Facebook shares whipsawed in after-hours trading, following a mixed third-quarter earnings report Tuesday.

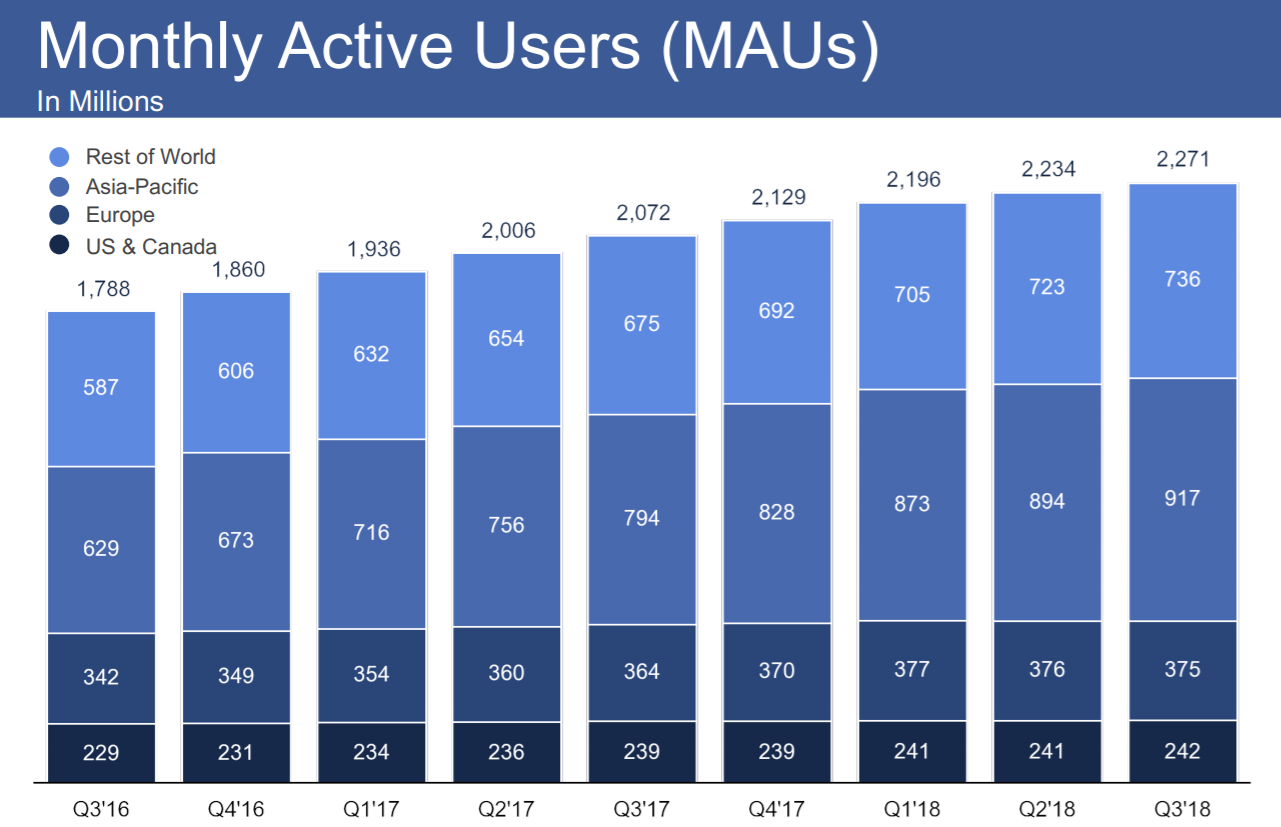

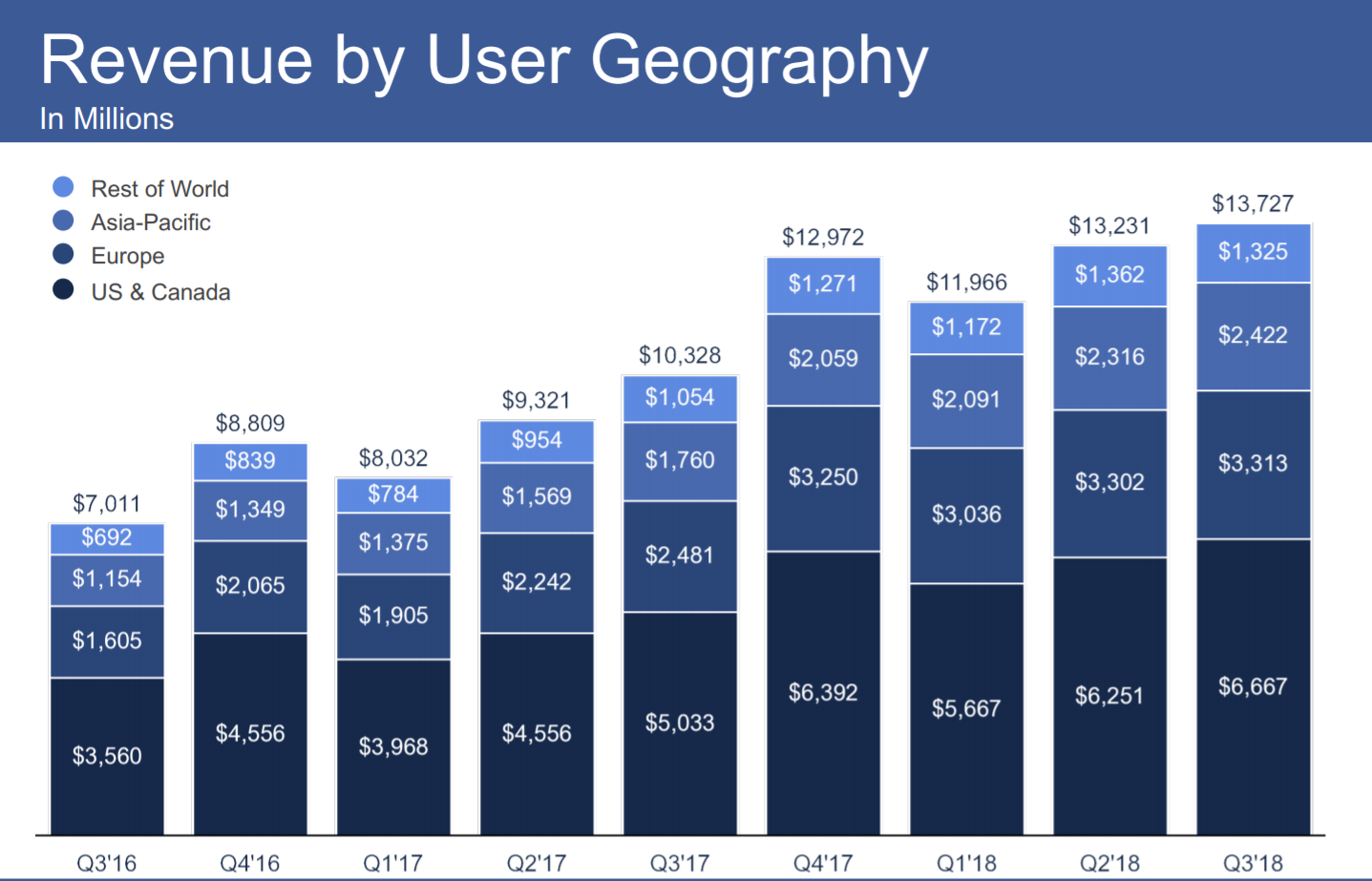

The results fell short when it came to revenue, daily active user and monthly active user estimates in the company’s latest earnings report, despite exceeding analyst expectations on earnings per share. Facebook also told investors to expect increased expenses in 2019.

The company reported its third-quarter earnings after bell on Tuesday:

- Earnings per share (EPS): $1.76 vs $1.47 estimated, per Refinitv

- Revenue: $13.73 billion vs. $13.78 billion estimated, per Refinitiv

- Daily active users (DAUs): 1.49 billion vs. 1.51 billion estimated, according to FactSet and StreetAccount

- Monthly active users (MAUs): 2.27 billion vs. 2.29 billion estimated, according to FactSet and StreetAccount

- Average revenue per user: $6.09 vs. $6.09 estimated, per 2.29 billion, according to Street Account

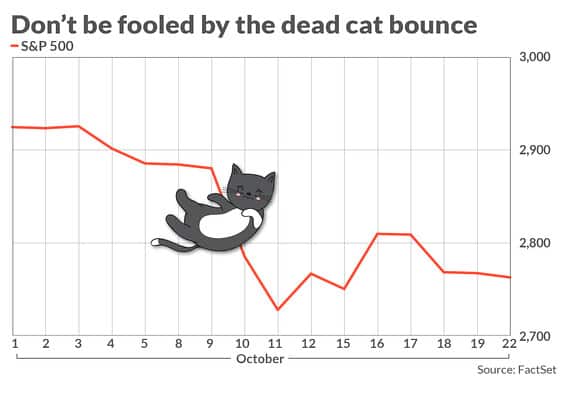

Facebook’s shares were down as much as 6 percent and up as much as 5 percent after hours as investors dissected CEO Mark Zuckerberg’s comments on future spending and growth. They finally settled in positive range, up about 3 percent, after the company’s earnings call concluded.

On the call, Zuckerberg said the company plans to invest significantly in the business in 2019 as it focuses on building out new products such as Facebook Watch, Instagram TV and Facebook Marketplace and improving cyber security. Facebook CFO David Wehner said 2019 total expenses will grow 40 to 50 percent compared to full-year 2018.

“I want you to know that looking out beyond 2019, I know that we need to make sure our costs and revenue are better matched over time, and that’s something that I am focused on as well,” Zuckerberg said.

Facebook said it’s expecting between $18 billion to $20 billion in capital expenditures in 2019, above the FactSet analyst estimate of $17.29 billion.

Zuckerberg also spent a large portion of the call discussing the company’s progress with “Stories” features that are available across Facebook’s apps, including Instagram and Messenger, saying that “the trends that we have seen suggest that in the not too distant future, people will be sharing more into Stories than they will into feeds.”

The Stories features are growing faster than the company is able to monetize, so Facebook will need to work on building out ad products to run alongside that user content, Zuckerberg said.

“This is one of those situations where the community growth that we’re seeing is outpacing the progress that we have made so far on developing the ads in that space,” he said.

Zuckerberg also discussed the company’s challenges with user safety and harmful content, saying Facebook has made progress but it will likely not have a firm grasp on the problem until end of 2019.

“We’re getting better and better at this, but I anticipate that it will be about the end of next year when we feel like we’re as dialed in as we would generally all like us to be,” he said. “And even at that point, we’re not going to be perfect.”

More than 2.6 billion people use the Facebook family of apps per month, the company said. Those apps include Facebook, WhatsApp, Instagram or Messenger. That figure was up 100 million more people from last quarter. More than 2 billion people a day use at least one of those apps.

“Our community and business continue to grow quickly, and now more than 2 billion people use at least one of our services every day,” Zuckerberg. “We’re building the best services for private messaging and stories, and there are huge opportunities ahead in video and commerce as well.”

The company said it increased headcount 45 percent and costs went up 53 percent as well. More than 92 percent of its advertising revenue for the quarter came from mobile advertising, up from 88 percent year-over-year.

Last quarter, Facebook advised it expected its revenue growth rates to decline as much as the high single-digit percentages during the third and fourth quarters of this year because the company has invested more in its Stories product, which has lower ad rates, and other things like security and compliance with the EU’s GDPR data privacy law.

However, the third-quarter earnings did not show as much of a slowdown as projected. Worldwide ARPU increased 2 percent from last quarter. U.S. and Canada ARPU showed signs of growth as well, up 7 percent from last quarter.