Most people won’t ask personal finance questions on a first date. Money is simply one of those topics that’s best left for when you know the person sitting across the table from you a little better — even though how someone handles their finances can offer you some key insights about whether they have relationship potential.

But given that personal finance is … well, personal, it can feel a bit presumptive to follow “So, what do you do for a living?” with “And, how much debt do you have.” That’s why 34% of people wait until they are dating someone consistently before they broach the subject, and 38% wait until they’re in a serious relationship, according to a new survey from Comet Financial Intelligence.

Another 2% don’t bring up finance until they’re engaged. That’s 74% of people who don’t even start talking about a topic that could produce a relationship deal breaker until they’re well into the relationship.

What debts cause worry?

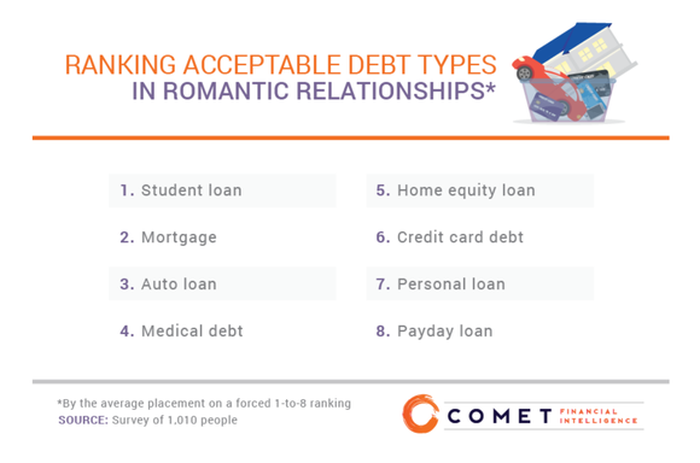

Over half (57%) of women and nearly half (46%) of men surveyed said they were concerned about their partner’s debt, but their level of worry varied considerably based on the type of debts involved. Respondents ranked these eight varieties from least troubling (1) to most (8):

That makes sense because student loans and mortgage loans are generally viewed as responsible debt. Auto loans in general shouldn’t raise a major red flag either, because most people don’t pay cash for their cars.

“Payday loans, in particular, were a notable concern among respondents,” according to the Comet report. “55% were worried about revealing this type of debt to their significant other, an unease that may be explained by another 62% who felt they were judged by a partner for having that particular kind of debt.”

That’s understandable, considering that a payday loan is dead giveaway of shaky finances. They’re generally taken out for relatively small amounts of money, at deeply unfavorable terms to the borrower. If a person is using one of these last-ditch bridge loans, it probably should concern anyone considering a serious relationship.

Survey respondents also said they would worry about their partner’s credit card debt if it exceeded 15% of their annual salary. Nearly half (45%) said they were unlikely to date someone who only makes minimum credit card payments regularly. On the other hand, one can take fiscal prudence too far: 49% of women and 28% of men said they would not want to date someone who was excessively frugal.

Not talking about money can end a relationship.

A hard conversation to start

“Hi, I’m Joe, and I have $11,000 in credit card debt and a timeshare I can’t sell” may not be a great opening line for a first date. You should, however, consider broaching the topic of finances fairly early in a relationship. Certain types of debt are red flags, but what you or your partner have done to address any issues can be even more telling.

If someone has steep debts and is failing to do what’s necessary to get them under control, it’s important to know what you’d be taking on should you get into a relationship that leads to a mingling of your financial lives. Conversely, if you know that a prospective partner has debt, knowing that they also have a plan and are paying it down can defuse much of the tension around the issue.

Taking a potential partner’s money situation seriously doesn’t mean you’re too materialistic — people can be incompatible financially, and that can torpedo a relationship down the road. The best way to avoid that is through open communication, and making joint honest plans about how you’ll handle money once you move from casual to committed.