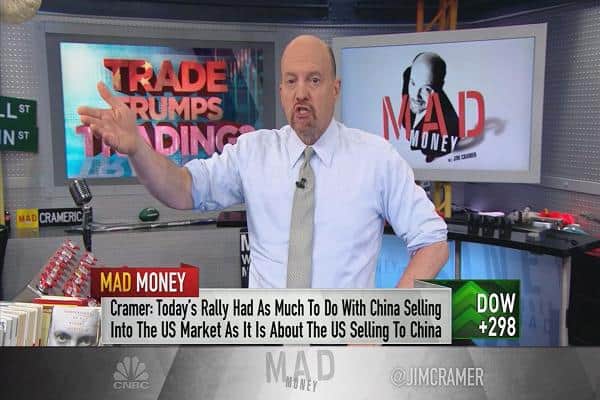

As the major averages jumped on Monday on news that the United States and China reached a momentary truce in trade talks, CNBC’s Jim Cramer wanted to verify the strength of the rally.

“While we often act like only the large-capitalization stocks like Caterpillar and Boeing … are really in the crosshairs here, the truth is it’s much, much bigger than that,” the “Mad Money” host said on Monday. “So […] let’s talk about why this rally actually makes a lot of sense.”

Cramer argued that in reality, China’s influence over the U.S. economy largely hinges on what Chinese companies sell into the U.S. market.

“A full-blown trade war could make life very, very expensive for most Americans,” he said.

As the Dow Jones industrial average crossed the 25,000 level for the first time since March, Cramer zoomed in on a group that reflected investors’ relief over the temporary truce: retail.

Since the possibility of a trade war came into focus, retail stocks have been under pressure on worries that the goods they produce in China could become unsustainably expensive.

If Chinese authorities made it too costly to produce goods there, U.S. retailers could charge consumers for the difference, causing price inflation.

“We import so much cheap stuff from the People’s Republic that the prospect of the Trump administration putting tariffs on those goods has made investors very worried,” Cramer explained. “So when we heard about the truce, we immediately figured that the consumer is going to be spared the shock of those much higher prices.”

That’s what sparked a rally in department store stocks like Macy’s, which hit a 52-week high on Monday as investors breathed a sigh of relief that, for now, prices would remain stable.

Cramer added that while most major apparel makers have the ability to move production to other countries, they wouldn’t be able to do so overnight and prices would most likely rise in the interim.

“At a time when we’re increasingly worried about inflation and how it might force the Fed to raise rates faster than we’d like, the last thing we needed were tariffs on retail goods,” the “Mad Money” host said.

Shares of retailers that turn to China for swaths of their low-cost merchandise — Walmart, Dollar Tree and Dollar General, to name a few — also shared in Monday’s gains.

“We can all breathe easier now that we’ve lost what could’ve been an immediate driver of inflation,” Cramer concluded. “I’ve told you over and over again that it’s trade, not the rising interest on the 10-year Treasury, that’s been hurting stock prices, and the retail element was a huge part of that. Putting the trade war on hold creates a much more positive backdrop for everything.”