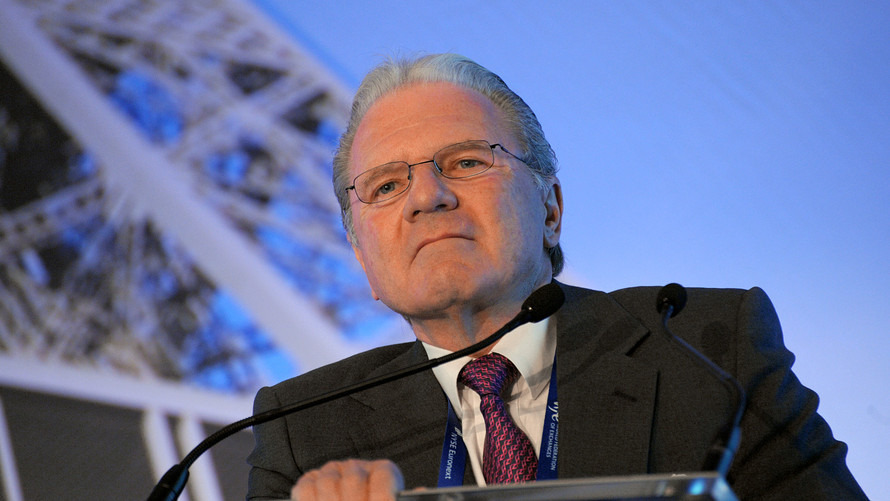

The stock market could be in for a steep drop come Wednesday, warns Thomas Peterffy, a pioneer of computerized stock trading.

That is, if Democrats are able to gain control of not just the House — as most polls predict — but also the Senate, Peterffy told CNBC on Tuesday, as voting in midterm elections was under way.

The Hungarian-born billionaire, who ranks as the richest person in Florida — with a net worth of $25.7 billion, according to Forbes — predicted that the stock market could see a tumble of as much as 15%, if the so-called blue wave materializes. Even if the Democrats take only the House, the founder of Interactive Brokers said the market could face a 2% or 3% decline in equity values.

That said, Peterffy said he believes he would be a buyer of stocks in either scenario, viewing declines as buying opportunities. He said a more positive outcome for the GOP would also prompt him to adopt a bullish stance, at least for the near term, because it might reaffirm optimism around a business climate conducive to indexes returning to all-time highs.

“I will be a buyer after the market drops, and I would be a buyer, of course, if the Republicans retain control,” he told CNBC.

Wall Street investors are keenly awaiting the outcome of elections that could help to determine the legislative agenda for President Donald Trump over the next two years, at least.

Political gridlock in which the levels of power in Congress and the White House are divided between the parties, many have pointed out, has tended to result in strong gains for U.S. equities.

Jeremy Siegel, finance professor at the Wharton School at the University of Pennsylvania and a longtime bull, said strong markets followed after midterm elections during the Clinton administration in 1994, where President Bill Clinton’s Democratic Party lost the House and Senate in a political defeat called the “Republican Revolution,” resulting in a net gain of 54 GOP House seats. Democrats under Clinton also lost the 1998 midterms decisively.

However, the market overall ended firmly higher during the Clinton years, with the S&P 500 index SPX, +0.63% rising 208% from Clinton’s inauguration until his final day in office in 2001. The Dow Jones Industrial Average DJIA, +0.68% gained 225% during that same period.

Siegel told CNBC that the a big victory for the House could be a negative for the market. He also said that investors should watch the Federal Reserve’s policy update on Thursday for any reaction to a shifting political landscape and its impact on the overall economy.

On Tuesday, all three main U.S. benchmarks were rising, led by solid gains in the embattled Nasdaq Composite Index COMP, +0.64% , where popular technology and internet-related shares have been drubbed in recent weeks amid concerns about the outlook for growth companies and lofty valuations.