The past two weeks on Wall Street have been wild, and not in a good way.

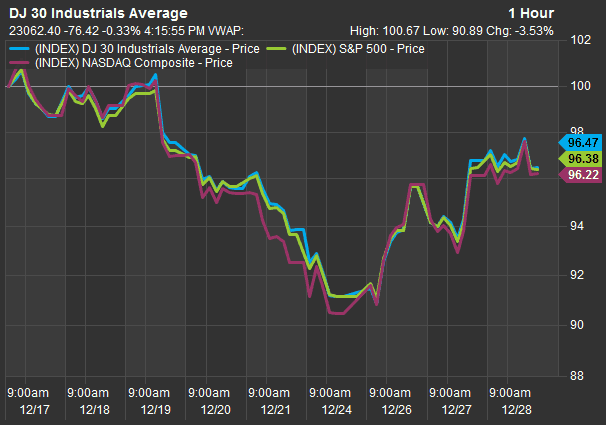

During that time, the major U.S. stock indexes have suffered losses that put them on track for their worst December performance since the Great Depression. Investors have also been gripped by volatile swings in the market as they grapple with a host of issues.

The S&P 500 has logged six moves of more than 1 percent over the period, three of which were of more than 2 percent. For context, the broad index posted just eight 1 percent moves in all of 2017.

The Dow Jones Industrial Average, meanwhile, has seen seven days of moves greater than 1 percent. Its intraday points ranges also widely expanded. The 30-stock index has swung at least 548 points in eight of its past nine sessions, and also posted its first single-day 1,000-point gain ever on Wednesday. The index ended down 76 points Friday after vacillating throughout the session.

It has been just as wild of a ride for the tech-heavy Nasdaq Composite. The index has posted five moves of at least 2 percent during the past two weeks.

“I wouldn’t use the word healthy” to describe these moves, said Marc Chaikin, CEO of Chaikin Analytics. “I’d say it’s been disturbing for investors.”

Big swings for stocks since Dec. 17

Wall Street’s wild ride began on Dec. 17, with the S&P 500, Dow and Nasdaq all dropping more than 2 percent. Fears of a slowing economy and worries over the course and speed of Federal Reserve monetary policy pressured stocks that day.

On Dec. 19, Fed fears came to a head after Chairman Jerome Powell said he did not anticipate the central bank changing its strategy for trimming its massive balance sheet. Those comments pushed down the broad indexes down another 2 percent that day.

Stocks again fell sharply later in the week as the likelihood of a U.S. federal government shutdown increased. Congress and the Trump administration failed to reach an agreement on funding for a wall along the U.S.-Mexico border. President Donald Trump has said the wall is key to national security, while opponents of the barrier think it will not solve the immigration issues plaguing both countries.

These concerns pushed the S&P 500 down 7 percent last week, while the Nasdaq plunged 8.4 percent. The Dow, meanwhile, dropped 6.9 percent.

All of these concerns set the stage Monday for the worst Christmas Eve ever in the U.S. stock market. The Dow and S&P 500 both fell more than 2.5 percent while the Nasdaq slid 2.2 percent. The S&P 500 also entered bear-market territory on Monday.

“It was the perfect storm of negativity,” Chaikin said. “What I think we’ve seen is a crisis of confidence in Washington. It’s sort of unprecedented and so the extremes in sentiment are all at bear-market low extremes.”

“There’s been panic and fear. When you’re in conditions like that, you never know when they’re going to reverse,” he added.

These moves took place against a backdrop of economic uncertainty as a series of leading indicators showed signs of a slowdown.

On Dec. 14, IHS Markit said its U.S. composite output index fell to 53.6 for December, a 19-month low. IHS Markit’s services and manufacturing PMIs also dropped to their lowest levels in about a year. A reading above 50 represents expansion.

“The markets are grappling with solid U.S. earnings and solid concurrent economic indicators. That’s the good news,” said Dave Haviland, managing partner at Beaumont Capital Management. “But that’s getting pitted against significantly poor or significantly worsening leading economic indicators here at home and significantly worse performance overseas.”

“We’ve got a lot of the ingredients for a re-pricing exercise and that’s basically what the markets are going through,” Haviland said.

Then came the turnaround

Monday’s declines looked like they were going to carry through Wednesday, when the market re-opened after the Christmas holiday. But after a brief decline, equities started surging and posted their best single-day performance in nearly a decade. The Dow also rose 1,000 points in one day for the first time.

“What happened this week was we traded down to 2,350” on the S&P 500, said Chaikin. “The market found support and bounced. You got this extraordinary surge in which the volume is to the upside.”

On Thursday, stocks closed higher after the 30-stock Dow posted its biggest reversal since 2010. Those gains propelled the major indexes to their first weekly gains since late November, as they all rose at least 2.75 percent. But while stocks have showed significant gains over the past two sessions, it is not clear whether this week’s lows mark the bottom of this recent downturn.

“I’m not sure we made a bottom. We certainly may have made an interim bottom here, and when valuations get to these levels it solves a lot of problems,” said Maris Ogg, president at Tower Bridge Advisors. “The crazy gap downs are probably over, but I’m not expecting the gap up.”

Ogg added more volatility is likely on the horizon as the fourth-quarter earnings results reflect slowing economic activity.

“I think the fourth-quarter earnings calls are not going to be fun because you’re going to see the magnitude of the softening,” she said.