The vast majority of baby boomers haven’t accumulated enough savings to fully retire at age 65 with their preretirement standard of living. That’s the sobering conclusion of recent studies from both the Stanford Center on Longevity and HR consulting firm Aon.

As a result, boomers will need to either work longer, reduce their standard of living in retirement or do some combination of the two. In addition, it’s critical that they squeeze the most from their modest financial resources.

That means baby boomers have to make some choices. Following are the top five retirement planning decisions that will have the biggest impact on most older workers’ financial security. If you’re in this category, you’ll need to determine:

- When and how to retire (including whether to work part-time for a while)

- When to start taking Social Security benefits

- How to build your retirement income portfolio, including deploying retirement savings and, for the lucky few, any pension benefits

- What choices to make regarding Medicare and medical insurance

- Which living expenses to reduce

Five scenarios

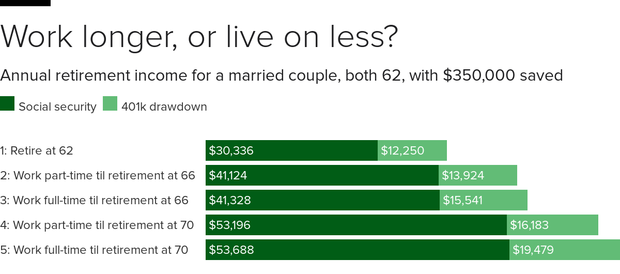

Let’s consider one example that illustrates the power of the first three choices. We’ll look at a married couple, both age 62, who have $350,000 in retirement savings (which, by the way, is above the average savings amount for similar older workers). Let’s consider the following five scenarios regarding decisions they can make:

- Retire at age 62, immediately start collecting Social Security and begin drawing down retirement savings

- Implement a downshifting strategy by working part-time, just enough to cover living expenses but with no additional contributions to savings, then start Social Security and savings drawdown at age 66

- Work full-time until age 66, while continuing to add to savings, then starting Social Security and savings drawdown

- Downshift until age 70, then start Social Security and savings drawdown

- Work full-time until age 70, then start Social Security and savings drawdown

The graph below shows the estimated annual retirement income for each of these scenarios (by my calculations).

Here are a few key conclusions we can draw from this graph:

- There’s a large difference between retiring at age 62, with a total estimated retirement income of $42,586, and retiring at age 70, with a total estimated retirement income of $73,167. As a result, the period between age 62 and 70 is the “retirement opportunity zone.” Decisions about working and retiring during this time can make a major impact on your retirement security.

- Compare Scenarios 2 and 3 — downshifting between ages 62 and 66 and working full-time during that period. These two scenarios don’t show a large difference in retirement income. Therefore, older workers who want to free up some time to enjoy their lives might want to consider downshifting, if they have the capability to make that choice. Scenarios 4 and 5 also compare a downshifting strategy to working full-time until age 70.

- Social Security benefits protect against inflation risk, investment risk, longevity risk, cognitive decline and death of a spouse. The graph illustrates that Social Security contributes the largest portion of most workers’ retirement benefits. That’s why it’s important to optimize your benefits.

- Any volatility in retirement income introduced by stock market investing is concentrated in the relatively small light-green portions of the graph. This might give retirees insights about the amount of their retirement savings they might invest in stocks.

Your retirement planning job

A big part of your retirement planning job is to learn as much as you can about generating income after you stop working and to understand the implications of when and how you should retire. You might want to prepare your own version of the above graph or find a qualified financial adviser who can help you with this analysis.

My latest book, “Retirement Game-Changers: Strategies for a Healthy, Financially Secure, and Fulfilling Long Life,” goes into more detail on the advantages and issues for a downshifting strategy, as well as other key decisions facing older workers as they transition into retirement.

Either way, it would be wise to spend some time learning about the choices you should be making during your own retirement opportunity zone.