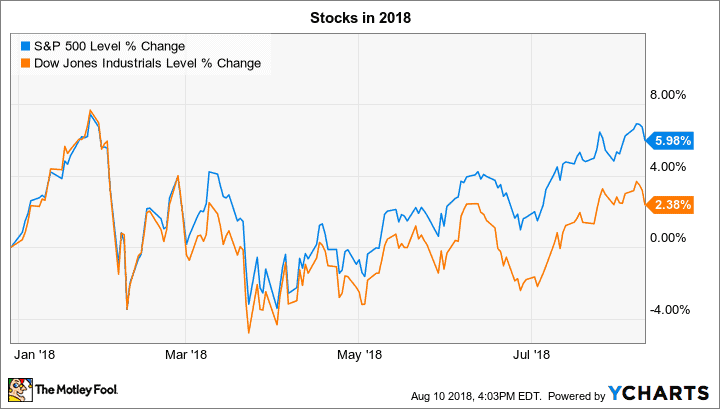

Stocks ticked lower last week as trade tensions offset investor optimism on rising corporate earnings. Both the S&P 500 (SNPINDEX:^GSPC) and the Dow Jones Industrial Average (DJINDICES:^DJI) shed less than 1% to stay in modestly positive territory for the year.

Second-quarter earnings season is still in full swing, and retailers will take center stage this week as Home Depot (NYSE:HD) and Wal-Mart (NYSE:WMT) post their latest results. Investors are also bracing for a potentially volatile week for NVIDIA (NASDAQ:NVDA) after it makes its earnings announcement.

Home Depot’s growth rebound

Home Depot is looking to return to its market-thumping form on Tuesday. The home improvement giant’s last earnings report was marked by a sharp sales growth slowdown, but management blamed unseasonably cold weather for the negative customer traffic the retailer endured in the fiscal first quarter.

Executives said back in May that those sales would likely just shift into the second quarter as warmer weather arrives, so investors have good reasons to expect a spike in comparable-store sales, customer traffic, and average spending per visit this week.

Shareholders will get an update on management’s view of the strength of the housing industry, too, the steady recovery of which recently pushed Home Depot’s annual sales to over $100 billion. The retailer’s long-term goals call for that number to reach as high as $120 billion by 2020 even as operating profit margin inches up to an industry-leading 15% of sales.

NVIDIA’s outlook

NVIDIA shares are trouncing the market so far this year ahead of what’s expected to be a strong second-quarter report from the chip giant. Sure, falling cryptocurrency prices have dampened demand for mining machines lately. But NVIDIA is still seeing plenty of room for head-turning growth across its other portfolio lines, including gaming and artificial intelligence.

CEO Jensen Huang and his executive team are predicting sales of roughly $3.1 billion in the second quarter, which would translate into a 39% increase over the prior year. Profitability is expected to remain strong, at about 63% of sales, thanks to firm pricing for its high-end graphics processors.

Investors will likely be even more interested in management’s forecast for the current quarter. Wall Street analysts are currently projecting sales growth of around 28% to $3.4 billion, and a management projection that significantly deviates from that figure could send the stock moving this week.

Walmart’s profit picture

It isn’t easy for a company that books over $500 billion in sales to fundamentally change its operating strategy. But, although it is taking time, Walmart is finding ways to protect its retailing dominance even as the industry moves toward multichannel selling. The most recent example of that success is the fact that a 33% increase in e-commerce sales combined with customer traffic gains at stores to push sales higher by 4% last quarter.

That sales growth is coming at a cost, though. Operating income fell 3% in the core U.S. market last quarter as the retailer poured cash into building out its digital selling infrastructure.

Investors should see more evidence of those contrary trends playing out in Walmart’s second-quarter report on Thursday.

On the bright side, the company should extend its streak of positive sales gains, both online and in stores. Meanwhile, aggressive spending in the digital sales arena will continue pressuring earnings as Walmart tries to stay on top of the quickly shifting retailing industry.