio.

Better than bullion. Investing in streaming companies also has a leg up on direct ownership of gold and silver. If you buy gold bullion, the only upside you have is a potential increase in the price of gold. An ounce of gold today will still be an ounce of gold tomorrow (or even 1,000 years from now). Since streaming companies invest in both developed and developing mines, they benefit, like miners, from the opportunity for increased production over time. That’s one reason that it’s important to view streaming companies as having a portfolio, managing a collection of streaming investments over time. Indeed, they need to balance investing in current production with investments that can maintain and enhance production in the future as they are developed.

Risks of investing in streaming companies

There are also issues that investors will want to keep in mind when looking at gold royalty and streaming companies. Since streamers are kind of like specialty finance companies, it shouldn’t be surprising at all to know that the biggest issues are found on the balance sheet. This is because the basic streaming model is to use short-term debt to fund streaming and royalty deals and then permanently finance that debt by issuing stock or long-term debt.

Dilution. Some streaming and royalty companies, notably Franco-Nevada, have a preference for maintaining a debt-free balance sheet. However, streaming deals can cost hundreds of millions of dollars. That’s not the kind of cash that most companies keep around. So, in order to raise the money needed to support streaming deals, streaming companies often issue stock. The risk here is that every new share of stock reduces the ownership stake, and financial benefit, of existing shareholders. This dilution, as it’s called, isn’t a problem if the streaming deals work out as expected. But if something were to go wrong, like a new mine not actually getting built, then issuing dilutive shares would be a notable negative.

Leverage. Other streaming and royalty companies, such as Royal Gold, prefer to use debt to permanently fund their deals. The goal is to use the cash flow from the streaming agreements to reduce the debt balance over time. There are two potential risks here. First, if a mine investment doesn’t work out as expected, then the projected cash flows won’t be there to pay down the debt or support the associated interest expense. But you’ll also want to keep an eye on the total debt load a streaming company is carrying, since too much debt could effectively leave it unable to ink new deals until its balance sheet is healthier.

Are streaming companies good investments?

Streaming and royalty companies aren’t right for every investor. For example, if you like to dig in and find unique opportunities being mispriced by the market, the more diversified and hands-off approach of a streamer isn’t appropriate for you. And buying gold bullion might be more attractive if you believe gold will be a more viable option in the case of a catastrophic market collapse.

However, for most investors, streaming and royalty companies are a great mix of risk and reward. The diversification, consistently wide margins, and regular dividends can make it much easier to maintain exposure to precious metals throughout the entire commodity cycle. And that, in turn, increases the chance that investors will benefit from the diversification that gold and silver can offer.

Top gold streaming companies

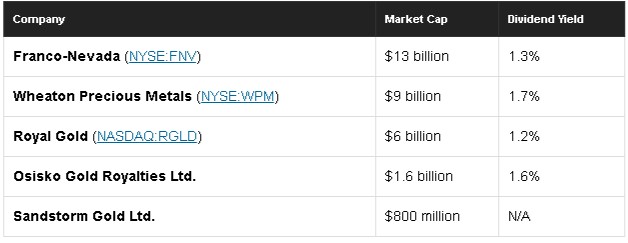

Although gold streaming is something of a niche in the precious metals market, the largest competitors have been in the business since the 1980s, while new entrants are showing up as well (including hedge funds, private equity, and pension funds). Most investors, however, should probably stick with the largest, easiest to trade, and longest-tenured companies for now. Here are the top five.

Franco-Nevada

The largest streaming company by market cap is Franco-Nevada. As noted above, it has investments in nearly 300 mines, 50 of which are producing. However, it has taken diversification further than its peers by investing in around 80 oil and natural gas assets (57 producing), following the same basic business model. It’s not as pure a play on metals, but if you are looking for diversification, that non-precious-metals exposure is an interesting addition to the mix. That said, gold provides roughly 70% of its revenue, with silver at 15%, and oil and gas at just 7% (the rest is, effectively, “other”), meaning that gold is still the big driver of performance here. The company has increased its dividend annually for 10 consecutive years.

Big streaming deals have gotten harder to find following the recovery in commodity prices that started in early 2016. So Franco-Nevada’s deep bench of development projects is going to be the driving force on the mining side of its business. Such projects, however, can take time to develop. Which is where the company’s diversification into energy comes in. Over the near term, management expects the revenue from its oil and gas investments to grow swiftly, supporting continued top-line growth. Note that those investments were made while oil was in a downturn, showing how Franco-Nevada’s management makes opportunistic use of its diversified approach for the benefit of its shareholders. If you are interested in this streaming company, you’ll want to keep a close eye on its oil investments right now, even though they aren’t the biggest piece of the portfolio.

Wheaton Precious Metals

Previously known as Silver Wheaton, this company changed its name to Wheaton Precious Metals in mid-2017 to reflect its shifting portfolio. As you might expect, silver was once this streaming company’s bread and butter. Today, however, production is split roughly evenly between gold and silver. It still provides more exposure to silver than its peers, and it is the least diversified by mine investment, with just 26 total projects in its portfolio (17 of which are producing).

Wheaton has a slightly different focus than its peers, concentrating on larger investments in larger assets with fewer speculative development projects. Wheaton’s dividend is variable, pegged at 30% of the average of the previous four quarters’ operating cash flows. Although that means the dividend will fluctuate over time, you’ll go in knowing that fact as well as how the final dividend is arrived at — with most miners, the dividend is based on nothing more than the current opinion of the board of directors.

Looking forward, Wheaton believes its investments have the potential to increase its production by as much as 45% if key projects start producing. However, as an example, one of its investments is in the long-stalled Pascua-Lama mine, which straddles Chile and Argentina. Barrick Gold has been trying to build this mine for over a decade at this point, and continues to face pushback from environmentalists, residents, and the government. So there’s material opportunity for production growth at Wheaton, but the success of just a handful of development projects in the company’s highly focused portfolio will determine how much opportunity.

Royal Gold

Royal Gold’s biggest differentiating factor is its impressive 17 years’ worth of annual dividend hikes — the longest streak in the streaming industry. Gold has gone through multiple booms and busts over that time, which speaks volumes about management’s ability to use the streaming business model to provide investors with a steadily growing stream of income. The portfolio includes 193 investments, with 39 operating and the rest in earlier stages of development. Gold accounts for around 80% of its revenue, the largest percentage within this trio of streamers, with silver and copper both at 9% (the rest is “other”). For those seeking a reliable dividend stream, Royal Gold has definitely proven itself over time.

With big streaming deals harder to find, Royal Gold has shifted gears and is paying down debt. This is exactly what investors want to see happen. That said, production growth is still in the cards here. Royal Gold has a number of streaming investments that are expected to start producing (or increasing production) over the next couple of years. Investors will want to watch the debt reduction efforts and updates on the development projects in its portfolio, which management likes to say are bought and paid for.

The best gold option?

Now that you have a better understanding of the streaming and royalty model’s pros and cons and have taken a look at some of the largest players in the industry, it should be pretty clear that owning shares in a streaming and royalty company is a strong alternative to owning gold coins or stock in gold miners. It’s probably best to focus on the largest companies in the space, with both Franco-Nevada and Royal Gold getting high marks for diversification and consistent dividend growth over time. That said, Wheaton’s focused portfolio holds impressive production potential; you’ll just need to keep a close eye on a small number of projects that may or may not work out as planned.