Retiring comfortably in yours 60s or 70s can seem a high-wire act, so how are some people pulling it off without a wrinkle in their face?

The FIRE (financial independence, retire early) movement is growing, with more and more people parting from their careers in their 30s and 40s. CNBC spoke to some of these young retirees to figure out how they did it.

“I think it should be possible for everyone,” said Karsten Jeske, who retired this year at 44. “It’s conceptually extremely simple to do.”

People should keep in mind the risks of forfeiting a paycheck, said Nick Foulks, a lead advisor at Great Waters Financial in Minneapolis.

“People are living longer, and our dollars today have to last longer than they ever have before,” Foulks said. Particularity young retirees might find a lackluster Social Security check waiting for them, since the monthly amount you receive is based on an average of your working years.

Joel Jonathan, retired at 34

Joel Jonathan was 29 when he decided he was done with work.

“I was longing for the ability to have time to take long walks, work on my personal fitness, cook a nice meal, without always being at work in a cubicle,” he said. (He requested CNBC only use his first and middle names, as he was disclosing so many financial details.)

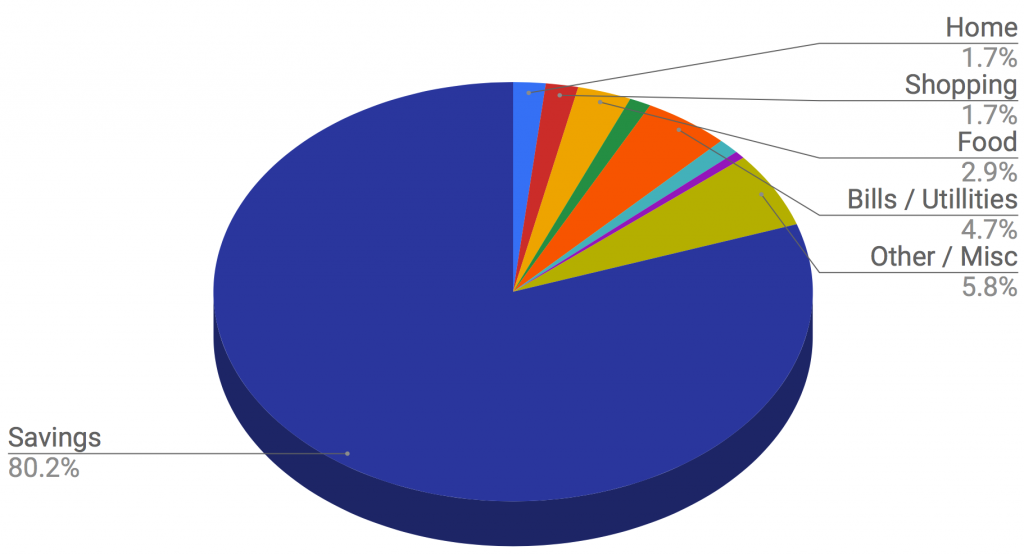

Joel was working 60 hours a week as an engineer when he began his journey to financial independence. He and his wife, Alexis, each made around $80,000 a year. They reduced their overhead until they were socking away 80 percent of their income, including money in their 401(k) plans and heath saving accounts. He invested in low-cost, total market index funds.

How did they actually save so much?

They moved in with his wife’s parents for a while and rented out their house. They downgraded from two cars to one, and carpooled to their jobs.

“[My wife] works about three miles from my old work location, so I dropped her off at work and then continued on to mine,” he said.

Additionally, they almost never ate out.

Here’s a chart of his budget.

They lowered their Internet speed, and found they didn’t notice a difference.

“We were paying more money for no reason,” he said. His wife cancelled her gym membership, but soon regretted it. “After a few months, she was like, ‘I want to go back to my spin class,'” he said. So, she did.

“To us, it’s an experiment in going out of our comfort zone,” he said.

After five years, at 34, he was able to leave his job. He now spends his days blogging about his financial journey, and working on a book about FIRE. He also writes music.

“None of it needs to produce any profit,” he said. “I can just enjoy [life] and work at my own pace.”

His wife still works, though he said he’s trying to get her to quit and join FIRE with him. For now, he uses her health insurance but when she retires they’ll switch to an Affordable Care Act subsidy.

They don’t have children, but they did include a line item in their budget for college costs one day.

“If we decide not to have kids, then that just becomes extra safety margin for ourselves,” he said.

His directions to FIRE: Save at least half of your income, until your savings are 25 times your annual expenses. He said this should take 10 to 15 years for most people.

Make sure those savings are invested in low-cost, passive total stock market funds. Quit your job (only if you’re ready) and then withdraw 4 percent of your portfolio per year, forever.

Karsten Jeske, retired at 44

San Francisco, California

Karsten Jeske said his path toward early retirement began in 2008, when the Great Recession taught him that there is no absolute financial stability.

The former economist at the Federal Reserve says that he’s part of fatFIRE, those who can afford to retire with more frills. For a decade, he saved 50 percent of his salary, which was in the mid-six figures.

(FatFIRE is the the pursuit of financial independence and/or early retirement on at least an upper-middle class lifestyle.)

“People say, ‘You work in finance. You must have some special sauce,'” he said. “No, I didn’t. I just invested in broad-based U.S. and international equity index funds.”

He said most people will probably not be able to retire early by putting their money in savings accounts or a certificate of deposit.

“Most people I know did this with equities,” he said.

Even though he was lucky to have a high salary, he said people who earn far less should be able to retire early, too.

“With $60,000 a year, you could live on $25,000, and you’re saving more than half,” he said.

He said every dollar you don’t spend helps you in two ways: “You put it in your savings so your nest egg grows faster, but also every dollar you don’t spend conditions you to consume less so your retirement budget is lower.”

He plans to live off around $80,000 a year in retirement. He has a 529 college savings plan set up for his 5-year-old daughter, Kati. He’s considering joining a health insurance ministry, in which members pay for each other’s medical expenses as they come up each month.

So far, his retirement has been spent travelling the world with his wife, Kristal, and daughter.

“I don’t think I’ll get bored,” he said, of the decades to come. “Even travelling now is like a full-time job.”

And if there’s a recession? Jeske said he isn’t worried.

“We’d just scale back from fatFIRE to FIRE and live in peace,” he said.

Tanja Hester, retired at 38

North Lake Tahoe, California

When Tanja Hester retired she was 38, and her husband, Mark Bunge, was 41.

She says people should save for early retirement and traditional retirement in different accounts.

Most regular retirement accounts come with required minimum distribution rules around when you can withdraw from them anyway. But also, Hester said, if you have all of your money in one account, it’s more risky.

“We know if we mess up, and spend too much money in our early years, we’re not going to jeopardize our older years,” Hester said.

She and her husband call their early retirement “phase one,” and their later retirement “phase two.”

They also have different expectations for their different retirements, young and old. Now, they don’t mind sleeping in tents and cheap motels. But, she said, “We might not want to rough it when we’re 70.”

It took them six years to reach early retirement. They both were earning six figures as political consultants, and saved 70 percent of their net income. They maxed out their 401(k) plans and they paid off their mortgage and bought a rental property.

“The absolute biggest thing that helped us was banking every raise and not letting our lifestyle inflate,” Hester said.

She also recommends automating your savings and investing.

“We looked at what we had in checking and it didn’t look like very much, and so that’s what we felt like we had to spend,” she said.

Hester feels that not everyone can retire early.

“It’s about looking at what is possible,” she said. “If you apply these principles and just translate that into a secure retirement, you’re already ahead of the majority of people.”