Anyone who has ever taken out a loan knows the critical role that credit scores play. But if you haven’t had time to build up a strong score or have not utilized much credit in the past, you may be locked out of the market when it comes time to borrow. If so, there’s good news. A new evaluation model is scheduled to debut next year that incorporates non-credit data like how well you handle your checking account. This innovative modification will allow computation of a score for many with limited or non-existent credit histories, and potentially increase the scores of those with marginal ratings, opening the door to worthy borrowers previously excluded by traditional credit evaluation.

By far the most ubiquitous ranking is the FICO score, created and maintained by the Fair Isaac Corp. The vast majority of credit decisions are based on this metric, which traces its origin to 1956 and today is relied upon by 90 percent of major lenders in assessing the probability of repayment.

But a decent chunk of potentially creditworthy Americans don’t have a FICO score and therefore have limited access to the credit markets in many instances. Fair Isaac estimates that 53 million adults in the United States lack enough historical data on previous loan activity in their credit files to compute a score. Enter the age of “alternative data” and with it a supplement to the traditional scoring method: the UltraFICO score.

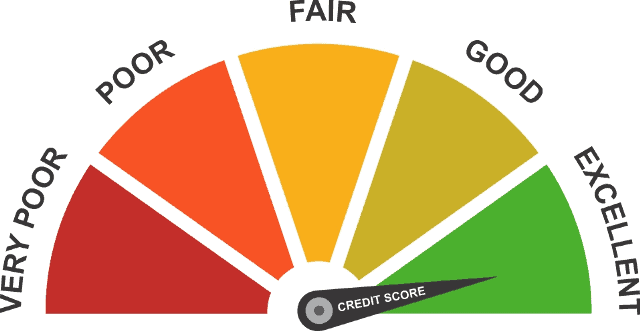

The well-known FICO rating pegs potential borrowers on a scale from 300 to 850 based upon previous borrowing and repayment history, and incorporates negative information like bankruptcies and late payments. In recent years, Fair Isaac has relaxed the deleterious impact of some events like medical bill delinquencies and collection actions, but the process still relies upon a compilation of transactions reported to the credit bureaus by creditors. The new method incorporates additional input derived from accessible financial transaction data not typically known to or reported by lenders.

Fair Isaac has established a joint venture with credit reporting agency Experian and data aggregation firm Finicity to supplement the supply of information fed into the model. With the permission of the consumer, Finicity will compile historical data from checking and savings accounts over a period of time to submit for evaluation in addition to any existing credit record. The resulting modified credit score, called UltraFICO, is expected to expand the universe of potential borrowers who can qualify based upon their revised standing.

FICO expects the new UltraFICO model to improve the scores of 7 million consumers with “thin” (sparse or non-existent) credit files. Meanwhile, the firm predicts that some 26 million borrowers with subprime scores (generally below 670) will see a measurable improvement thanks to the incorporation of alternative data like bank account history. The modifications are also expected to open the door to more favorable loan terms for previously marginal borrowers.

The program is scheduled to begin a limited pilot period in early 2019 involving a small number of financial institutions. A full roll out of the UltraFICO program is slated for later in the year.

Some analysts caution that the liberalization of FICO scores comes just as aggregate household debt has reached an all-time high, particularly in the auto and student loan sectors, and as loan delinquencies are rising sharply. But it has long been recognized that a large swath of responsible prospective borrowers has been heretofore excluded and that some with weaker scores have made significant recent improvement not fully reflected in the traditional FICO model. The incorporation of verifiable alternative data is a logical and beneficial development.