The average holding period for a stock has declined significantly over the last few decades, falling from a peak of eight years back in the 1950s to a mere 8.3 months in recent years, with some stock trades lasting a fraction of a second. That short-term thinking not only leads to investors racking up trading fees and taxes, but can cause them to miss out on even bigger gains. That’s why we prefer to take the long-term view since that approach is a proven winner.

With a long time horizon in mind, three stocks that three Fool.com contributors think are good ones to buy and hold for the next couple of decades are Canopy Growth (NYSE:CGC), Brookfield Renewable Partners (NYSE:BEP), and Microsoft (NASDAQ:MSFT). Here’s why we think they could richly reward investors over the long haul.

This marijuana stock could be worth setting and forgetting

Todd Campbell (Canopy Growth): The global marijuana market is valued at $150 billion per year, according to the United Nations, and as more of those sales increasingly move out of the shadows and into legalized marketplaces, companies like Canada’s Canopy Growth could see remarkable growth.

Marijuana remains illegal federally in the U.S. However, 33 states have passed pro-pot laws of one-kind-or-another and recently, the U.S. Farm Bill removed hemp – a non-psychoactive strain of cannabis – from the federal controlled substances list. The hemp decision prompted Canopy Growth to announce in January its plans to enter the U.S. market.

Tapping into the U.S. marijuana market is a significant long-term opportunity for the company. In Canada, Canopy Growth is the leading provider of medical cannabis with over 30% market share. The Canadian market, however, is much smaller than the U.S. market. It’s estimated that $50 billion is spent annually on marijuana here, while only about 6 billion Canadian dollars is spent in Canada.

Canopy Growth is also targeting big markets outside North America. For example, it gets about 10% of its sales from Germany, where a fast-growing medical marijuana market is emerging, and it’s set it sights on Australia, too. If more European markets OK marijuana sales, then Canopy Growth is positioned to benefit.

However, this isn’t a stock for the faint of heart. Regulators could change their minds and clamp down on marijuana again, new competitors may emerge, or the company could stumble in its attempts to go global.

Nevertheless, beer, wine, and spirits giant Constellation Brands invested $4 billion in exchange for a 38% equity interest in Canopy Growth last year, and it’s got plenty of experience Canopy Growth can leverage to avoid pitfalls.

Admittedly, there’s no telling where this stock is going to trade from here, but I think owning a little of it in set-it-and-forget portfolios could pay off big.

A multidecade growth opportunity

Matt DiLallo (Brookfield Renewable Partners): The world is slowly pivoting away from fossil fuels toward renewables. It’s a multidecade opportunity as it will take trillions of dollars in investment to replace the globe’s current carbon-based energy system with renewables. Given that long-term growth potential, investors who are several years from retirement should seriously consider holding a renewable energy stock in their portfolio.

One option that should top their list is Brookfield Renewable Partners. The company is a global leader in owning and operating hydropower plants, which currently supply it with 76% of its income. In addition to that, it has been investing in other renewable technologies like wind and solar in recent years to both diversify its portfolio as well as expand its growth potential.

Brookfield Renewable estimates that it can grow the cash flows of its existing business by 6% to 11% annually over the long term through a combination of inflation escalators on its power sales contracts, margin expansion as it squeezes more profit out of its legacy assets, and growth projects it has in development. In addition, the company believes it can invest about $700 million per year to acquire and develop new renewable power-generating facilities. Those future additions could enable it to grow cash flow at or above the high end of its long-term target range.

Given the sector’s ultra-long-term growth potential, Brookfield Renewable Partners is an ideal stock to hold for the next couple of decades.

Tech’s quiet giant

Travis Hoium (Microsoft): Microsoft’s business in 2019 isn’t as high profile as it was when the company was selling the operating system for most PCs and building some of its most popular software. But that doesn’t mean the company isn’t just as important as it was then or as financially successful. Microsoft is now one of the largest cloud companies in the world with Azure, providing services to thousands of business and building the back-end infrastructure that new, innovative companies are built on.

The tech giant has also moved most of its critical software to the cloud and is transitioning to recurring revenue business models. Office 365 has replaced the old Office software that often left consumers’ software out of date and businesses can add many layers of services to support their operations with a familiar partner in Microsoft.

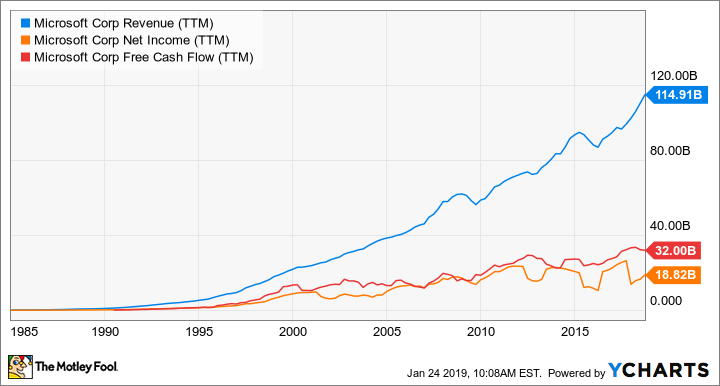

Financially, the move to a more cloud-based business has gone well, turning around a revenue decline three years ago. As you can see below, Microsoft is generating more revenue and free cash flow than it ever has before.

There’s no certainty as to what the tech landscape will look like in 20 years, but I think it’s safe to say Microsoft will play an important role. It’s demonstrated the ability to adjust to market trends and has the capital to compete with anyone in the industry, even buying them out if that’s what is necessary. That’s a company investors can feel safe with for at least the next two decades.