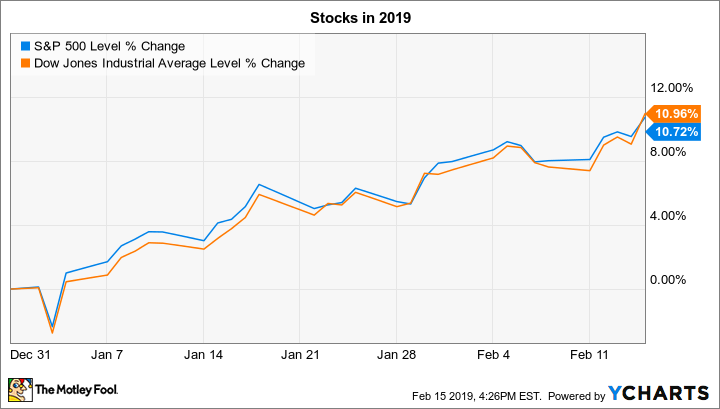

Stocks rose significantly last week to continue the 2019 winning streak for both the S&P 500 (SNPINDEX:^GSPC) and the Dow Jones Industrial Average (DJINDICES:^DJI). The indexes each gained roughly 3% to put year-to-date returns at 11%.

Fourth-quarter earnings season continues over the shortened trading week ahead, with hundreds of companies set to announce their latest numbers. Below, we’ll take a look at the metrics that could send shares of Domino’s (NYSE:DPZ), Garmin (NASDAQ:GRMN), and Wayfair (NYSE:W) moving over the next few days.

Domino’s market share

Domino’s delivers its fourth-quarter earnings report on Thursday in an announcement that investors believe will include plenty of good news. The pizza giant soaked up market share through most of fiscal 2018 despite intense competition in the industry. Its technological innovations around ordering and pickup helped it maintain its leadership on delivery and supported a 6% spike in domestic comparable-store sales in the most recent quarter.

Domino’s is expected to post another improvement on that key metric this week in what would mark its 31st consecutive quarter of growth at existing locations.

Investors will be following management’s outlook for 2019 for signs that growth might slow down and imperil the chain’s decade-long expansion. It’s more likely that Domino’s keeps finding ways to boost sales, though, including by attacking the carry-out market. Success there would give it room to continue aggressively adding locations in the coming years, both at home and in international markets.

Wayfair’s cost outlook

Investors already know that Wayfair captured market share in the home-furnishings industry over the holiday shopping season. The e-commerce company said in late November that sales gains during the peak sales period between Thanksgiving Day and Cyber Monday shot up to a 58% pace from 53% in the prior year. Yet there’s plenty of room for surprises in Wayfair’s fourth-quarter report slated for Friday, Feb. 22.

The biggest questions to be answered center around costs. Wayfair warned in its last quarterly report that it might need to slash prices to stay competitive over the holidays; we’ll find out this week whether that move pressured gross profit margin. Elevated promotional spending might also show up in the company’s advertising spending, which has hovered at around 12% of sales lately.

CEO Niraj Shah and his executive team will also provide an outlook for infrastructure spending in 2019 that, as in recent years, will likely power significant net losses. Investors have accepted this red ink so far because it has helped deliver market-thumping sales gains. But Wayfair will soon need to start showing progress toward its plan to generate sustainable annual profits.

Garmin’s profit margin

GPS device-giant Garmin will announce its holiday-quarter results on Wednesday. The report is expected to show only modest sales growth in the period, but its broader business trends are decidedly positive. In fact, Garmin is on pace to close out its third-consecutive year of profitability gains as revenue growth improves to 6% for 2018 from 3% in 2017. That’s an impressive feat given shrinking demand for automotive GPS devices and rapidly shifting consumer preferences on fitness trackers.

Garmin’s technical and retailing wins have allowed gross profit margin to rise to 59% of sales lately compared to 42% for the more specialized Fitbit. Its sales base is also far more stable, thanks to significant revenue from areas like aviation and marine navigation.

These advantages should support continued growth for the business, as long as Garmin continues delivering design innovations that push its various industries forward.