Goldman Sachs on Monday downgraded two real-estate stocks as housing-market challenges persist and the end of the spring selling season looms.

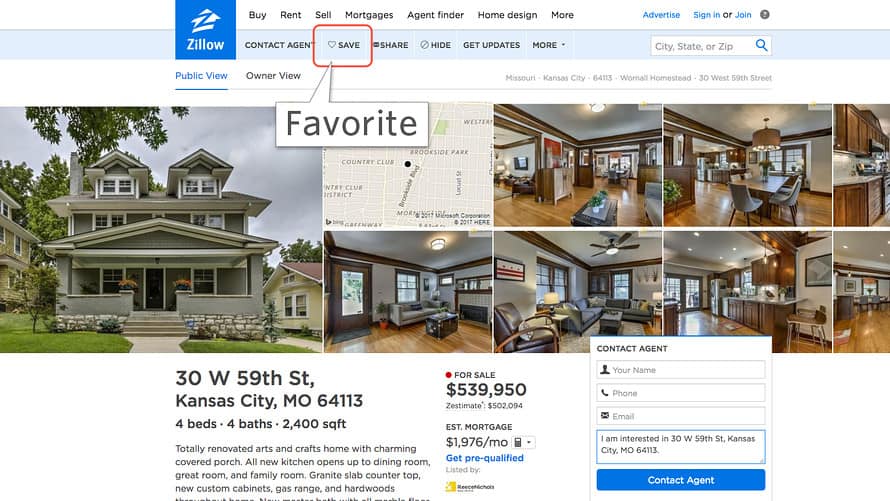

In a research note, Goldman equity analysts call Zillow Group ZG, -1.36% and Redfin Corp. RDFN, -7.45% “online real estate stocks” but note that, despite their internet origins, both companies are still at the mercy of the real-world housing backdrop: tight supply, rising prices and a challenging mortgage lending environment in which credit remains tight even as rates rise.

What’s more, both companies face challenges from upstarts.

“While Zillow has successfully consolidated much of the real estate category online, through its own organic growth and purchases of companies like Trulia and StreetEasy, we are beginning to see signs of refragmentation,” the analysts wrote. “As we noted in the first edition of our Venture Capital Horizons series, real estate tech has been one of the fastest growing verticals in terms of attracting VC investment.”

Both Zillow and Redfin have launched their own versions of “iBuyer” initiatives, a step Goldman calls “necessary,” but they’re squaring off against companies who’ve made this model their only focus. iBuyers like Opendoor and OfferPad buy homes directly from owners, allowing them a more certain, less time- and effort-intensive selling process than listing properties on the open market.

Zillow expanded its Instant Offers platform in April, and Redfin has steadily beefed up its version, Redfin Now. But iBuyers are picking up attention from venture capital, Goldman said.

In the short term, Zillow shares, which are up 59% in 2018, may come under pressure, the analysts wrote. Online real-estate stocks usually underperform in the second half of the year, as the traditional “selling season” comes to an end.

Zillow’s broad footprint means it could be insulated from a market downturn, Goldman wrote. Slower market activity could prompt real-estate agents to spend more on Zillow’s services, for example. The analysts cut their rating on the stock to neutral from buy but raised their 2018-20 earnings estimate by 2 cents a share.

In contrast, the Goldman analysts write, “macro pressures have an outsized impact on Redfin,” a discount brokerage that relies on transaction growth to drive revenue. For Redfin, growth in revenue is important, because it’s spending more on new initiatives.

Goldman cut its Redfin rating to sell from neutral, and trimmed 2018-20 revenue and EBITDA estimates by 1% to 2%. The analysts also noted that their 12-month price target of $21 represents a 15% loss for the stock, versus a 7% median expected increase for the internet sector as a whole. Redfin shares are down 26% to date in 2018 but up about 53% from an initial public offering price of $15. Redfin went public late last July.