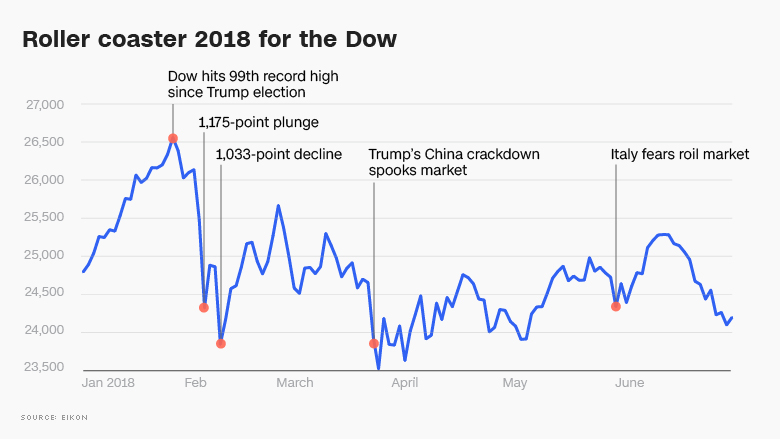

Two 1,000-point plunges for the Dow. Crashes in emerging market currencies. A spike in crude oil. Political chaos in Italy. And the start of a trade war.

Investors are marking the end of a wild first six months of the year.

At first glance, it looks ho-hum: The Dow and S&P 500 are little changed from where they started. A 55-point gain for the Dow on Friday left the index down 1.8% for the year.

But that belies the extreme turbulence that rocked the markets. Last year’s so-called melt-up for stocks, inspired by the corporate tax cut, transformed into a near-meltdown.

“The first half of this year couldn’t be any more different than the entirety of 2017,” said Art Hogan, chief market strategist at B. Riley FBR.

Hogan noted that last year the S&P 500 moved 1% just eight times in a single trading day. So far this year? Nearly 40. That includes February 5, when inflation fears sent the Dow spiraling lower by a record 1,175 points.

Markets around the world were volatile, and much of it started with the United States. Aggressive trade and central bank policy from Washington combined to send shock waves across the globe.

President Donald Trump’s trade crackdown triggered fears of a trade war that could slow the booming economy or even push it into recession. Those fears even helped knock Chinese stocks into a bear market, a 20% decline from prior highs.

And hotter inflation in the United States forced the Federal Reserve to keep raising interest rates, sending the US dollar spiking.

“The strength of the US dollar is crushing emerging markets. It’s very destabilizing,” said Hogan.

The problem is that the roaring US currency makes it harder for countries to repay money they’ve borrowed in US dollars. The stronger dollar has also caused investors to shift their money from emerging markets to the United States.

That double whammy has sent the Argentine peso crashing 55% to a record low against the greenback. Argentina had to reach a $50 billion bailout from the IMF.

It’s not just Argentina. India’s rupee plummeted to a record low this week because of worries including a trade war and the soaring price of crude oil. Ditto for the Turkish lira, which has also been hurt by concerns about the independence of Turkey’s central bank. Even China’s currency has begun to show cracks, making it more expensive for the country to pay back its mountain of debt.

Investors fear that the emerging market storms will eventually become a hurricane that lashes the rest of the world. That’s what happened during the Mexican peso crisis in 1994 and the Asian financial crisis of 1997.

And then there’s Europe. The Italian election sparked fears that Italy could move to leave the group of countries that use the euro, dealing a heavy blow to the currency. These concerns even rippled onto Wall Street, causing US stocks to stumble briefly. While Italy has since backed away from the brink, it’s a fresh reminder of the delicate state of the eurozone.

For now, most investors think the stock market can eventually overcome these global concerns. Companies are minting money, thanks to the strong economy and the Republican corporate tax cuts.

Although they’ve cooled lately, tech stocks remain huge winners. Amazon (AMZN) has soared 45%, Twitter (TWTR) is up 82%, and Netflix (NFLX) has more than doubled. The Nasdaq composite recorded its eighth straight quarterly gain.

So what could stop that march higher? Further evidence of a trade war.

Terry Sandven, chief equity strategist at US Bank Wealth Management, said it’s “hard to envision” the S&P 500 making a new high until there’s a “resolution on trade.”

Yet Bank of America and Goldman Sachs recently warned that the trade turmoil is likely to get worse before it gets better.

Trump has already invoked national security to impose steel and aluminum tariffs on close allies including the European Union, Canada and Mexico. He’s putting tariffs on China, setting off a trade showdown between the world’s two biggest economies.

Other countries have retaliated — creating major problems for American companies. Harley-Davidson (HOG) has warned it could lose $100 million a year because of EU tariffs on motorcycles shipped from the United States.

Next up? The White House is exploring tariffs on auto imports, which would raise the stakes considerably.

“It feels as though the administration is making it up as they go along,” Hogan said.

One key will be whether earnings season, which begins next month, reveals deep worries from Corporate America. If companies start talking about scaling back investments and cutting profit targets, that could trigger a new wave of unease on Wall Street.

It’s possible that a market freakout could even force Trump and China to make a deal that prevents a trade war.

“The end game is someone blinks and we get back to rationale behavior,” Hogan said. “We’re just not there yet.”