Stock-market bulls brushed off an escalation in trade tensions and an awkward-at-best start to a summit meeting of world leaders in the past week. Next, they get to run a central-bank and geopolitical gauntlet as the Federal Reserve and the European Central Bank each prepare to hold crucial policy meetings.

In the case of the Fed, members of the Federal Open Market Committee are seen as virtually certain to raise the fed-funds rate by a quarter of a percentage point, marking the second hike of 2018 when they conclude their two-day meeting on Wednesday. The ECB is expected on Thursday to at last outline its plan for eventually winding down its purchase of monthly bond buys—a process many economists expect to be completed by the end of the year.

So, which one will matter most?

“I think the Fed will be more important because of the kind of leadership we’re seeing from U.S. markets again…although the ECB could be more interesting just because it’s an important meeting in terms of signaling [the end of] their QE program,” said James Ragan, director of wealth management at Seattle-based D.A. Davidson, in a phone interview.

Dissecting the ‘dot plot’

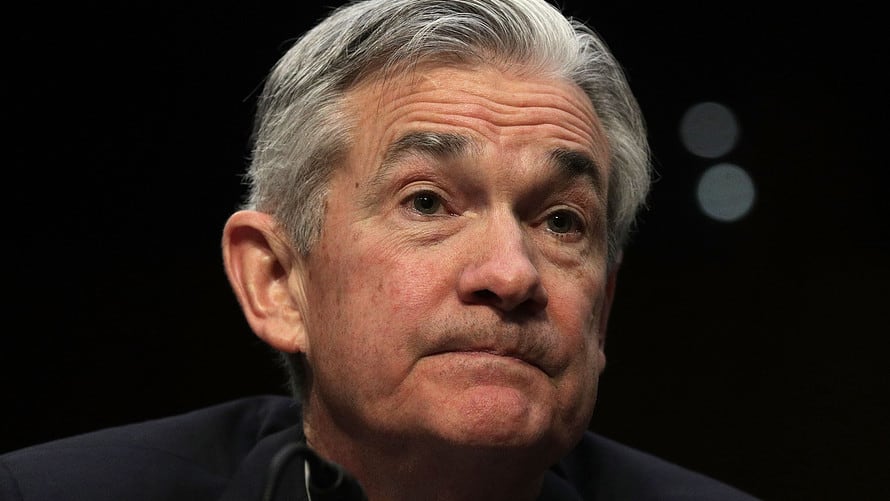

While an increase in the fed-funds target to a range of 1.75% to 2% should be fully discounted, investors will have plenty to pore over, including the Fed’s policy statement; the updated projections on the future interest-rate path by individual policy makers, known as the “dot plot;” and Chairman Jerome Powell’s news conference.

“The key question for the markets is whether the dot plot still implies three hikes for this year or an upward shift to four hikes,” said Philip Marey, senior U.S. strategist at Rabobank, in a note.

A more aggressive forecast could spur fears the Fed will tighten too fast, potentially accelerating the onset of recession. But investors might be inclined to doubt the Fed.

Marey, who expects the Fed to end up delivering a total of three rate increases this year, said he wouldn’t change his call even if the dot plot sees an upward shift. “As long as the Phillips curve refuses to materialize, we continue to have our doubts about the Fed’s hiking plans,” he said, referring to the inverse relationship that says falling unemployment should spur a pickup in inflation.

Watch Treasurys

Ragan said stock-market investors will pay attention to the reaction in the bond market. While a rise in the 10-year Treasury yield TMUBMUSD10Y, +0.91% toward 3.25% could eventually be in store as the Fed continues to tighten, rising rates shouldn’t present too much of a headwind for equities as long as economic growth is also seen picking up steam and policy makers continue to signal a steady and deliberate approach.

The minutes of the Fed’s May policy meeting and speeches by Fed officials showed policy makers expect tightening resource utilization, a moderate rise in wages and nonlabor costs and stable inflation expectations to lift inflation to the central bank’s 2% annual target, noted Kathy Bostjancic, head of U.S. investor relations at Oxford Economics.

And the minutes signaled the Fed “does not intend to overreact to a rise in inflation above the ‘symmetric’ 2% target,” she said, in a note. “In turn, the Fed officials do not want the bond market to overreact to the expected rise in inflation and price in a hawkish tightening path.”

The big wind-down

Remarks by ECB officials, meanwhile, indicate that policy makers are prepared to begin setting the stage for the wind-down of its bond-buying program despite recent political turmoil in Italy, which briefly caused a sharp selloff in the country’s bond market that sent ripples through global financial markets.

ECB President Mario Draghi is certain to field questions about both the discussion surrounding the timetable for winding down bond purchases as well as the situation in Italy. The key point for U.S. investors will have to do with the outlook for the eurozone economy, which saw a significant softening of first quarter data after a strong 2018 performance, Ragan said.

If the ECB holds off on laying out a timetable for QE exit, it could be taken as a sign of concern by policy makers about the economic outlook, which could be something of a negative for markets, he said.

The other summit…North Korea

If the Fed and ECB aren’t enough, don’t forget that there is also another summit meeting—this time between President Donald Trump and North Korean leader Kim Jong Un—on Tuesday. Investors in the past have largely ignored the back-and-forth between Washington and Pyongyang, but the high-stakes nature of the talks on North Korea’s nuclear program mean the meeting will be closely watched.

As analysts at Bank of America Merrill Lynch succinctly put it: “It is very hard to know what will happen, but it could have profound global implications.”

And headlines on trade could also be a wild card. While investors took the past week’s developments in stride, it appears that tensions between the U.S. and its trade partners are on the rise.

The Dow Jones Industrial Average DJIA, +0.30% rose 2.8% over the past week, its best such performance in three months, while the S&P 500 SPX, +0.31% advanced 1.6%. Both the Dow and the S&P 500 ended Friday at or near three-month closing highs, while the tech-weighted Nasdaq Composite COMP, +0.14% saw 1.2% weekly gain after knocking out back-to-back record closes earlier in the week.

Looking ahead, the economic calendar features May consumer-price index data on Tuesday, followed by producer prices on Wednesday. May retail sales are on the docket Thursday.