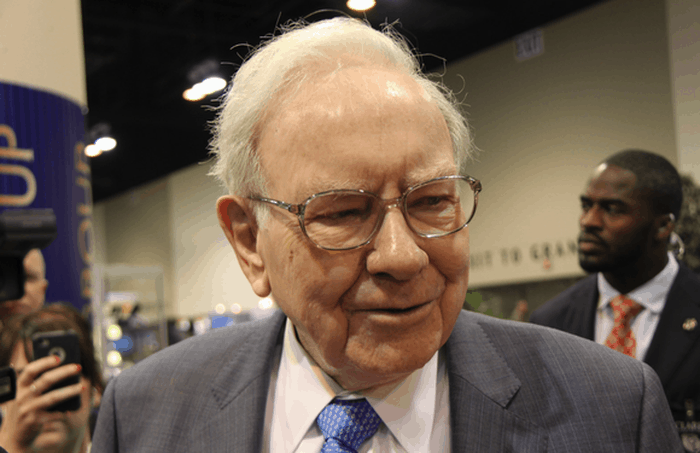

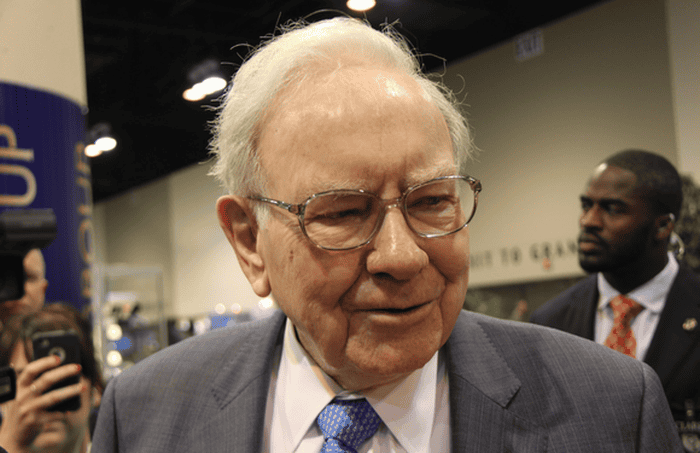

Warren Buffett’s Berkshire Hathaway (NYSE:BRK-A) (NYSE:BRK-B) has been busy. In addition to swooping in and buying bundles of bank stocks, Buffett sold some of Berkshire’s longtime holdings in the third quarter. Since Berkshire Hathaway manages a portfolio worth more than $200 billion, and it tends to be among the biggest owners of the stocks it purchases, knowing what stocks it’s selling is important. Fortunately, it’s required to file a 13-F report with the Securities and Exchange Commission detailing its activity every quarter. The latest report shows that the Oracle of Omaha sold a significant number of shares in Phillips 66 (NYSE:PSX), Sanofi (NYSE:SNY), and Walmart (NYSE:WMT). It also shows Berkshire trimmed its stakes in three airlines: American Airlines (NASDAQ:AAL), United Continental (NYSE:UAL), and Southwest Air (NYSE:LUV). Should you follow suit?

Exiting energy

Warren Buffett has been selling his shares of Phillips 66 all year, but the pace accelerated in the third quarter as Berkshire Hathaway punted more than half of its stake in the energy company.

In Q1, it sold 35 million shares in the oil and gas transport, storage, refining, and marketing company, which brought its ownership below 10%. In Q2, it sold another 10.9 million shares, reducing Berkshire Hathaway’s position by about 24% to 34.7 million shares. And in Q3, it cut its position by 55% to 15.4 million shares.

We don’t know exactly when these positions were sold in the quarter, but it could be that each sale was prompted by share prices hitting record 10-year highs. In May, Phillips 66 shares rallied to more than $120 before retreating, then they rebounded back above $120 again in August.

The new highs have been driven by high refining capacity utilization and crude oil prices that rallied all year up until October. In Q2, those tailwinds resulted in sales of $29.7 billion, up 21%, that were over $600 million better than industry watchers were expecting and earnings per share of $2.80 that outpaced estimates by $0.61. Its refining business alone produced $910 million in net income, up substantially from $224 million in the same quarter last year. The third-quarter results were similarly strong, as record net income in its midstream operations fueled adjusted earnings of $1.5 billion, or $3.10 per share, that were 25% better than expectations.

It certainly doesn’t look like Buffett’s decision to sell is rooted in a backward-looking evaluation of this energy company’s performance. Instead, it appears that Buffett is simply exercising the same discipline he’s exercised in the past with cyclical businesses like this, choosing to book profits when they’re near their peak to reduce the risk of suffering losses during an eventual decline.

Berkshire Hathaway’s remaining shares still make it Phillips 66’s fourth-largest investor, but if past is prelude, then it wouldn’t shock me if his steady selling this year will continue until this stock is no longer in the portfolio.

Going, going, gone

Berkshire Hathaway’s portfolio also got some thorough housecleaning last quarter as small remaining stakes in both Sanofi and Walmart were sold off.

A global biopharma company, Sanofi is probably best known for Lantus, a long-acting insulin that at its peak was hauling in about $7 billion per year in sales, but it also has a significant presence in cancer treatment and rare disease treatment. The company’s roughly $11 billion in quarterly sales, at current exchange rates, makes it one of the biggest drug companies on the planet, but there are some question marks that could’ve contributed to a decision to sell.

Lantus has lost its patent protection, and competitors are starting to chip away at its sales. Also, Sanofi completed an $11.6 billion acquisition of Bioverativ to gain exposure to the $10 billion-per-year hemophilia market earlier this year, but new treatments in development could reduce future sales of those newly acquired drugs if trials pan out.

Meanwhile, Walmart was once a top Berkshire Hathaway holding, but Buffett began selling shares in 2016 after referring to Amazon.com founder Jeff Bezos as a “genius” and saying at his annual investor conference that “We’re not going to out-Bezos Bezos.”

Walmart’s inability to slow Amazon’s success to maintain market share and worry over how trade disputes and rising wages could impact sales and profitability are probably why Berkshire Hathaway sold the last of its remaining 1.4 million shares in the third quarter.

Prepare for landing?

One of the most shocking investments in recent memory has been Warren Buffett’s scattershot embrace of airline companies. In the past, he’s called airlines a terrible investment because of overcapacity, volatile jet fuel costs, labor disputes, price wars, and a reliance on a strong economy supporting business travel and personal travel demand.

Yet he stockpiled airlines in Berkshire Hathaway’s portfolio in 2017, acquiring a slate of the biggest performers, including American Airlines, United Continental, Southwest Air, and Delta Air (NYSE:DAL). In the third quarter, he trimmed positions in every one of those companies except Delta. He sold 1 million shares in American, 700,000 shares of United Continental, and 500,000 shares in Southwest, but he added 1.9 million shares of Delta, boosting his stake by 2%.

The changes are in keeping with recent quarters, in which some positions were increased while others were trimmed or remained unchanged. For example, he boosted his Southwest stake by 20% in the second quarter to take advantage of a sell-off in shares caused by an in-air accident earlier this year. For perspective, the half million shares Buffett sold in Southwest is a reduction of less than 1% in Berkshire Hathaway’s position. It still owns more than 59 million shares, which represents about 9.7% of the airline, so the small sale could’ve been to keep his position beneath 10% to avoid onerous regulatory compliance requirements. Similarly, he still owns more than 9% of both American and United Continental after trimming those positions.

Overall, it’s probably best not too read as much into Berkshire Hathaway selling airline stock as you read into his selling of these other stocks, especially Phillips 66. Phillips 66 has been delivering solid financials this year, but with crude oil prices retreating, it wouldn’t surprise me if more of Berkshire Hathaway’s shares get sold this quarter.