Just five of the stocks of the Dow 30 have carried it back within reach of record highs.

Boeing, IBM, United Technologies, Goldman Sachs and Home Depot have rallied double digits to start the year, contributing around 50 percent of the year’s gains to the price-weighted index.

Two of those could be set for a pullback, says Matt Maley, equity strategist at Miller Tabak.

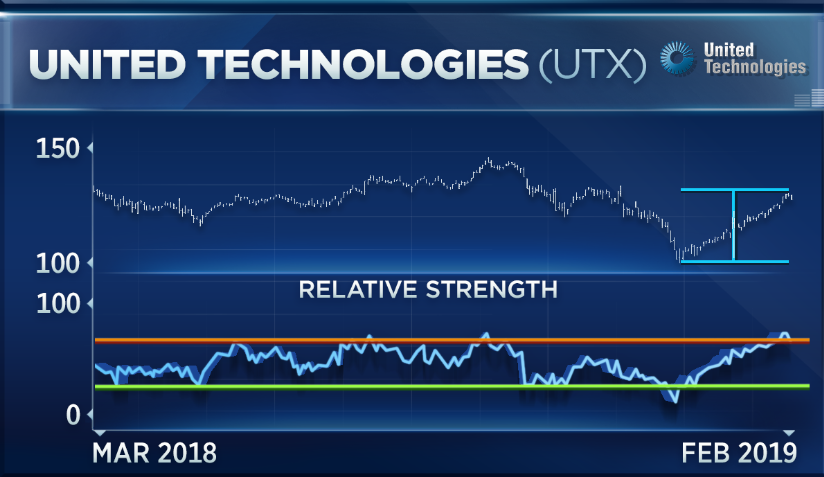

“Two of our favorites are Boeing and United Technologies. However, they’d had such big runs here and they’ve become very, very overbought on a near-term basis,” Maley said Thursday on CNBC’s “Trading Nation. ”

Boeing and UTX are the top and third-best performers on the Dow for the year, adding 30 percent and 19 percent, respectively. Boeing has rocketed 43 percent off its December lows, while UTX has bounced 26 percent.

“You want them to pull back a little bit, it’d actually be healthy for them if they did that and would allow them to kind of work off those conditions and move higher later on, so I would say I wouldn’t want to chase those names,” said Maley.

While Maley expects UTX and Boeing to pull lower, he sees a bigger breakout in fellow Dow stock Walmart.

“It was overbought, but it’s now working off that situation,” said Maley. “It’s formed a symmetrical triangle pattern and it’s at the upper end of that pattern, so now that it’s working off this short-term overbought position, if it can rally within the next week or so and break above that formation, that’s going to be very bullish for the stock.”

The symmetrical triangle pattern generally typifies a consolidation period before a break higher or lower. The move closer to the top end of that pattern suggests it could break out of that consolidation.

Erin Gibbs, portfolio manager at S&P Global, has a different pick for MVP of the Dow.

“If you’re going for the Dow, you’re looking at very large-cap, blue-chip, stable so we really see IBM as just one of those companies that even at these prices, we’re still looking at potential appreciation,” Gibbs said. “It has above average earnings growth expected versus its industry, so still nice, stable consistent, over the next three or four years.”

Analysts anticipate earnings growth of nearly 1 percent for 2019 and 2 percent for 2020, according to FactSet estimates, up from flat in 2018.

“It’s just one of those nice defensive stocks,” added Gibbs. “We just see IBM delivering those strong stable returns for you.”